/Uber%20and%20Lyft.jpg)

As artificial intelligence (AI) continues to impact a wide range of industries globally, institutional investors are broadening their exposure to companies that look poised to benefit from expanding adoption and utilization of AI tech. In an analysis of large-cap mutual funds with a combined $3.3 trillion in assets, brokerage firm Goldman Sachs (GS) noted that institutional investors trimmed their exposure to the "Magnificent Seven" market leaders during Q1, but added utilities and other AI-exposed stocks to their portfolios.

Here are five of the AI-related stocks that institutional investors were loading up on during Q1, according to Goldman - with their list refined to highlight names that have a consensus “Strong Buy” rating from Wall Street analysts, and plenty of upside potential to analysts' mean price targets.

#1. Uber

We start our list with ride-hailing giant Uber Technologies (UBER). Founded in 2009 and based out of San Francisco, Uber offers app-based ride-hailing, food delivery, freight transportation, and micro-mobility options such as scooters and bikers. It currently commands a market cap of $135.67 billion.

Uber stock is up 5.9% on a YTD basis, and has gained nearly 70% over the past 52 weeks.

Overall, analysts have a rating of “Strong Buy” for UBER stock, with a mean target price of $85.28. This denotes an upside potential of about 31.3% from current levels.

Out of 40 analysts covering the stock, 35 have a “Strong Buy” rating, 3 have a “Moderate Buy” rating, and 2 have a “Hold” rating.

#2. Vistra

Formed in 2016 by the merger between Dynegy Inc. and Exelon Corporation, Vistra (VST) operates in the energy sector. It is focused on competitive electricity generation, retail electricity sales, and utility operations. Its market cap currently stands at $36 billion.

VST stock, which offers a dividend yield of 0.84%, has rallied 171.2% in 2024 so far.

Seven out of eight analysts have deemed VST stock a “Strong Buy,” with 1 “Moderate Buy” rounding out the ratings. The mean target price is $110.43, which indicates an upside potential of roughly 6.6% from current levels.

#3. Intuit

Founded in 1983, Intuit (INTU) is a California-based company that develops fintech products and services for consumers and small businesses. Their popular offerings include TurboTax tax preparation software, the Mint personal finance management app, QuickBooks accounting software, and the Credit Karma credit score and monitoring service. The company's market cap currently stands at $167.25 billion.

INTU stock is down about 5% on a YTD basis, and offers a dividend yield of 0.60%.

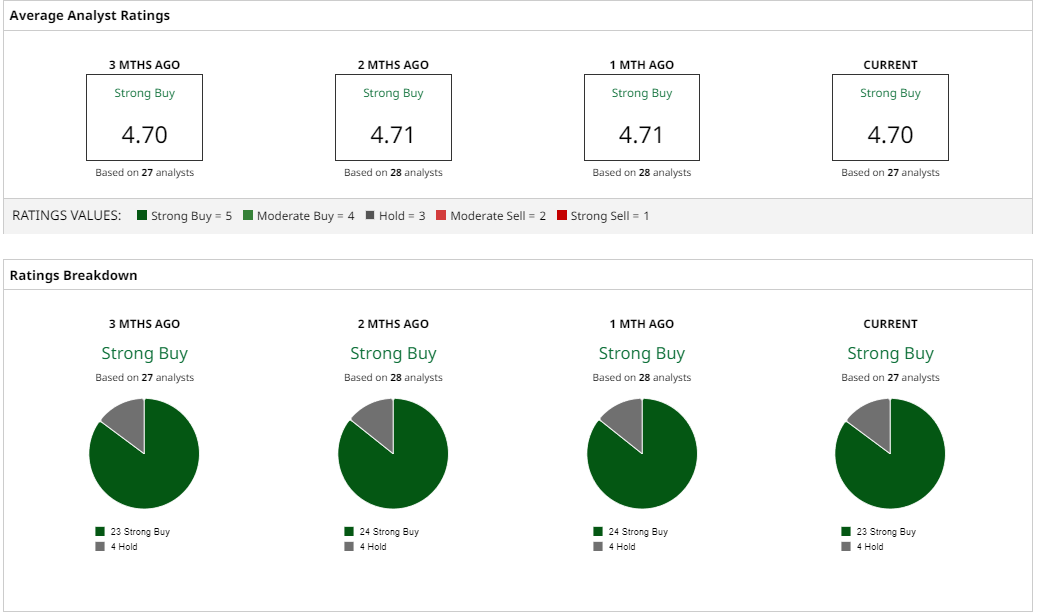

Overall, analysts have a consensus rating of “Strong Buy” for INTU, with a mean target price of $687.79, which denotes an upside potential of nearly 15% from current levels. Out of 27 analysts covering the stock, 23 have a “Strong Buy” rating and 4 have a “Hold” rating.

#4. ServiceNow

Santa Clara-based ServiceNow Inc (NOW) is a cloud software company that provides a platform for digital workflows and IT service management. Their platform helps organizations automate and streamline various business processes, including incident and problem management; asset and change management; and service request fulfillment, among others. The company currently commands a market cap of $149.8 billion.

NOW stock is up 30.4% over the past 52 weeks, though it's slightly negative on a YTD basis.

Analysts have an average rating of “Strong Buy” for NOW stock, with a mean target price of $828.70. This indicates an upside potential of about 13.3% from current levels.

Out of 33 analysts covering the stock, 28 have a “Strong Buy” rating, 2 have a “Moderate Buy” rating, and 3 have a “Hold” rating.

#5. Marvell Technology

We conclude our list with Marvell Technology (MRVL), a company that develops and manufactures semiconductors and related technology. Founded in 1995, their products are essential components in various electronic devices and play a critical role in data infrastructure. Marvell's market cap currently stands at $65.58 billion.

Ahead of tonight's Q1 earnings report from the chip specialist, MRVL stock is up 25.5% on a YTD basis. The stock offers a dividend yield of 0.32%.

Overall, analysts have a consensus rating of “Strong Buy” for MRVL stock, with a mean target price of $88.56, which denotes an upside potential of nearly 17% from current levels. Out of 28 analysts covering the stock, 25 have a “Strong Buy” rating, 2 have a “Moderate Buy” rating, and 1 has a “Hold” rating.