The following real estate investment trusts (REITs) are interesting because each one bears a balance sheet not too different from those considered desirable in Benjamin Graham’s classic “The Intelligent Investor.” Graham, of course, is deemed the father of value investing and greatly influenced Warren Buffett, his student at Columbia University.

Each of these REITs is trading at a discount to book value, and each one is paying a dividend of some kind. Obviously, there’s a lot more to consider but, as a starting point for the serious long-term investor, these below-book and dividend-paying REITs may be worth looking at.

Annaly Capital Management Inc. (NYSE:NLY) is trading at a 1% discount to book value with a price-to-earnings ratio of just 2.42 and is now paying a 14.57% dividend. This is a mortgage real estate investment trust with assets mostly consisting of agency mortgage-backed securities and debentures.

The daily price chart for Annaly Capital is here:

The price from near $7.80 at the beginning of the year down to $5.30 by mid-June is quite a range. A rally from June to late July took it back up to $7, but then the selling started again, taking the REIT down to $6 before some buyers showed up again.

Check out: This Little Known REIT Has Produced Double-Digit Annual Returns For The Past Five Years

City Office REIT Inc. (NYSE:CIO) trades with a very low price-to-earnings ratio of 1.13 and pays a 6.9% dividend. The company buys and operates office properties, mainly in the West and Southwest including cities such as Denver, Dallas and Phoenix. City Office is trading at just 66% of its book value.

The daily price chart for City Office REIT looks like this:

Note the drop from $20.50 at the beginning of the year to the recent price of $11.63 — a 43% decline in about seven months. The good news for City Office REIT is that, so far, the June low of less than $11 is holding.

Cousins Properties Inc. (NYSE:CUZ) trades with a price-to-earnings ratio of 14.14 and is paying a dividend of 4.76%. The company owns, manages and develops real estate rental properties primarily in the Southern United States, mainly in Texas and Georgia. It’s available for purchase at a 13% discount to book value.

The daily price chart for Cousins Properties looks like this:

That’s a slide from $41 to $26.91 in about 5½ months — a 34% drop in value. The REIT is still flirting with the early September low, which is also the low for the year.

Dynex Capital Inc. (NYSE:DX) trades at 79% of book value with a price-to-earnings ratio of 3.5 and pays a dividend of 10.5%. The company invests in residential and commercial mortgage-backed securities — mostly of the agency-backed variety.

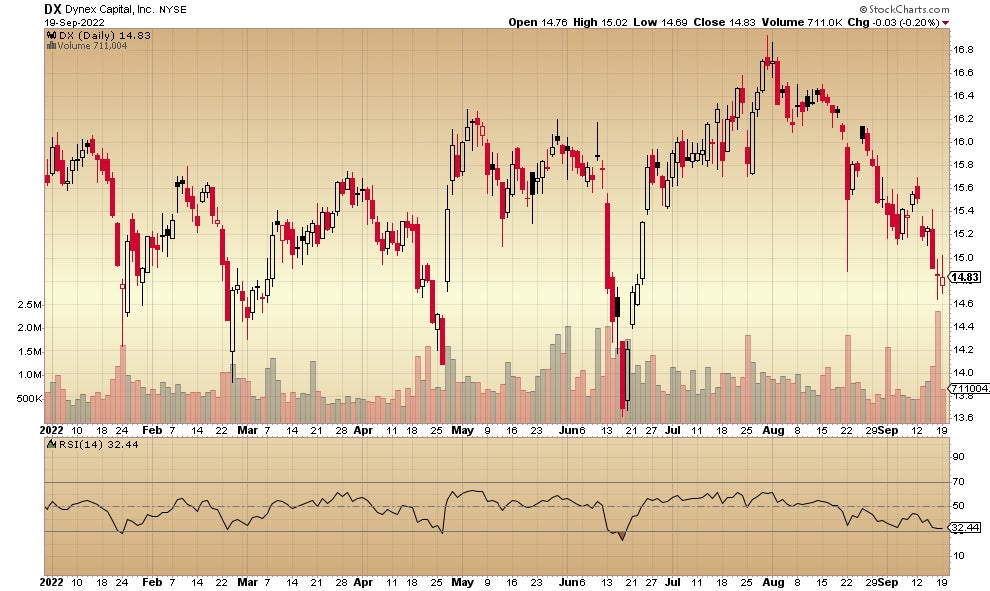

The daily price chart for Dynex Capital looks like this:

This is a big trading range for a real estate investment trust — from just above $13.80 in mid-June up to $16.80 by late July before dipping down to $14.83 in September.

SL Green Realty Corp. (NYSE:SLG) is trading with a price-earnings ratio of 10.94 and pays investors a dividend of 7.95%. The company is one of the largest property owners in New York City with interest in about 35 million square feet of Manhattan property. The REIT trades at a 33% discount from book value.

This is the SL Green daily price chart:

Note the significant level of the price drop from early in the year to the present. The REIT traded at $81 at the end of March and now goes for $47.87.

No guarantees exist that any of the dividend yields described in this article will continue as they are. Real estate investment trusts can lower or cut such payments with not too much notice.

Looking for high dividend yields without the price volatility?

Real estate is one of the most reliable sources of recurring passive income, but publicly-traded REITs are just one option for gaining access to this income-producing asset class. Check out Benzinga's coverage on private market real estate and find more ways to add cash flow to your portfolio without having to time the market or fall victim to wild price swings.

Latest Private Market Insights:

- Arrived Homes expanded its offerings to include shares in short-term rental properties with a minimum investment of $100. The platform has already funded over 150 single-family rentals valued at over $55 million.

- The Flagship Real Estate Fund through Fundrise is up 7.3% year to date and has just added a new rental home community in Charleston, SC to its portfolio.

Find more news, insights and offerings on Benzinga Alternative Investments

Not investment advice. For educational purposes only.

Charts: Courtesy of StockCharts