Whales with a lot of money to spend have taken a noticeably bullish stance on Lululemon Athletica.

Looking at options history for Lululemon Athletica (NASDAQ:LULU) we detected 59 trades.

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $217,905 and 52, calls, for a total amount of $2,957,779.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $480.0 for Lululemon Athletica during the past quarter.

Analyzing Volume & Open Interest

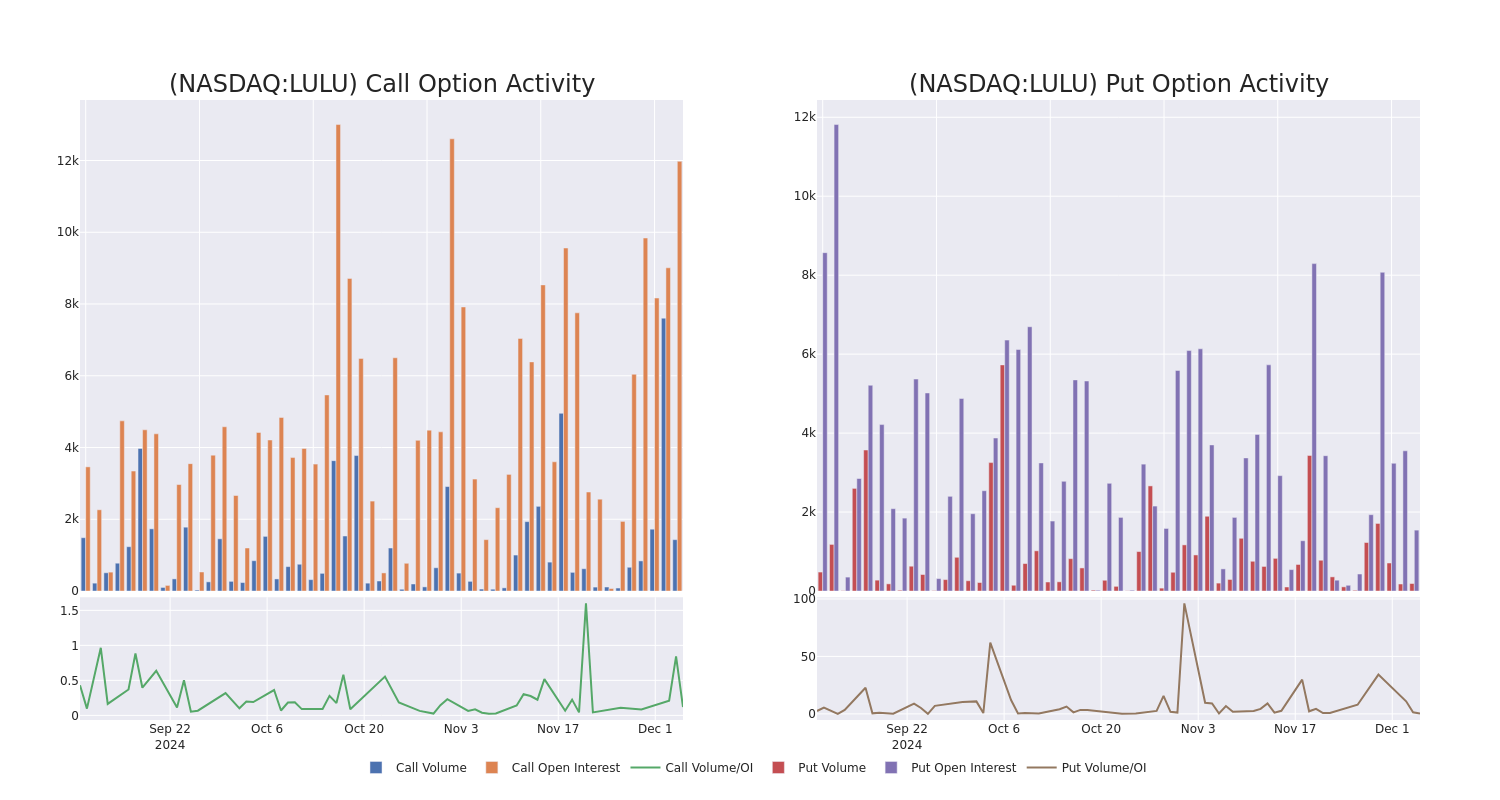

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lululemon Athletica's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lululemon Athletica's substantial trades, within a strike price spectrum from $130.0 to $480.0 over the preceding 30 days.

Lululemon Athletica Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LULU | CALL | TRADE | BULLISH | 01/17/25 | $19.5 | $18.6 | $19.4 | $410.00 | $193.9K | 759 | 299 |

| LULU | CALL | SWEEP | BULLISH | 12/06/24 | $78.05 | $73.05 | $76.47 | $330.00 | $122.2K | 353 | 92 |

| LULU | CALL | SWEEP | BEARISH | 12/06/24 | $7.85 | $6.7 | $6.75 | $400.00 | $114.2K | 2.8K | 5.5K |

| LULU | CALL | TRADE | BULLISH | 01/16/26 | $131.7 | $130.5 | $131.7 | $310.00 | $92.1K | 163 | 10 |

| LULU | CALL | TRADE | BEARISH | 12/19/25 | $115.65 | $111.3 | $112.93 | $330.00 | $79.0K | 46 | 8 |

About Lululemon Athletica

Lululemon Athletica designs, distributes, and markets athletic apparel, footwear, and accessories for women, men, and girls. Lululemon offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. The company also sells fitness accessories, such as bags, yoga mats, and equipment. Lululemon sells its products through more than 700 company-owned stores in about 20 countries, e-commerce, outlets, and wholesale accounts. The company was founded in 1998 and is based in Vancouver, Canada.

Following our analysis of the options activities associated with Lululemon Athletica, we pivot to a closer look at the company's own performance.

Lululemon Athletica's Current Market Status

- With a volume of 7,192,514, the price of LULU is up 18.28% at $407.84.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 104 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lululemon Athletica options trades with real-time alerts from Benzinga Pro.