Saving money often sounds easier than it is, even if you have disposable income once the bills are paid. That’s because nowadays, there are so many things that scream ‘buy me’ and the process of buying itself has never been easier – just a few clicks and your cart is paid off.

But what if we postpone paying for the cart and review the things we have in it after a while? Maybe even delete an item or two that we don’t actually need? Reviewing and scaling down the shopping cart was one of the tips netizens of Reddit’s ‘Frugal’ community shared after one of them asked about the easiest frugal changes people have made that helped them save money.

Today, we’d like to shed some light on their tips and tricks that might inspire you to make some frugal changes in life, too. So scroll down to find them on the list below—where you will also find Bored Panda’s interview with the netizen who started the thread, u/Peliquin—and go dust off that piggy bank.

#1

Put things in the Amazon cart but don't buy right away. Come back a few days later and realize I don't NEED that, remove. Repeat.

Image credits: writergeek

#2

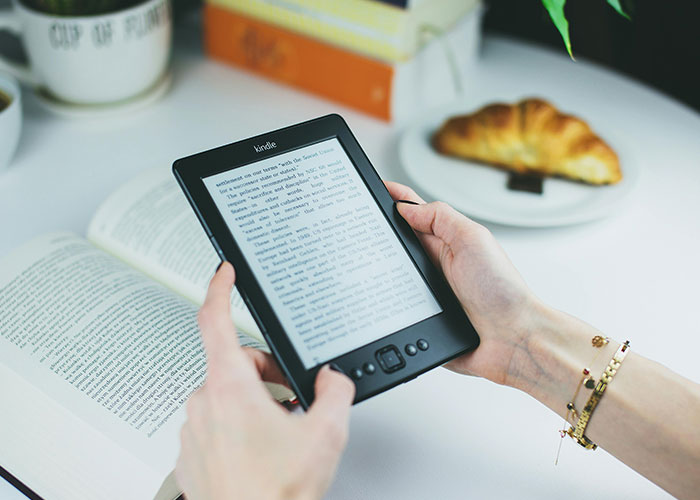

Finally got a library card and connected to my Kindle via Libby. I haven't bought a single book, ebook or physical, all year.

Image credits: suzygreeenberg

#3

Got rid of sodas. With the prices increasing, and sodas leading to health issues down the road I definitely will save more than just money in the long run.

Image credits: Sensitive_Section_98

Changing your lifestyle or old habits is not that easy, so going from barely setting any money aside to putting half of your paycheck into savings probably wouldn’t be, either. But the frugal changes redditors discussed in the thread were far from extreme; maybe even something many of us would manage doing. And even baby steps still count as moving in the direction of a more frugal lifestyle and a smaller hole in the wallet.

#4

I often met up with friends at restaurants, just by default, and that got really expensive, even when they weren't that special. I started volunteering ideas of just meeting for dessert (instead of a drink and meal), going for a hike, or just meeting at a park to sit and chat. The whole point was to just be together, so no one really paid attention to the switch and they were actually a little glad to not have to plan the outings themselves. My budget is happy about it!

Image credits: naturalbornoptimist

#5

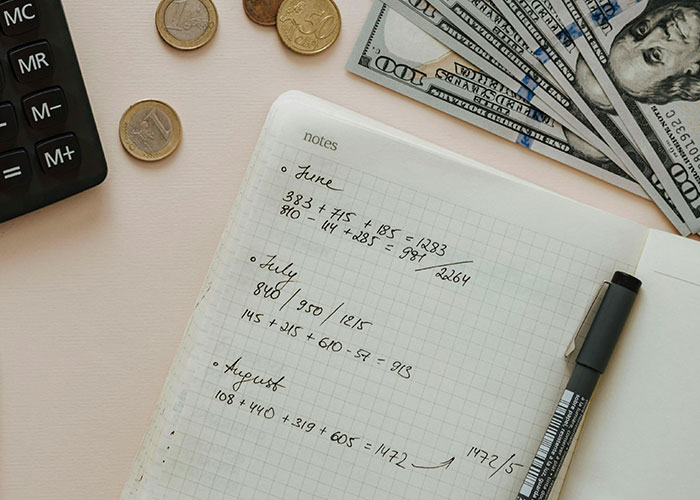

Writing down every expense in an actual budgeting notebook. I've tried budgeting apps on/off for years and never stuck with them. Having an actual notebook where I physically write all of my expenditures has made me way more frugal in every aspect of my life. Something about writing it & seeing it made me want to stop spending it!

Image credits: SaltiePopkorn

In an interview with Bored Panda, the redditor who started the thread, ‘Peliquin’, also emphasized the significance of seemingly minor change. “I often see frugal tips being out of reach for people who are just beginning a frugal journey,” they noted. “People don't go from drinking 3-4 sodas a day to drinking only tap water easily. Downshifting to fewer sodas, or an at home soda maker isn't necessarily pure frugality, but it's an easy step.”

#6

I created a gift bin. Whenever I see a great deal online or in a thrift store, bin store etc. I buy things and store them in my gift bin.

I always have nice gifts handy for kids, family members. I’m ready for Christmas

For example, we are going to a birthday next week and I have 2 brand new boxes of nice legos that I got for very cheap back in January. The kid will be happy with gifts and we only have to worry about wrapping it.

Image credits: morninglight789

#7

Quitting a 2 pack a day smoking habit. $500/mo.!!

Image credits: Frankengamer

#8

Starting to cook my own meals more and not eating in restaurants.

Every time you cook a meal, you make it better. I’m at the point now where food served in restaurants isn’t good enough for me.

Go YouTube!

Peliquin shared that they joined the ‘Frugal’ community because they had seen a good frugal gardening tip there and thought that it might be a good place to learn a few tricks. “I can't really think of something I've picked up, but I do think that being in this subreddit has made me think in more dimensions about how to use common items in more ways,” they said.

#9

Stopped using DoorDash etc and started using frozen chicken strips and tater tots when I need a quick fix.

Image credits: Capable_Mud_2127

#10

One morning when I had some downtime, I went through my email and unsubscribed from basically any email list I was a part of. Wayfair, H&M, Home Depot etc etc. All of it. Not only has this completely cleared up my inbox, I no longer get tempted by sale days, coupon codes etc. It has helped curb impulse spending immensely!

Image credits: javajunkie10

#11

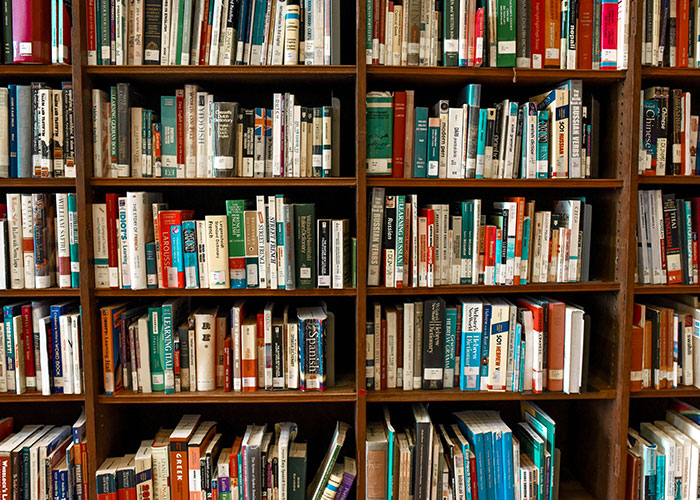

Not a change this year, but one that all my friends have been shocked by as I've slowly converted them over time! Your local library is your best resource for a lot of things, but especially accessing books, audiobooks, magazines, manga, graphic novels, music, television shows, movies, and so on and so forth. Language learning apps? Many libraries (like mine!) have free subscriptions for their users. Doing genealogy? Tons of free resources, including, often, Ancestry.com. My library has several apps like Libby, Kanopy, and Hoopla. Free online classes, free sessions with lawyers and job search professionals, free internet, hotspots, board games, yard games, video games, puzzles.....

Also, many libraries have seed libraries and 'library of things' --> anything from science-y or artsy kits to car/house/etc repair.

Image credits: efflorae

The redditor admitted that as useful as some tips shared on r/Frugal are, not all of the netizens’ answers to their thread were equally helpful. “I thought that a lot of people just shared their top favorite frugal tip whether or not it was easy to implement. I really had to hunt to find stuff that was more what I was looking for,” they told Bored Panda.

“I think people can [benefit from threads as this one], but I think what people need is more like some sort of six-month frugality boot camp. I wrote a post about that a few years ago, and I wish I could get more people to have read it. It's what I personally did when I was finally making enough money to make real choices, and it has kept me pretty well ahead of all spending.”

#12

Drinking. I like a glass of wine or two with dinner or after. Doing it every night is expensive and unhealthy. I have started to replace it with drinking hot tea at night. I’ve never been a tea drinker but it’s fun to explore different options and it’s starting to grow on me a bit.

Image credits: dsook2

#13

Started shopping at the discount grocery store. Ours has lots of things that are nearing or just past sell by dates, and I was nervous things might not be good. Haven't had a single issue and we're literally saving hundreds per month on groceries.

Image credits: caffeinatedintrovert

#14

I learned to make my fancy coffee at home. I used a cheap espresso machine we had to make sure i would stay in the habit and after a couple weeks i bought a used nicer model and have made my fancy coffee at home since. I dont have to sacrifice taste for frugality. The $250 i spent on the nice espresso machine has easily been "earned" back not going to coffee shops.

Image credits: flipflop924

#15

Cancelled cable, no one was watching ‘regular’ TV, kept prime and Hulu. No one in the house has noticed.

Image credits: According-Paint6981

#16

Went on a "no-buy." Sounds nuts but gamifying making do with my existing wardrobe, decor, cooking utensils, gardening tool etc has made it so easy. And it simplifies the process of figuring out whether a purchase is worth the money because it DOESNT MATTER- I'm not allowed to buy it anyway.

I did a no buy month and wondered if I would make it through but wound up breezing through it and found it so helpful and easy I am committing to a year.

Image credits: peanutbutterprncess

#17

Online thrifting for toddler clothes. They are outrageously expensive and the tots grow out of them in a year or less.

#18

Not this year but during the pandemic... we only ordered from restaurants that let us come and pick up the order. No food delivery services whatsoever. Once we slowed down our eating out from "once a week" to "once a month or two", we started spending way less on takeout.

also giving up alcohol when my husband needed major surgery. The doctors recommended to not drink 2 weeks before and 2 weeks after... and we just never made it back into a liquor store. Going on 8 months of total sobriety now!

#19

Meal Prep!

I prep 5 oatmeal breakfasts, 5 chicken pasta and sauce meals and 5 chicken, rice and black bean meals.

This saves me so much money and time!

I mix in fruit cups for breakfast and lunch. I usually go with pineapple or mandarin oranges. I eat way healthier and I’m saving money.

Image credits: Ibn_Khomeini

#20

Switching auto and home insurance. Our auto went down by two-thirds and our home by half. I don’t even want to think of the money we overpaid over the years.

Image credits: Librashell

#21

Espresso machine. I was buying a 7 dollar Starbucks drink daily. Now it costs about 25 cents for the same thing.

Image credits: BlackLotus8888

#22

I started cutting my own hair. As a guy, paying $50-60 a month for something that only looks good for probably 2 weeks is not ideal. I'll only pay that if I have a special event like a wedding or if I'm going on a memorable trip (once or twice a year). Otherwise, I'll just cut it at home and spend $0.

Image credits: JA-868

#23

Turned 40 and decided to quit dying my hair. I’m over a year in and have not only saved money, but my hair is the healthiest it’s ever been! I also like my natural gray sparkle!

#24

The only real change that we made was not ordering take out so much. We were ordering 3-4 times a week and going out about once a week. Now we are ordering out once ever other week and not dining out. It’s saving my family of 4 about $1000 a month. Honestly, I miss being able to have all the dining options, but due to certain circumstances we can no longer afford such luxuries.

Image credits: Hot_Engine_2520

#25

Use the envelope method for groceries and my fun money. It makes me pay attention to how much money I'm spending and what I'm spending it on when I have to count out the cash.

Image credits: NeverEnoughGalbi

#26

Buying bone-in chicken thighs for $0.99/ lb instead of boneless/skinless for over $3/lb. Also bought a cheap boning knife ($10) and YouTube'd how to remove the bone. It's surprisingly easy. Then you keep the bones for stock. Takes me about 15 mins to process about 10 pounds of meat.

Image credits: battahboombattahbing

#27

NOT renewing Prime.

#28

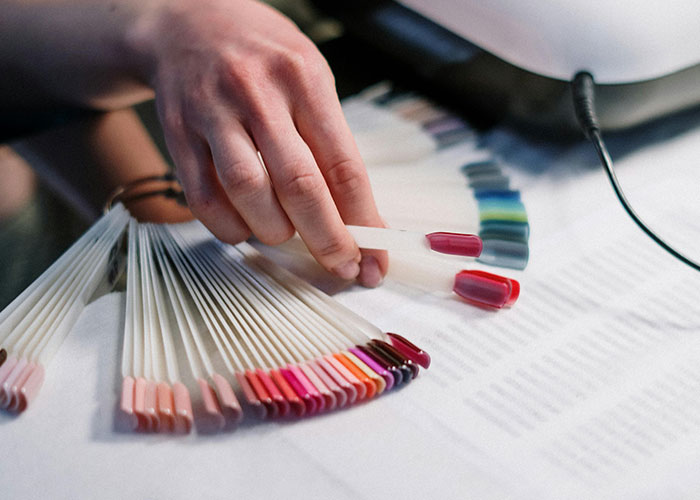

Went back to doing my own manicures. I have such a collection of polish to use up! .

Image credits: Kirby73

#29

I moved somewhere with an Aldi nearby and my grocery budget is about half of what it used to be.

#30

Setting a budget. I grew up poor and no one taught me about money. I’ve just been winging it my whole life. This year my husband and I sat down to have a come to Jesus and figure out *where was all our money going?*

We just sort of divided our money up into different accounts because we can’t be trusted. The main account is only for bills and gas and groceries, but I only spend a set amount a month on groceries. Then each of us has a fun account that we add money to each pay period. That’s the only money we have to blow. Then there is a family fun money. If we want to buy pizza or go to the movie it comes from there.

It completely changed my relationship ship to money, and I thought I was frugal. I was a single mom who raised two kids on one income before o got married. I was not good with money. I was good with stretching the last few dollars after I wasted all my money.

#31

I have started to go through all drawers, cabinets wardrobes etc having a clear out. Not only have I discovered things I'd forgotten and organised things in such a way that I know how much of everything that I have, but it's illustrated to me where I was making impulse purchases that I regreted. That's helped me stop repeating those same mistakes. For example, I am done with eyeshadow, I've never really "got" how to do it, I end up looking awful and I've chucked the lot out, it wasn't a matter of finding the "right palette", it's just not for me!

#32

Doubled my 401k contributions. Less extra money burning a hole in my pocket.

Image credits: fishsticklovematters

#33

Fewer trips to the Grocery Store! After routinely popping in 3-4 times per week for odds and ends forgotten on my primary weekend trip, I started going to the grocery store just once a week . This restricts opportunities for unhealthy impulse purchases, pressures me to use and consume the fresh food and pantry items I already have on hand instead of letting them go to waste, and sometimes saves on fuel for short inefficient car trips to the neighborhood grocer (if I'm desperate, I make myself ride my bike). The main grocery store chain in my area offers a weekly coupon for 4x fuel points on Fridays. By restricting most grocery purchases to Fridays I can also optimize that perk which is a great bonus.

Image credits: FreedomCharacter4622

#34

Spent way less at restaurants/I don’t go there that much any more. I spent only 21 dollars last month on fast food.

Image credits: daydreamer_she

#35

Using an insurance broker to find the best deals for you every year.

They deal with finding the quotes, talking to vendors, and just present the numbers to you. Every year I end up changing my insurance provider for something cheaper while still getting the same value/protection.

#36

Not easy, but finally took hubby off my Verizon plan - he passed 2 years ago and it took me that long to make myself do it. Meanwhile, he’s like, why didn’t you do that 2 years ago?! Anyway, saved $40/mo.

#37

Travelling less. I made the decision on July 1 to cut out any domestic travel that requires a rental car, except for going home at Christmas-time. I haven't left North Carolina since mid-June when I visited family in Chicago. I had spent 30 years in travel heavy jobs and still have tons of American and Delta miles to spend, but the rental car and hotel costs were killing my budgeting.

Slowly transitioning to drinking mostly water when at home and rarely buying soda when out. This transition took most of the first eight months of 2024 to break habits and build new ones. I still buy some 8-packs of Polar or LaCroix or a 2L bottle of ginger ale, but only one at a time and only in weeks where I spend $35 or less on other groceries. I also picked up a box of individual Crystal Light packets from Sam's Club to help with transition, and now I use only one or two a week. When I'm out, I have a Panera subscription at $5.75/month for iced coffee and soda, and I use that 4-5 days a week so I don't buy anything if I get breakfast or lunch somewhere else. That along with bringing a water bottle with me also means that I rarely buy combo meals when I am out, and while I do eat out a lot many of the times it's only $2.50-$3.25 instead of $7.50.

#38

Removed my saved credit card info from every online store - it’s safer, but also, my want for an item goes down significantly if I have to get off the couch to grab my wallet.

And I shop up our local natural food store that has a ton of bulk bins. Buying the exact amount of something that I need for a recipe is way cheaper and cuts down on waste!

Image credits: SpinningBetweenStars

#39

I switched my savings from my account I've had literally forever to a high yield savings (4% apy or something). It's not an account I can easily withdraw from, so that money is sitting safe. I went from getting like a single cent from my money every month to $30 or so.

Image credits: EvangelineTheodora

#40

Sold my truck for a suv and quit nicotine in the same month started saving nearly $100 a month with those two changes.

Image credits: That-Future7560

#41

Getting rid of paper towels at home

I bought a thing of painter's rags for my art space and brought most of them in the kitchen. they go in a bag to use, into the laundry to wash.

Image credits: bristlybits

#42

Make coffee from home and bring it to work instead of spending $5 per cup.

#43

Every time I wanted to spend money on something useless on Amazon I “pulled myself up by my bootstraps” and transferred it to savings instead. Took me a few months to not break the habit but I have accumulated a little over $500 in savings instead of throwing it away.

#44

Drawing out my household food budget in cash- when it's gone, it's gone. If something edible can't be paid for in cash we don't buy it. It's cut our spending from almost £500 per month (with an embarrassing amount of food wasted) to around £250.

#45

I started using the pressure cooker.

I was astonished by how quickly I could cook a whole chicken breast, how juicy/tender it still was, and how fast & easy it was to clean.

I can shred the whole breast in less than a minute and mix it with a microwaved southwest blend (quinoa, rice, peppers, onions, etc), sprinkle a bit of adobo on it and have a healthy cheap quick easy burrito bowl to rival Chipotle's.

The actual labor part of that meal is about 2 minutes. Then I just do something else while the chicken cooks for like 25 minutes and throw the frozen mix in the microwave for the last 5 minutes.

#46

Learning how to cook beans! It seemed intimidating and I've made some mistakes, but now I eat beans for at least one meal a day. My gut, waistline, and wallet are very happy. .

#47

Started making homemade pizza. Fast, easy, cost-effective and always a crowd-pleaser with the family.

I (kitchen-delinquent husband) started doing this on nights my wife had a long/hard day at work instead of opting to eat out.

#48

Finance hack here. If I need a big power tool for something, I buy it on Facebook Marketplace, use it, and then resell it on Facebook Marketplace. Usually it’s for the same price, but sometimes I get more. For example, my kids wanted an in-ground basketball hoop. I bought an auger for $100, used it, and sold it for $160. I bought a concrete mixer for $150, used it, and sold it for $175. For another project I bought a table saw for $100, used it, and sold it for $100.

Image credits: HookItLeft

#49

Making my own coffee creamer. I used to buy the brown sugar oat milk kind from coffee mate and it was creeping up to over $6 per container each week. Now I buy oat milk, add some brown sugar and vanilla extract, shake it up, and put it in a jar. Lasts me 2 weeks and costs $2-3/week depending on when I need to buy ingredients.

#50

Honestly removing the exposure to ads/influencing. I deleted tik tok and stopped clicking on the instagram pics/vids of influencers telling me what I need to buy. I also unsubscribed from all email lists (I’m still doing this, each time I get an email I unsubscribe). I also turned off notifications from shopping apps. I’m sure there is more stuff too that I’m not thinking of but genuinely when you’re not always seeing stuff that tempts you to buy, you forget about wanting to buy stuff. Seriously.

#51

Buy powdered drink mix for my sports-playing kids instead of bottled sports drinks after every practice.

#52

YouTube for home repairs. Even with a home warranty our deductible is $150, for the AC the part was $12 on Amazon. But normal first reaction used to be just call the warranty and have someone come out.

#53

I got a windfall and paid off all my consumer debt. It saves about 30%.

#54

Spending $10 on a candle warmer. Instead of spending a big expense repeatedly buying candles, I can melt them again and again and they still smell amazing.

#55

Meal prep, canceling subscriptions, and starting an impulse buys list where I wrote what I want, how I feel, and if it keeps popping up consistently then I decide to buy it. Much more intentional! (edit: grammar).

#56

In the past year plus: Reduce monthly charges/subscriptions. Savings sometimes at the click of a button. Marie Kondo that streaming list, and cut cable. No cable TV saved $1000/yr by itself.

#57

Not exactly by me, but local store moved all alcohol to locked display. Now you have to press a button for store clerk to come and open it. I pressed a button, waited 5 minutes and realized that I don’t want to buy the alcohol today.

#58

Not buying a clothes! Recognizing I can live off what I have in my closet and don’t have any NEEDS just wants.

#59

Moved to a an apt with cheaper rent.

#60

Deleted my Starbucks app.

#61

Got a Costco membership only to use on gas and protein. I save probably $100/month on a $60 membership.

#62

Use the stock in the pantry. Get adventurous and mix foods. Keep life simple.

#63

Canceled all streaming services. Been watching tv shows via library dvd 'rentals'. Just watched Westworld season 1, now watching True Detective. I don't miss streaming at all so far. My goal is to exhaust my local library's supply of stuff I want to watch- movies and tv- then maybe sign up again. But it's going to take a good long while.

#64

In our kitchen after washing my hands I now use a hand towel instead of tearing off a sheet on the paper towel roll.

#65

I started making my own yogurt this year.