“Recession” has become somewhat of a buzzword in recent weeks. Largely thanks to U.S. President Donald Trump announcing major tariff hikes that impact not only America, but dozens of countries around the world. Economists are divided over whether a recession is in fact looming. Some say "definitely!" Others say "absolutely not." But ordinary netizens claim they’re already seeing the signs...

“Recession Indicators” have been flooding X, with people posting the major red flags that they believe point to a global market crash and some super tough times on the horizon. Some of the tweets are tongue-in-cheek, others are funny. Then there are those that perhaps shouldn’t be taken lightly. Bored Panda has gathered a collection of the best for you to scroll through while you pinch your pennies. Let us know which ones you believe to be true by hitting the upvote button.

#1

Image credits: MikeNellis

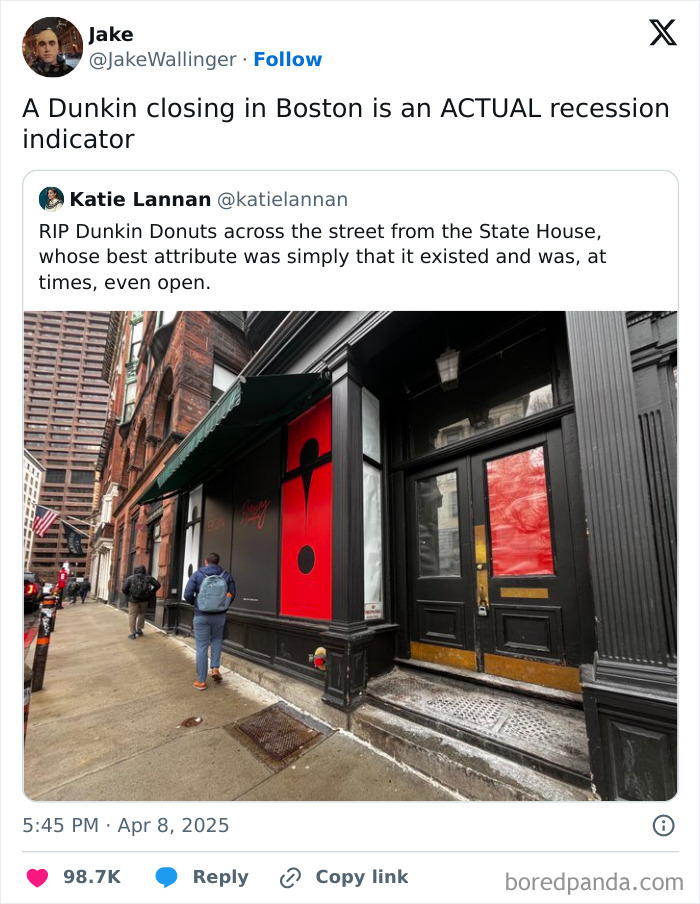

#2

Image credits: JakeWallinger

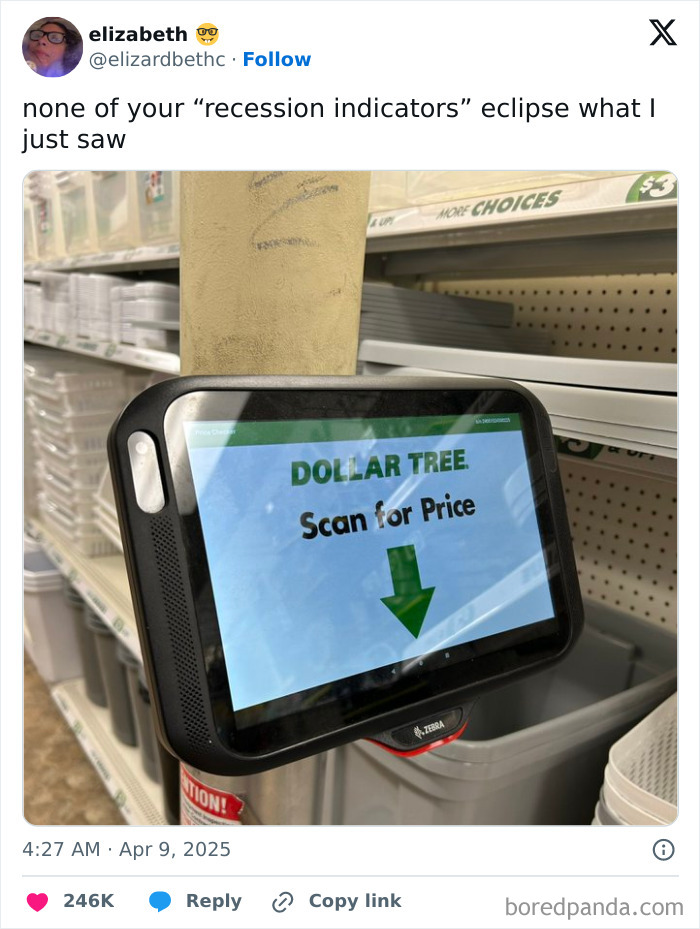

#3

Image credits: elizardbethc

The definition of "recession" depends on who you ask... Investopedia defines it as "a significant decline in economic activity that lasts longer than a few months." In 1974, an American economist named Julius Shiskin described it as “two consecutive quarters of declining growth.” That's a definition that many countries still follow.

In the United States, the National Bureau of Economic Research (NBER) defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators."

If you think of it as a graph, the NBER explains that a recession "begins when the economy reaches a peak of activity and ends when the economy reaches its trough."

#4

Image credits: Sweguin7

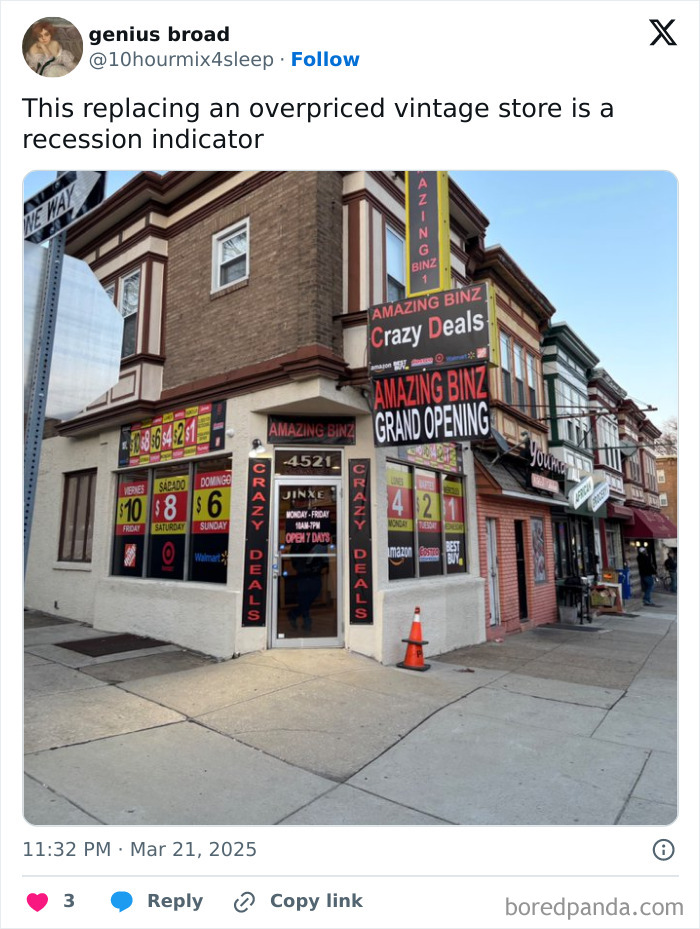

#5

Image credits: 10hourmix4sleep

#6

Image credits: mansamusso

There's a lot of uncertainty at the moment. A few economists say we shouldn't panic, while others are warning us to brace ourselves. According to J.P. Morgan’s chief global economist, a recession is possible in the near future. In March this year, Bruce Kasman put the risk of a recession in the United States at 40% - a 10% jump from January. And in early April, J.P. Morgan Research raised the probability of a recession occurring in 2025 to 60% — up from 40%.

The chief economist at Moody’s Analytics shared the sentiment, saying there's a 35% chance of a recession in the U.S., which is an increase of 15% from the beginning of the year. When Reuters reached out to economists in Canada, Mexico, and America, 95% of them said the risk of recession in their economies had risen.

#7

Image credits: jeremysmiles

#8

Image credits: madisontayt_

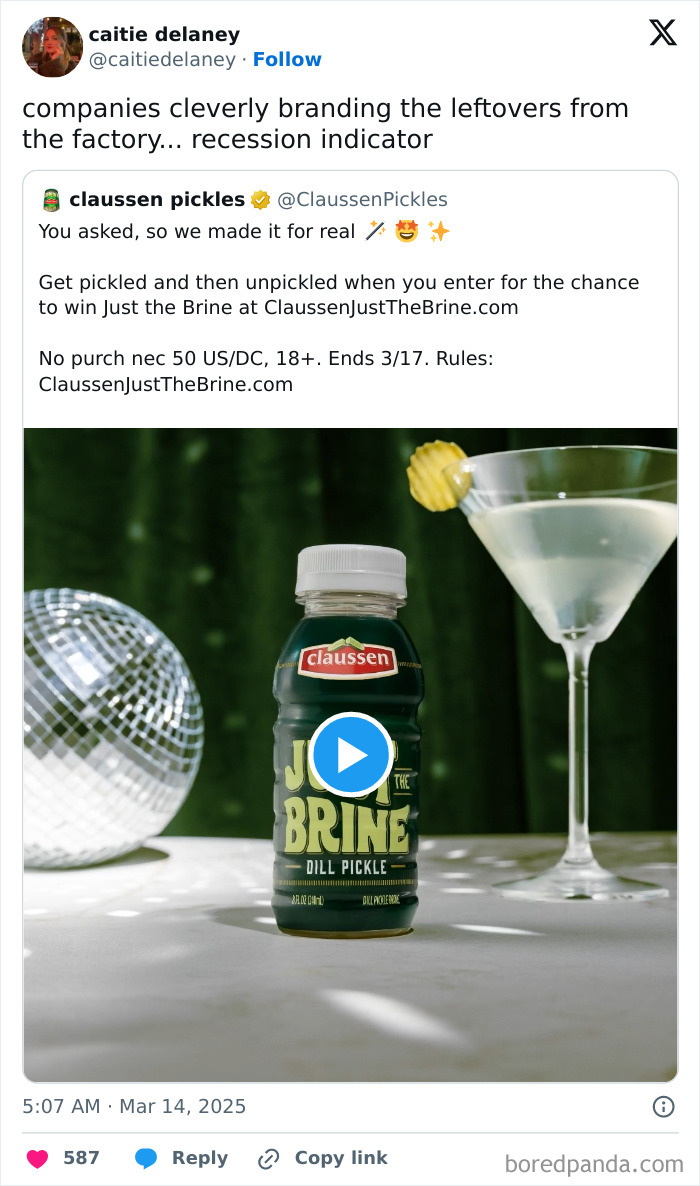

#9

Image credits: caitiedelaney

Recessions usually start in one geographical area and spread to another, says McKinsey Senior Partner and McKinsey Global Institute Chair Sven Smit. And there are several reasons a recession might happen ... Like geopolitics or economic cycles.

The International Monetary Fund (IMF) has said that recessions can also be caused by a decline in external demand, especially in countries with strong export sectors. "Adverse effects of recessions in large countries—such as Germany, Japan, and the United States—are rapidly felt by their regional trading partners, especially during globally synchronized recessions," notes the site. So it's no surprise that U.S. President Trump's tariff announcement has caused much concern.

#10

Image credits: Ankaman616

#11

Image credits: Ariellex1_

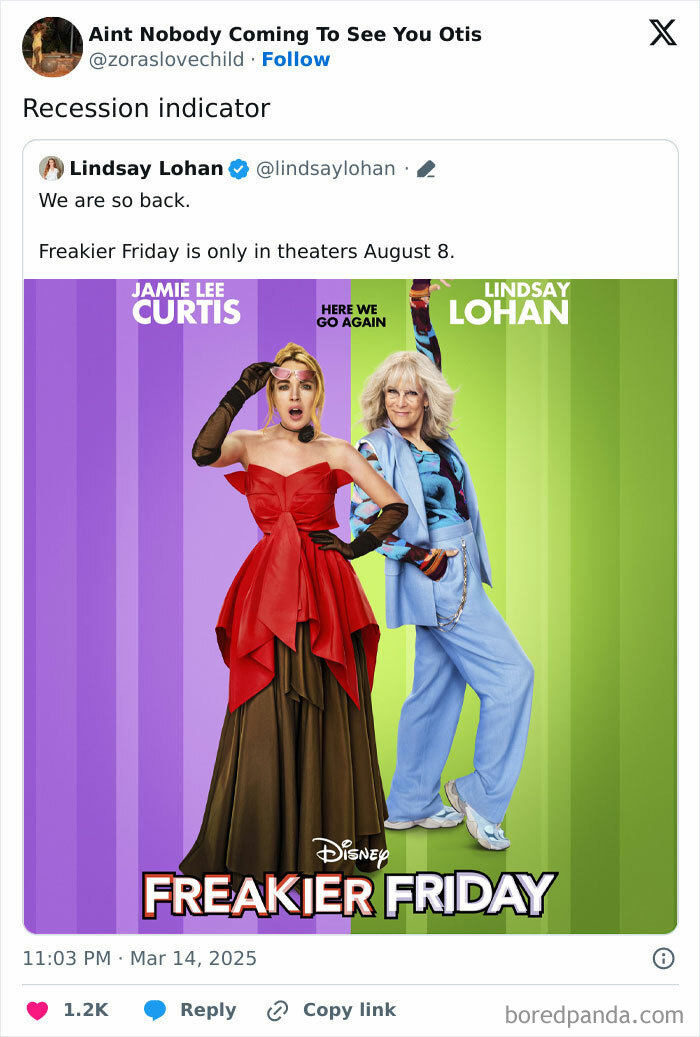

#12

Image credits: zoraslovechild

That said, the IMF doesn't believe we should panic. It recently announced that global share prices have dropped "as trade tensions flared" and also warned of an "erosion of trust" between countries. But added that the "new growth projections will include notable markdowns, but not recession".

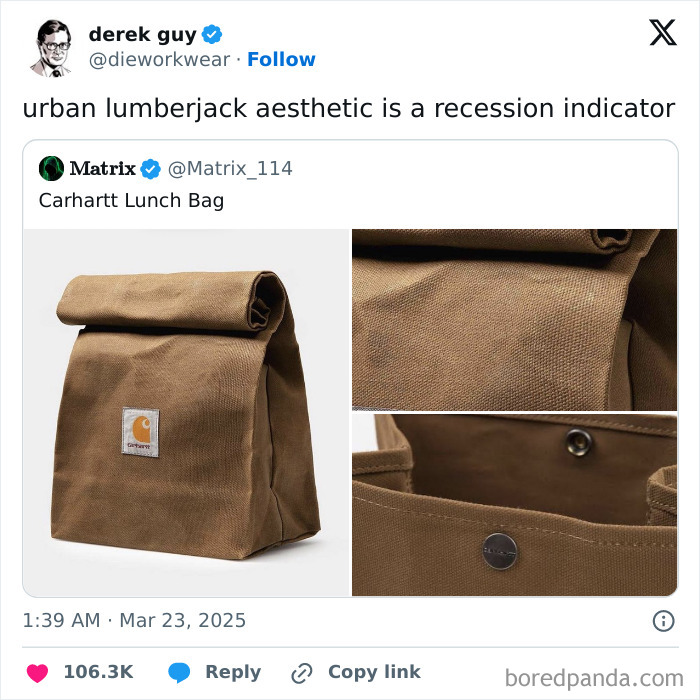

#13

Image credits: dieworkwear

#14

Image credits: zoerosebryant

#15

Image credits: holy_schnitt

Meanwhile, on social media, ordinary Johns and Janes are throwing their two cents into the mix. X, for one, has been flooded with memes, posts, and photos from people who are convinced the economy is crying out for help, and that we're all in for a bumpy ride. Some of their "recession indicators" are funny, others are strange.

But it wouldn't be the first time we've seen weird indicators of an economic downturn. In 2001, the American economy was deep in recession and people were holding onto their money. But a particular beauty product seemed to be flying off the shelves...

#16

Image credits: CarterJahad

#17

Image credits: RobDenBleyker

#18

Image credits: lilgrapefruits

Billionaire heir to the Estée Lauder cosmetics fortune, Leonard Lauder let the world know that despite consumers tightening their spending, lipsticks seemed to be in high demand. He came to the conclusion that lipstick sales and the health of the economy were in inverse proportion to one another... And he believed this was because consumers considered lipstick an "affordable luxury." And so, the "Lipstick Index" was born.

#19

Image credits: WTFJXR63

#20

Image credits: thenoasletter

#21

Image credits: Cait_Cavell

Another sign of a recession can be found below the belt. Or so argued the former Federal Reserve chair Alan Greenspan. The expert was a big believer in the "men's underwear index." In a nutshell, when the economy is in decline, men don't buy new underwear because most people won't see what they're wearing down there anyway. Greenspan said when the economic outlook improves, sales of boxers and briefs will follow suit.

#22

Image credits: awawawhoami

#23

Image credits: evelynvwoodsen

#24

Image credits: KaufmanAudrey

It turns out, he wasn't wrong... According to Euromonitor data, men's underwear sales dipped in 2008 and 2009 during the Great Recession. And guys went back to buying briefs and boxers between 2010 and 2015.

Similarly, Bloomberg data found revealed that there was a dramatic decrease in men's underwear sales in America in 2020 during the Covid pandemic, and undies buying came back into fashion again 2021.

#25

Image credits: simplywangui

#26

Image credits: hamptonism

#27

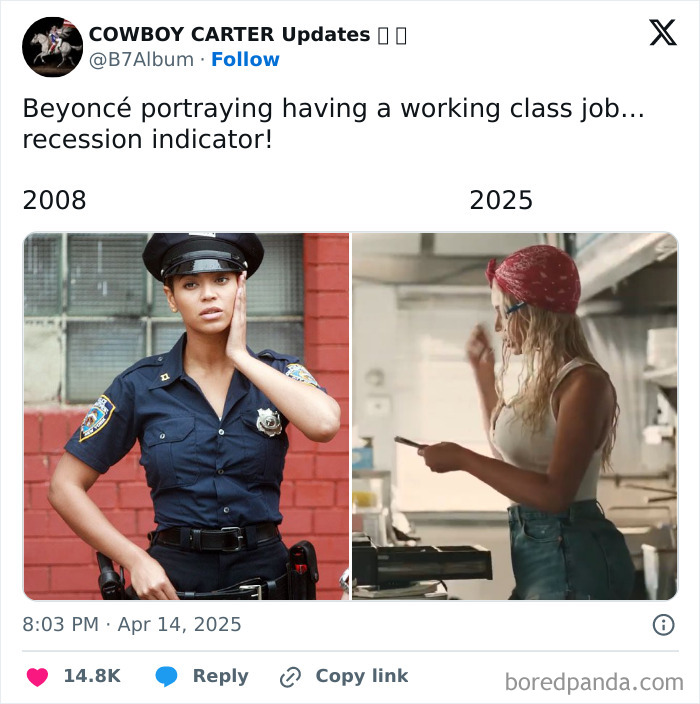

Image credits: B7Album

If the signs on this list are anything to go by, we might be in for some tough times ahead. And here's what the World Economic Forum (WEF) warns could happen, should a recession hit: "Unemployment could rise. Graduates and school leavers may then find it more difficult to find jobs. Companies may struggle to pay their workforce or give their employees pay increases to match inflation..."

WEF adds that investors could also see losses, as stock markets fall. "During a recession, we may see an increase in foreclosures, and banks will be less likely to loan money to potential borrowers looking for a mortgage or a personal loan."

In short, brace yourself. And hold onto your precious pennies.

#28

Image credits: Voltaic117

#29

Image credits: _casscore

#30

Image credits: outfieldxgrass

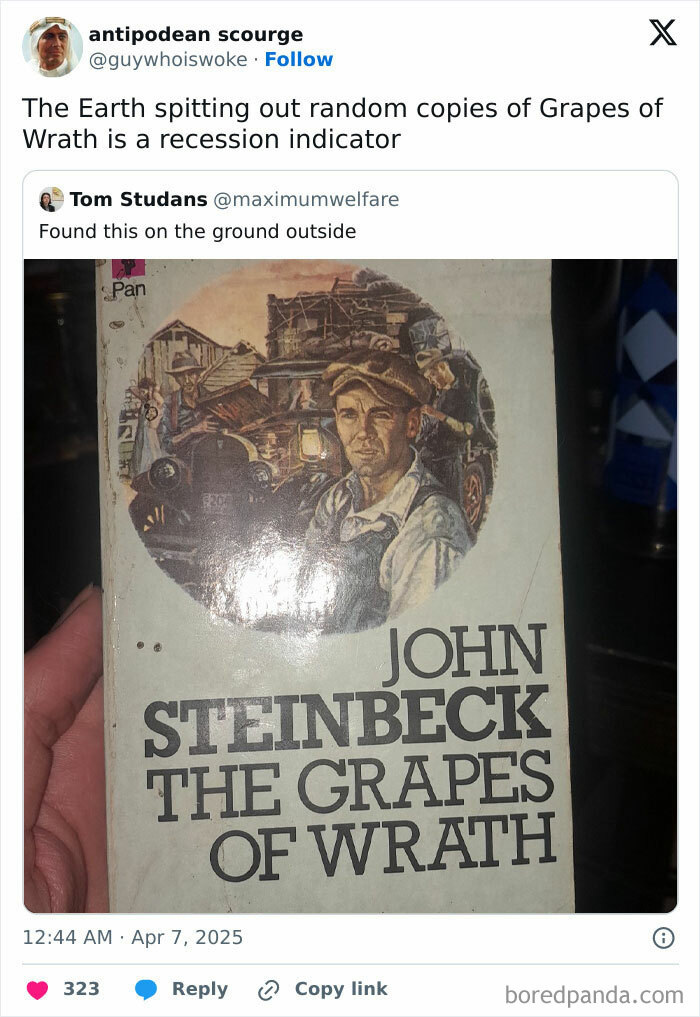

#31

Image credits: guywhoiswoke

#32

Image credits: pasta_niece

#33

Image credits: DapperDomo

#34

Image credits: iamntyrell

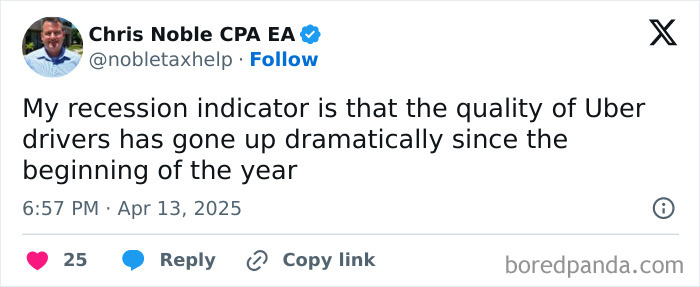

#35

Image credits: nobletaxhelp

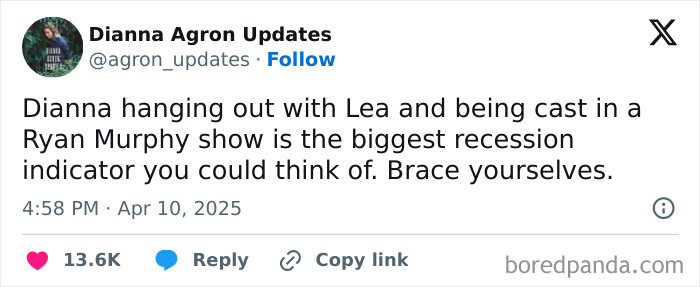

#36

Image credits: agron_updates

#37

Image credits: laracroftbarbie

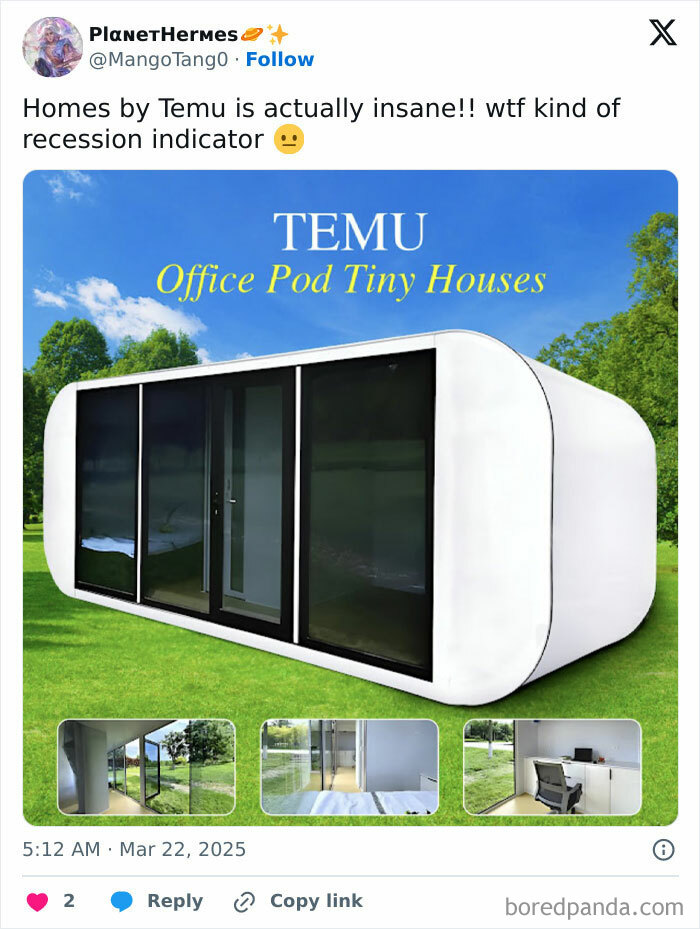

#38

Image credits: MangoTang0

#39

Image credits: hotelgaruda

#40

Image credits: thisispaff

#41

Image credits: thatwimpydeer

#42

Image credits: DijahSB

#43

Image credits: kzzrttt

#44

Image credits: jwstarling

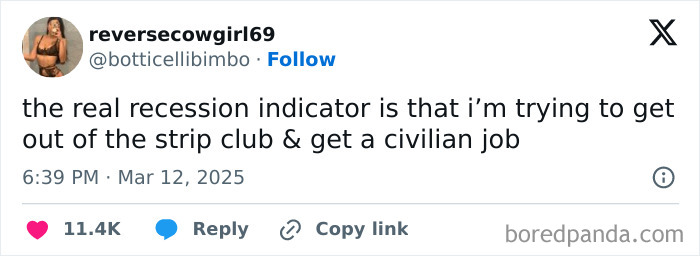

#45

Image credits: botticellibimbo

#46

Image credits: offbeatorbit

#47

Image credits: 1800ghostman

#48

Image credits: quartzmorrigan

#49

Image credits: zoraslovechild

#50

Image credits: PtakTestKitchen

#51

Image credits: offbeatorbit

#52

Image credits: nilecassandra

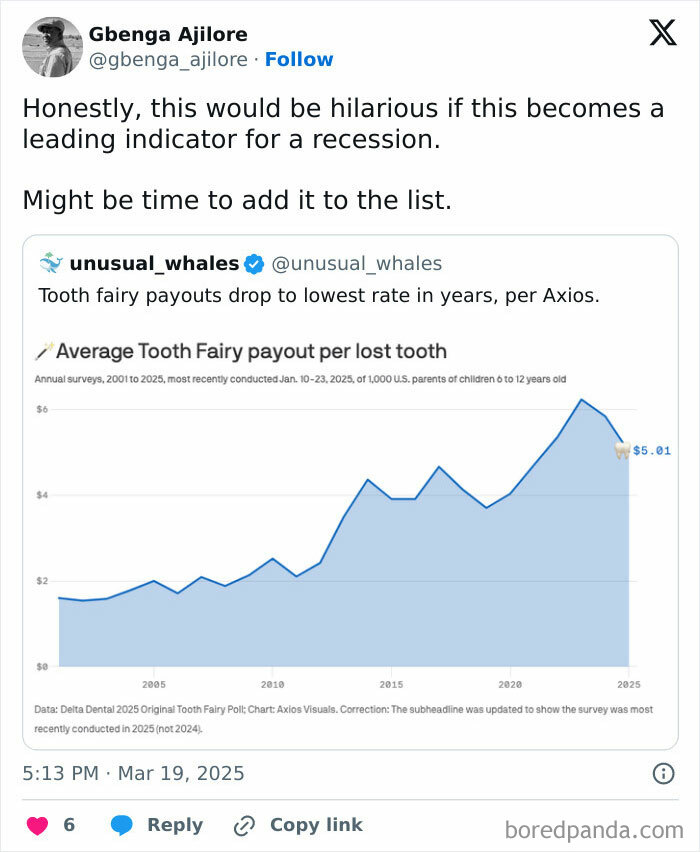

#53

Image credits: gbenga_ajilore

#54

Image credits: lmp3rfect

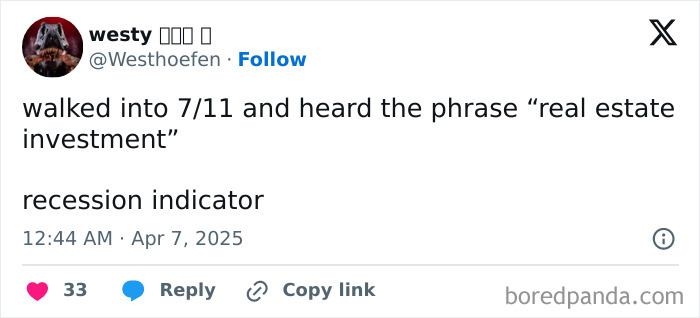

#55

Image credits: Westhoefen

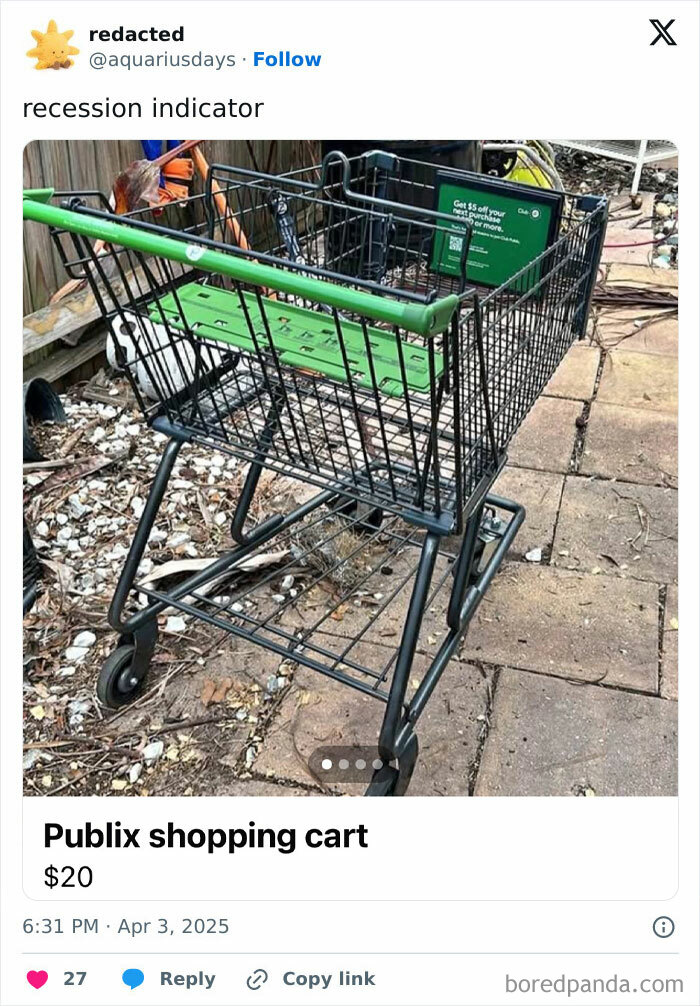

#56

Image credits: aquariusdays

#57

Image credits: audiohymn

#58

Image credits: irationalised

#59

Image credits: duckisaurus_

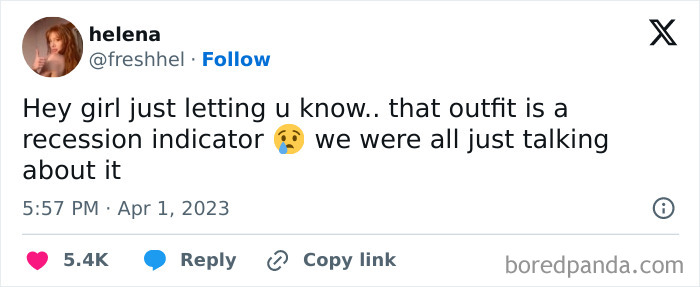

#60

Image credits: freshhel

#61

Image credits: noahalyx

#62

Image credits: addysgreatmind

#63

Image credits: VeginaDentata

#64

Image credits: foxydeadbeat

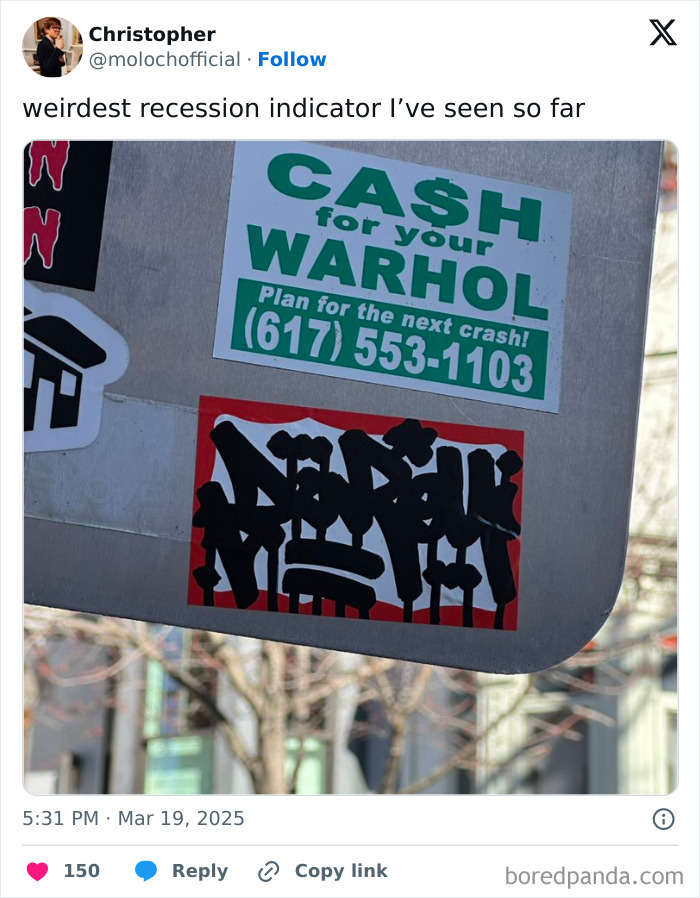

#65

Image credits: molochofficial

#66

Image credits: mrsballs69

#67

Image credits: qourtneycuinn

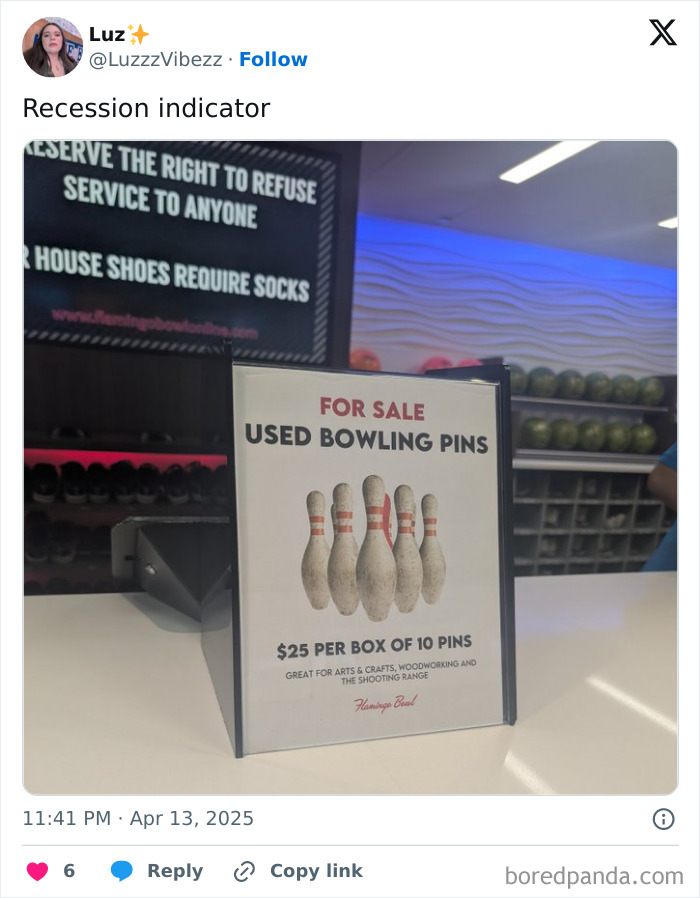

#68

Image credits: LuzzzVibezz

#69

Image credits: lordsteele

#70

Image credits: theidi_

#71

Image credits: drtymartinifan

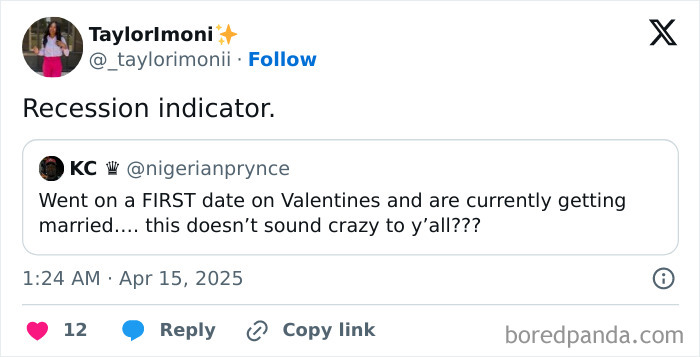

#72

Image credits: _taylorimonii

#73

Image credits: ehisilozobhie

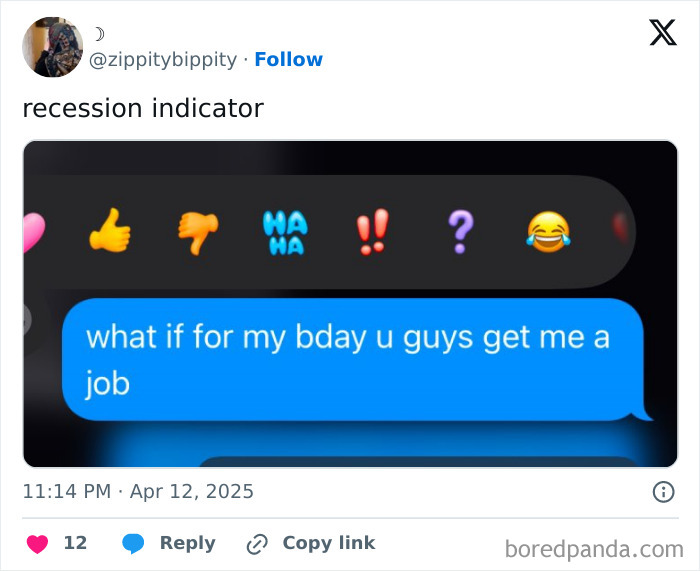

#74

Image credits: zippitybippity

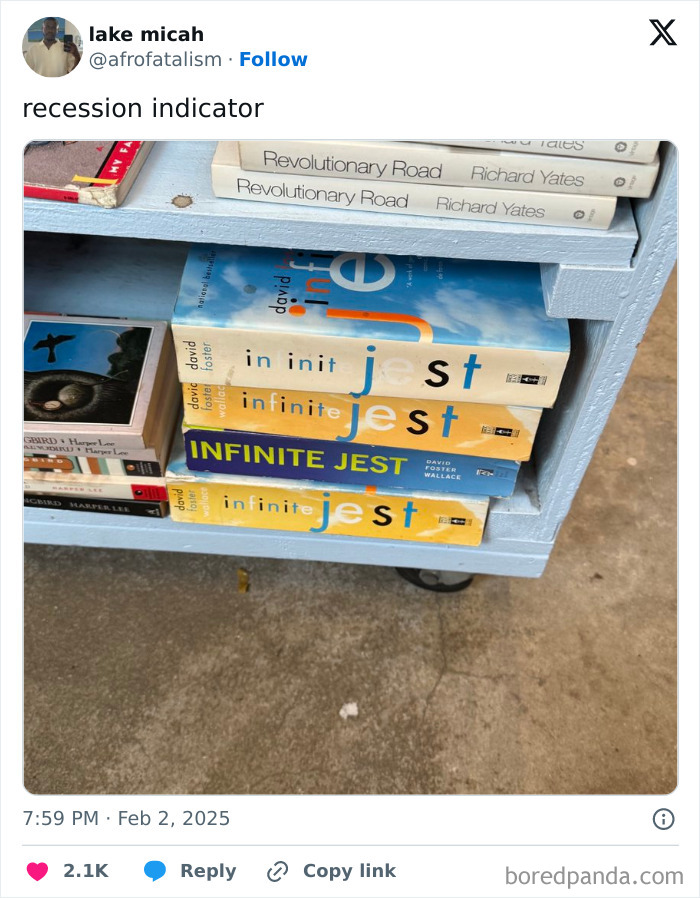

#75

Image credits: afrofatalism

#76

Image credits: trashpopsong

#77

Image credits: postproctorism

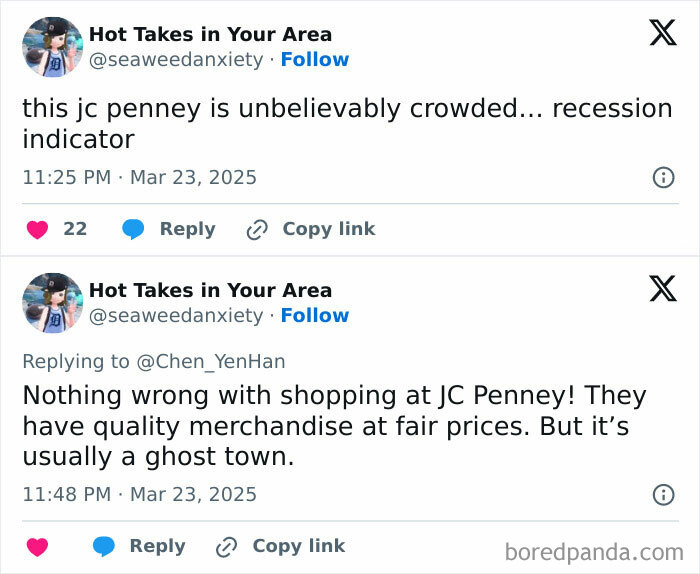

#78

Image credits: seaweedanxiety

#79

Image credits: lavfeysun

#80

Image credits: yrssuf

#81

Image credits: rosslpmanager

#82

Image credits: aaatarangi

#83

Image credits: keystonelyte