In the last three months, 8 analysts have published ratings on Fastenal (NASDAQ:FAST), offering a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 0 | 6 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 2 | 0 | 4 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

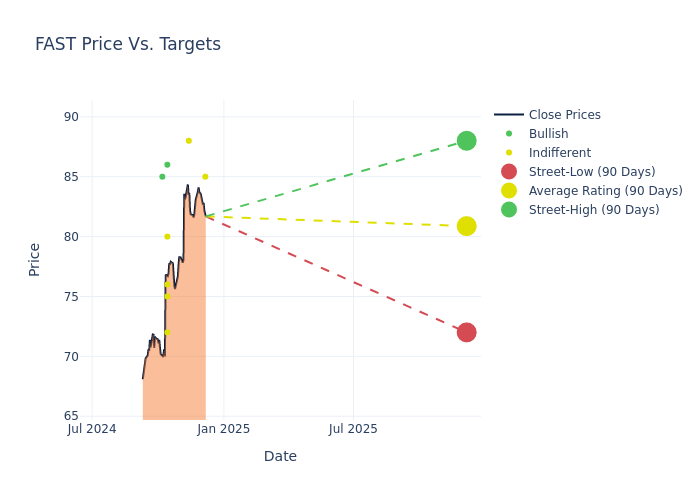

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $80.88, a high estimate of $88.00, and a low estimate of $72.00. Witnessing a positive shift, the current average has risen by 15.54% from the previous average price target of $70.00.

Interpreting Analyst Ratings: A Closer Look

The standing of Fastenal among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Volkmann | Jefferies | Raises | Hold | $85.00 | $74.00 |

| Amit Mehrotra | UBS | Raises | Neutral | $88.00 | $71.00 |

| Chris Snyder | Morgan Stanley | Raises | Equal-Weight | $76.00 | $72.00 |

| Patrick Baumann | JP Morgan | Raises | Neutral | $72.00 | $70.00 |

| Brian Butler | Stifel | Raises | Buy | $86.00 | $80.00 |

| Tommy Moll | Stephens & Co. | Raises | Equal-Weight | $75.00 | $56.00 |

| David Manthey | Baird | Raises | Neutral | $80.00 | $67.00 |

| Sabrina Abrams | B of A Securities | Announces | Buy | $85.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Fastenal. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Fastenal compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Fastenal's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Fastenal's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Fastenal analyst ratings.

Unveiling the Story Behind Fastenal

Fastenal opened its first fastener store in 1967 in Winona, Minnesota. Since then, it has greatly expanded its footprint as well as its products and services. Today, Fastenal serves its 400,000 active customers through approximately 1,600 branches, over 1,800 on-site locations, and 15 distribution centers. Since 1993, the company has added other product categories, but fasteners remain its largest category at about 30%-35% of sales. Fastenal also offers customers supply chain solutions, such as vending and vendor-managed inventory.

Financial Milestones: Fastenal's Journey

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Fastenal displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 3.48%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Fastenal's net margin is impressive, surpassing industry averages. With a net margin of 15.61%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Fastenal's ROE stands out, surpassing industry averages. With an impressive ROE of 8.41%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Fastenal's ROA excels beyond industry benchmarks, reaching 6.38%. This signifies efficient management of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.15.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.