Fraud and identity theft are major issues affecting millions worldwide every year. Not only can these criminal acts harm your wallet, credit score, and reputation but it’s also a deeply nasty feeling knowing that someone’s pretending to be you. However, things get even more complicated in some cases if some of your nearest and dearest family members are involved.

One anonymous internet user turned to the financially savvy CreditScore online community for help regarding an incredibly sensitive issue. They explained how their mother stole their elderly grandmother’s identity to open up a few credit cards in her name. Scroll down for the full story and the advice the internet gave them. Bored Panda has reached out to the author to hear what happened next, and we’ll update the article once we hear back from them.

Identity theft is an issue that affects millions. Those particularly vulnerable are children and the elderly

Image credits: JSB Co/ Unsplash (not the actual photo)

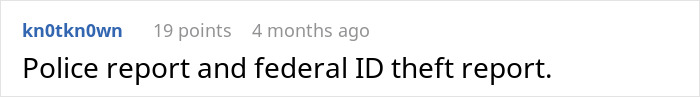

A person asked for advice after finding out that their own mother stole their grandma’s identity to open up new credit cards

Image credits: Giovanni Gagliardi/Unsplash (not the actual photo)

Image credits: granisintrble

Identity theft can affect you in many negative ways, from damaging your finances to ruining your credit score

Image credits: Andy Quezada/Unsplash (not the actual photo)

It doesn’t matter if the person who steals your identity is a stranger or your relative: it’s a crime either way. But how you handle things will depend a lot on your relationship with the person who hurt you.

When it comes to family members, generally, people are more willing to talk things out and solve things diplomatically. Nobody wants to involve the police or get into a drawn-out legal battle if there’s a quicker, cheaper solution to the problem. Sometimes, an honest and open conversation can put the entire matter to rest. However, things don’t end well for everyone.

In some cases, a direct confrontation just isn’t enough. You might run into a situation where the other person isn’t sorry or willing to pay for the damages and make amends. So, your only options may be to get in touch with the authorities and contact a lawyer. These are difficult decisions to make if it’s a parent, sibling, or child who’s used your identity for their nefarious purposes.

Broadly speaking, identity theft happens when someone uses your personal information without your permission to either gain financial benefits or to commit fraud. Investopedia notes that this can involve someone using your social security number, bank account number, and credit card information.

The criminals can use your personal info to then make unauthorized transactions, access your personal accounts, or open up new accounts. The fallout can be pretty big. For instance, you might end up with your credit score damaged, incorrect info added to your records, or even end up wrongfully arrested.

If you’re a victim of identity theft or fraud, it’s vital that you report it immediately

Image credits: Daniel Martinez/Unsplash (not the actual photo)

While it may not be the end of the world, it can still take an awfully long time to recover from the damage done to your finances and reputation. It can take a lot of energy to fight back against identity theft, and the entire situation can add a ton of stress to your life. If you’re a victim of identity theft living in the United States, you should contact the Federal Trade Commission (FTC) at IdentityTheft.gov.

There are a few main categories of identity theft. The most widely known and most common one is financial identity theft, when a criminal uses a victim’s information to get credit or buy goods, services, or benefits.

Others include social security identity theft (applying for credit cards and loans or to get medical, disability, and other benefits), medical identity theft (getting free medical care), synthetic identity theft (combining real stolen info with fake info to create new identities), and child identity theft (using a kid’s identity for personal gain).

Meanwhile, there’s also tax identity theft (when someone uses your info to file state or federal tax returns) and criminal identity theft (criminals who pose as other people to avoid arrest, conviction records, or court summons).

There are various ways that criminals gain access to people’s personal information. Some might use scam emails or messages. Others might browse social networking sites to collect your info. Still, others access digital public records, hack computer networks, or even search discarded or stolen computer hard drives.

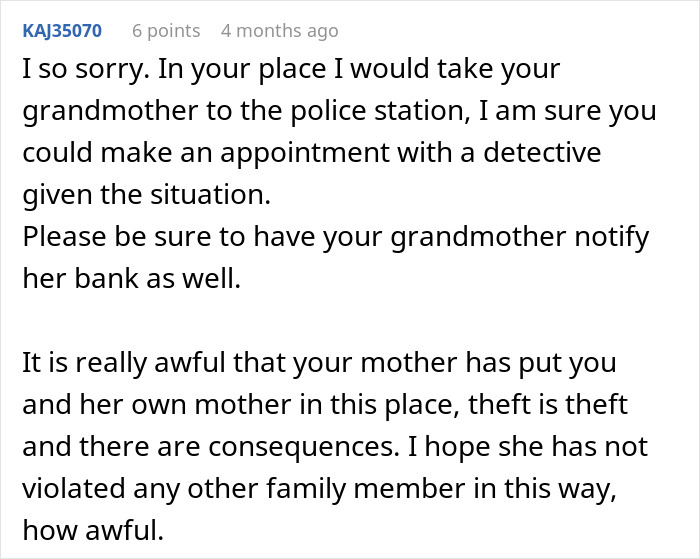

The fact is that anyone can fall victim to scammers and identity theft. However, some groups of people—the very young and very old—are most at risk.

Credit card debt and minimum payments are growing concerns for many Americans

Image credits: Getty Images/Unsplash (not the actual photo)

Statista reports that there were over 1.1 million complaints of identity theft filed with the FTC in the US in 2022. A year prior, in 2021, that number stood at over 1.4 million complaints.

CNN reports that many Americans are growing “increasingly anxious” about mounting credit card debt.

In fact, they haven’t been this worried about missing payments since April 2020, nearly half a decade ago.

The New York Fed’s Survey of Consumer Expectations from September 2024 revealed that the average probability of missing a minimum debt payment over the next three months stands at 14.2%.

Have you ever had your identity stolen, dear Pandas? How did you resolve the situation? What would you do if you found out that a family member of yours was committing fraud using another relative’s personal information? Tell us in the comments.

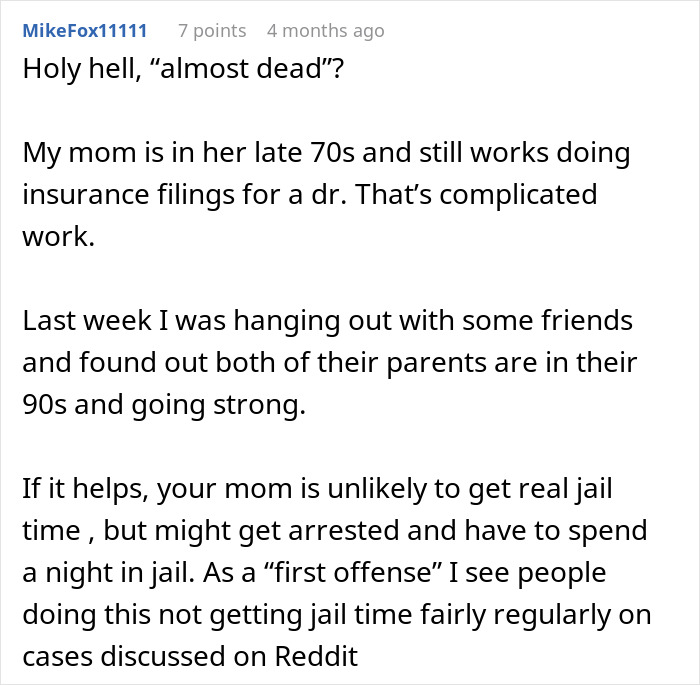

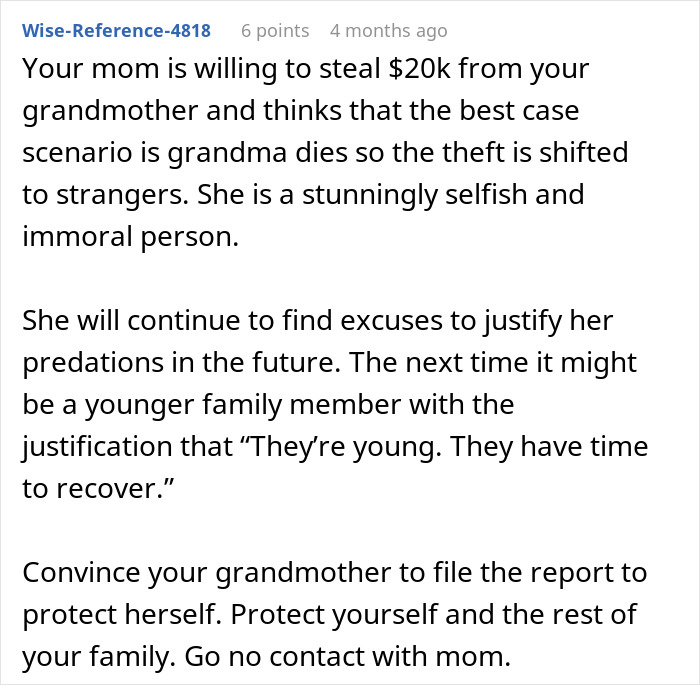

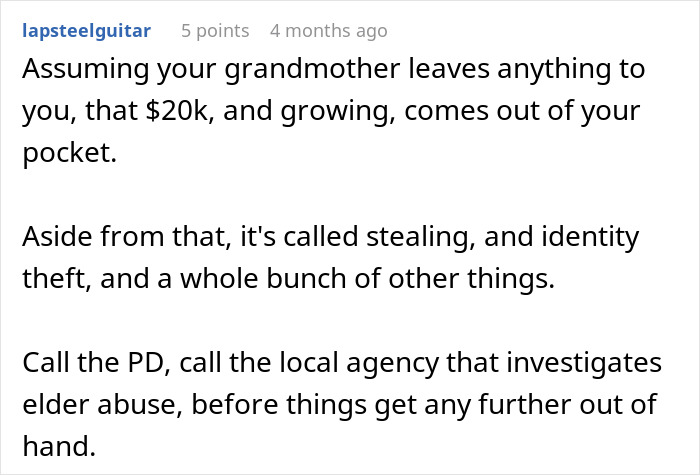

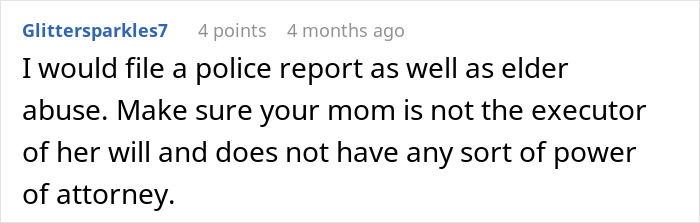

The author was worried that their grandma might not be the only relative affected

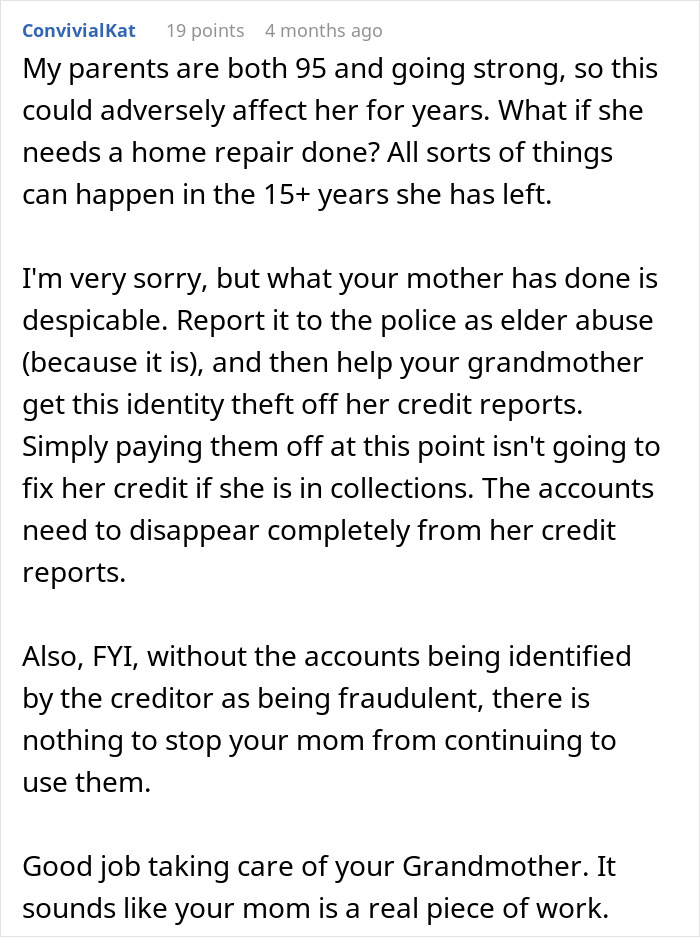

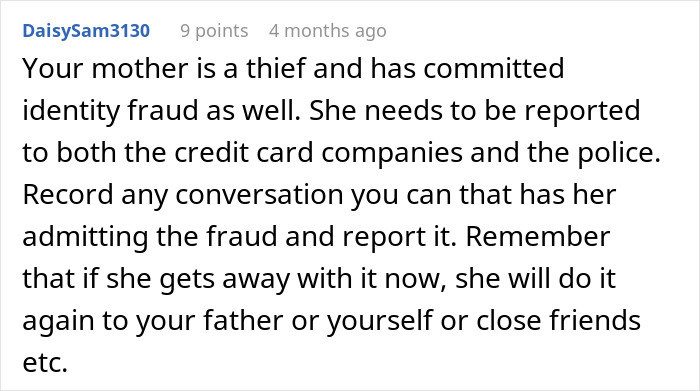

Many internet users were utterly horrified to hear about what happened. Here’s the advice they gave the author