Berkshire Hathaway (BRK.B) shares nudged higher Friday, extending their year-to-date gains to around 16%, ahead of the investment group's fourth-quarter-earnings report and annual report publication early Saturday morning.

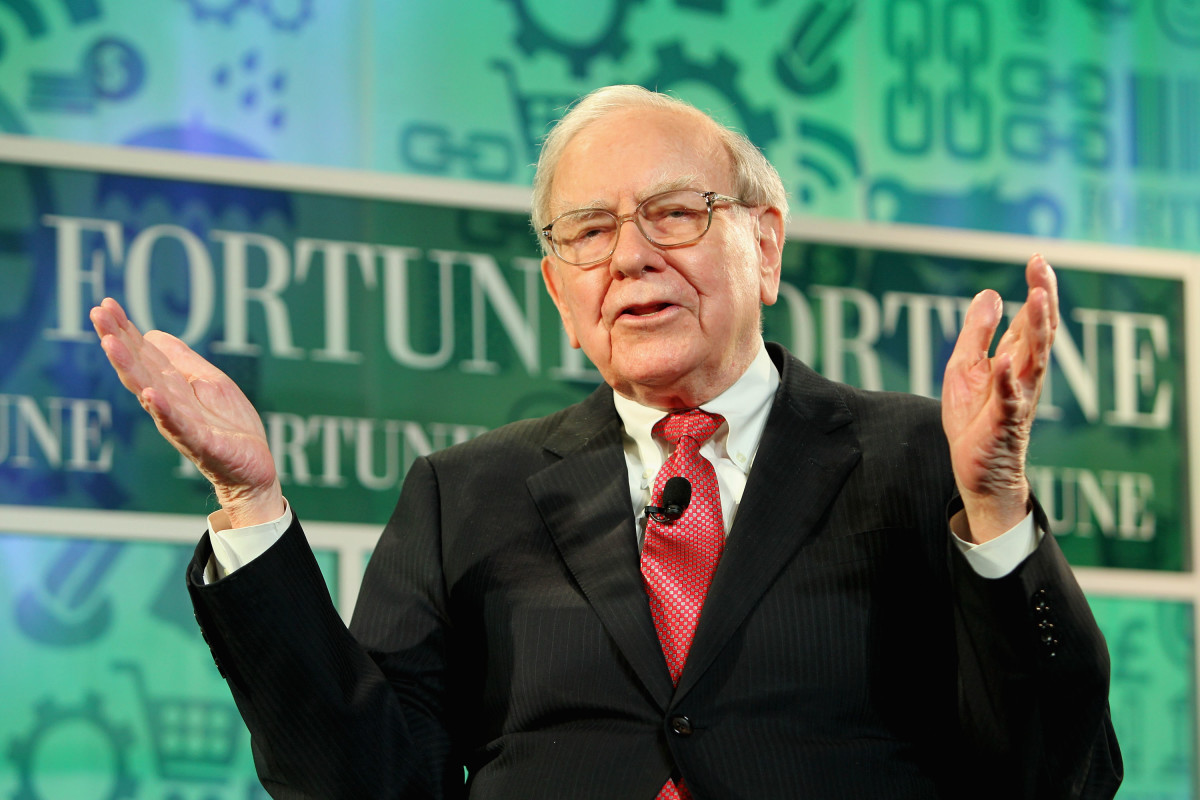

Berkshire, (BRK.A) , the seventh-largest stock on the S&P 500 with a market value of $910 billion, is an investment conglomerate with holdings in insurance, manufacturing, rail, and consumer assets guided by Founder and CEO Warren Buffett.

Buffett, 93, is also one of the world's most famous investors, having amassed a personal fortune of more than $120 billion – nearly all of which he has pledged to donate to charity – and a stock portfolio last valued at $371 billion.

Berkshire's largest stakes, which account for around 75% of that total portfolio value, are compressed into just five stocks: Apple (AAPL) , Chevron (CVX) , Bank of America (BAC) , American Express, and Coca-Cola.

Image source: Getty Images.

Berkshire Hathaway's investment strategy

"We own publicly traded stocks based on our expectations about their long-term business performance, not because we view them as vehicles for adroit purchases and sales," Buffett wrote in his annual letter to shareholders in February 2023. "That point is crucial: [We] are not stock-pickers; we are business-pickers."

That said, the businesses that Buffett does pick have performed exceedingly well: Berkshire has delivered a compounded annual return of 19.8% since 1965, nearly double that of any fund tracking the S&P 500.

With the group's annual report set to be published on Saturday, alongside Buffett's highly anticipated letter to shareholders, we've compiled five key questions investors are likely to focus on heading into the Oracle of Omaha's 59th year at the helm of Berkshire Hathaway.

1. Cash is king?

Berkshire Hathaway had around $157.2 billion in cash and cash equivalent securities at the end of the third quarter, an all-time high that's stocked mostly in short-term Treasury securities.

However, while longer-term rates have remained high, short-term yields have fallen notably since the end of the third quarter as traders extended bets on spring interest-rate cuts from the Federal Reserve.

Benchmark 6-month Treasury bill rates were marked at around 5.26% at the close of the year, down from around 5.55% in late September. That provides less incentive for Buffett to keep building his cash hoard, particularly when broader stock indexes were rallying hard over the final months of 2023.

"Cash is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent."

— Investment Wisdom (@InvestingCanons) February 23, 2024

— Warren Buffett

"We see acquisitions and/or share buybacks remaining part of Berkshire’s capital allocation strategy, given the more than $160 billion in cash and short-term investments we expect Berkshire will have on hand at year-end 2023," said CFRA analyst Catherine Seifert.

2. What's that confidential investment?

Perhaps the most intriguing element of Berkshire's annual report will be the revelation, if any, of Buffett's secret new investment.

Berkshire has twice filed for permission from the U.S. Securities and Exchange Commission to keep the new investment, which he began to build in the second quarter of last year, temporarily confidential.

More fund manager buys and sells:

- Warren Buffett just sold shares of this popular streaming stock

- Paul Tudor Jones’ hedge fund just made a big bet on Nvidia stock

- Stanley Druckenmiller just sold two AI tech stocks

Suggestions are that Buffett or his Berkshire Hathaway colleagues Todd Combs and Ted Weschler are amassing a stake in a U.S. financial services company based on some retooling changes in the group's third-quarter accounting.

Buffett has said that his investment plans are often mimicked by both retail and institutional investors, and keeping his buying plans private – SEC rules allow for as long as a year of confidentiality – would give him more control over future share purchases.

3. Oil's well?

Berkshire's latest 13-F filing with the SEC, which detailed holdings as of the end of the year, showed it had amassed a stake of 126.1 million shares of Chevron, the country's second-largest oil major in terms of market value behind Exxon Mobil (XOM) .

The holding marked a 14.4% increase from its holdings at the end of the third quarter and pegs the stake at around $19 billion, making it the fifth-largest in Buffett's $371 billion portfolio.

Buffett also holds a 27% stake in Occidental Petroleum (OXY) and carries preferred shares and warrants that could take his ownership to as high as 33%.

Those holdings, along with his 100% ownership of freight-rail giant BNSF Railway and a 92% stake in BH Energy, tie Berkshire Hathaway's overall financial commitment directly to the health of the U.S. economy.

Related: Occidental Petroleum Stock Jumps As Warren Buffett Adds to $16 Billon Stake

Consolidation in the oil sector, particularly around shale assets, likely provides Berkshire with a derivative play on big acquisitions. For example, Occidental unveiled plans to buy U.S. shale-oil producer CrownRock for around $12 billion, giving Buffett access to those assets and his Occidental holdings for a fraction of their overall value.

But his manufacturing, energy, and rails holdings comprise around 44% of Berkshire's operating profit.

Buffett's comments on the health of the U.S. economy and its ability to avoid recession this year will be crucial in terms of Berkshire's performance.

4. Further slicing of Apple?

Buffett has long touted the value of holding Apple shares, which he first began amassing in the winter of 2016, and he has said the iPhone is "enormously underpriced" compared with the value it offers consumers.

However, Berkshire's fourth-quarter SEC 13-F filing showed that Buffett, or one of his colleagues, trimmed the firm's overall holdings in Apple by around 10 million shares.

Apple remains Buffett's single-largest holding, pegged at 905 million shares with a market value of around $174 billion at the end of last year. But any suggestion that Berkshire is looking to spread its tech-investment dollars outside the consumer-focused giant would be massive news for investors.

Related: Analysts unveil new Apple stock price targets after earnings

The profit potential tied to AI-related technologies, of course, has been the market's unquestioned bull narrative for much of the past year, driving stocks to records and taking Nvidia to a $2 trillion valuation.

But Buffett has a long history of encouraging investors to "buy what you know," and he only recently confessed that "I still don't think I understand exactly where the cloud is going."

Buffett has closed out holdings in IBM, Oracle, and Amazon in recent years and appears reluctant to dive into AI and leading-edge technologies, preferring to focus on manufacturing and insurance assets.

With Apple's growth prospects in question and its lagging position in AI pegging the stock in negative territory for the year, investors will be keen to read any commentary on Buffett's plans for the stock or the broader tech sector.

5. What of succession ... the good kind?

Buffett will likely devote a good portion of this year's annual letter to the passing of his good friend and longtime business companion, Charlie Munger.

Munger, who died Nov. 28, just a month shy of his 100th birthday, joined Berkshire Hathaway as vice chairman in 1978 after leaving his law practice in favor of a role in financial markets the previous decade.

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom, and participation,” Buffett said of his closest associate, who helped shepherd a 4,000% increase in the value of Berkshire Hathaway stock under his one-in-a-generation tenure in Nebraska.

Munger's passing, however, raises the uncomfortable issue of succession at Berkshire Hathaway now that Buffett is just six months away from his 94th birthday.

Related: The wisdom of Charlie Munger: 5 simple steps to investment success

Canadian-born Greg Abel, who runs Berkshire's noninsurance businesses, was tipped by Munger as Buffett's heir apparent. The Oracle of Omaha told CNBC in 2021 that "if something were to happen to me tonight, it would be Greg who'd take over tomorrow morning."

That's not exactly the kind of succession plan investors may feel entirely comfortable with, given Buffett's enormous influence on the group and his cult-like status among legions of retail investors worldwide.

Munger's passing could allow Buffett to sketch out a future for the company without him, given his admission to be "playing in extra innings." And investors will read with great interest any suggestion that his time at Berkshire Hathaway is coming to an end.

Related: Veteran fund manager picks favorite stocks for 2024