As we enter 2023, you’ve no doubt heard the “good” news.

You’ve heard that the Dow Jones industrial average’s best returns always arrive after the midterm elections. And that the S&P 500 has delivered a positive return in the 12 months following every midterm election since 1960.

But …

This view is too “static.”

“These statistics, which are supposed to guide us through the market’s gyrations, ignore whether we are in a secular bull market or a secular bear market,” warns Real Money technical analyst Bruce Kamich. “They ignore whether we are in a secular bull market for commodities or not. They ignore the fact that interest rates have broken a 40-year downtrend.”

The 54-page report, which you can download for free if you sign up for any of our subscription products, contains insight into what to expect over the next 12 months — including trends in energy and other commodities, specific stock picks, potential political influences on the market, economic outlooks and more.

The report includes the perspectives of 18 of our regular contributors, including hedge fund managers, market technicians, and investing professionals.

Subscribers can log in to access this special report for free.

First Quarter Low May be Time to Buy

Kamich — who in December 2021 correctly called the top of the market — gives investors this word of caution in TheStreet's 2023 Market Outlook Report just published this week.

He says the rally in November gave investors hope that their accounts could get back to even. But that hope won’t last much longer if the market moves against them.

“If the major averages turn down yet again the result could then be that on the margin we could see the over 65 crowd sell stocks in the first quarter of 2023. This could be the price low that we want to buy,” Kamich writes.

To the same point, Kamich warns traders that have been buying recently to “consider raising their sell stops to not give back their gains when prices weaken into a first quarter 2023 low.”

Big Tech Starting to Look Attractive Again

Hedge fund manager Doug Kass, who pens the Daily Diary on Real Money Pro made some big (and incredibly accurate) predictions for 2022. He correctly predicted that Elon Musk and Jeff Bezos would vie for the biggest loss of a personal fortune in 2022 and that the ARK Innovation ETF ARKK would trade under $70 per share.

Kass also forecasted that AT&T would outperform FAANG stocks in 2022, which it did in a meaningful way.

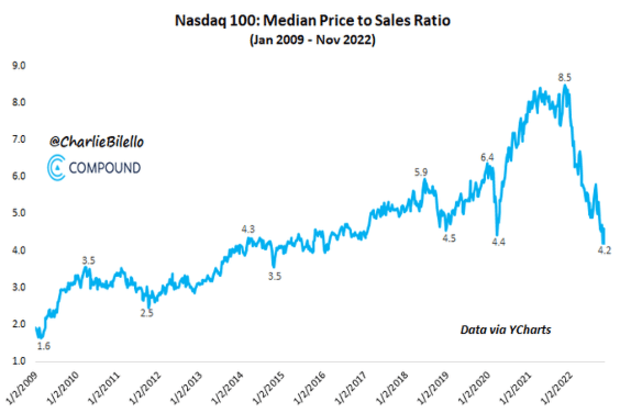

Heading into 2023, he says “large-cap technology has begun to look attractive (Amazon (AMZN), Alphabet (GOOGL), Microsoft (MSFT)) as their competitive moats have improved as less well capitalized companies fall to the wayside. Also, in valuation terms, the Nasdaq 100 Index’s share prices relative to sales has dropped from more than 8x to under 4x.”

But Kass warns that 2023 will be hard for investors and will require special skills. “Pairs trading,” he says, “in a period of sluggish and uneven growth is my preferred route and it’s the direction I am taking my hedge fund.”

Still a Trader’s Market

One of our contributors asks when “tradeable” becomes “investable”? Most of the experts in this report are aligned in saying that we certainly aren’t there yet.

Real Money columnist James “Rev Shark” DePorre explains why this “is not the time to buy individual stocks for the long term.”

DePorre says there are fantastic trading opportunities available in this market. “The biggest bounces occur in the worst markets,” he says, “but those bounces must be traded.”

DePorre warns that, “the most common mistake that is made in markets as we have now is to keep building up a long-term position as a stock keeps sinking.”

Expect Danger — Hold Cash and Contractors

Real Money’s Stephen “Sarge” Guilfoyle says he will go into 2023 “ready to be surprised, and thus will leave myself less exposed to danger.” He says he is starting the year with extra cash on hand.

And Guilfoyle says, “because the world will remain a dangerous place,” he is and likely will remain long the military contractor names that carried him through 2022 — Lockheed Martin (LMT), Northrop Grumman (NOC), General Dynamics (GD), Raytheon Technologies (RTX) and CACI International (CACI).

Bond Buying

The iconic former hedge fund manager and fixed income expert Peter Tchir expects the Fed to reach a lower terminal rate than consensus after already going “too far too fast.” Tchir adds that “concerns about the economy will help bond prices, while hurting stocks.”

Tchir likes the municipal bond sector a lot right now which he says is still trading relatively cheap to other areas. He likes investment-grade over high-yield. In the full report Tchir explains why he prefers closed end funds for this exposure and which ones he would be buying.

Commodities expert Carley Garner lays out why she thinks Treasuries are a solid play in the new year. “Perhaps it is a self-fulfilling prophecy in that a yield curve inversion could deter investments in infrastructure or discretionary spending. In any case, there is a good chance that we will enter into an official recession in 2023. With Treasury yields high and prices low (capable of appreciation), it might be the best play on the board.”

In the full report, Garner also reveals her thesis on copper and explains how the dollar should impact other assets.

Look to Asia for Clues and Opportunities

TheStreet's 2023 Market Outlook details how events in Asia can dramatically impact U.S. markets in 2023 — How China’s reopening will affect our economy, Japan’s role as one of our largest debt holders, and India’s ability to spur a commodity super cycle.

Alex Frew McMillan, Real Money's Asian market columnist, writes about investment opportunities in Asia and the best ways for U.S. investors to execute them.

However, he also has two privately held companies on his radar right now — ByteDance, operator of TikTok, and online retailer Shien — Particularly since they have both looked at the prospect of Wall Street listings in the past.” He adds, “A rally in stocks for China or on Wall Street would see ByteDance and Shein seizing the capital-markets headlines once again.”

Valuation, Valuation, Valuation

Real Money Pro columnist Paul Price shows why focusing on valuation is key — no matter the year — and uses historical data for powerhouse tech giants Apple (AAPL) and Alphabet (GOOGL) to make his case.

You can download the full 54-page report with extensive stock picks, trade ideas, and economic predictions. It is free with any subscription purchase! Check out some of TheStreet's subscription products at some of the best prices of the year.