In the latest quarter, 5 analysts provided ratings for Omega Healthcare Invts (NYSE:OHI), showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

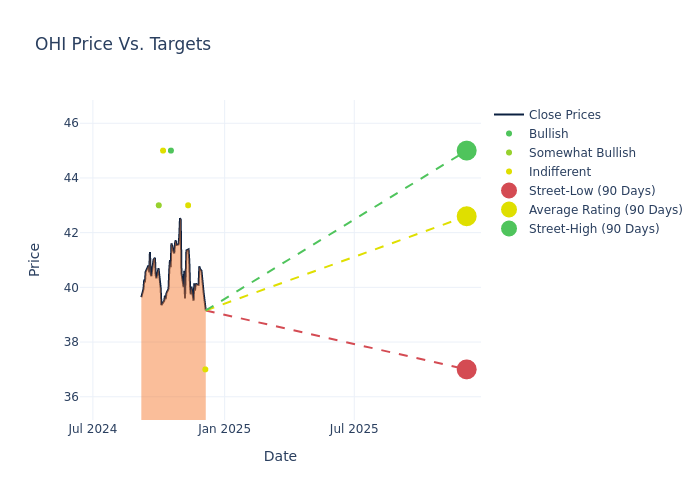

Insights from analysts' 12-month price targets are revealed, presenting an average target of $42.6, a high estimate of $45.00, and a low estimate of $37.00. This current average has increased by 7.85% from the previous average price target of $39.50.

Understanding Analyst Ratings: A Comprehensive Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Omega Healthcare Invts. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Haendel St. Juste | Mizuho | Raises | Neutral | $37.00 | $35.00 |

| Michael Carroll | RBC Capital | Raises | Sector Perform | $43.00 | $39.00 |

| Kai Klose | Berenberg | Announces | Buy | $45.00 | - |

| Juan Sanabria | BMO Capital | Raises | Market Perform | $45.00 | $44.00 |

| Connor Siversky | Wells Fargo | Raises | Overweight | $43.00 | $40.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Omega Healthcare Invts. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Omega Healthcare Invts compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Omega Healthcare Invts's stock. This analysis reveals shifts in analysts' expectations over time.

Capture valuable insights into Omega Healthcare Invts's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Omega Healthcare Invts analyst ratings.

Get to Know Omega Healthcare Invts Better

Omega Healthcare Investors Inc is a healthcare facility real estate investment trust that invests in the United States real estate markets. Omega's portfolio focuses on long-term healthcare facilities. Omega has one reportable segment consisting of investments in healthcare-related real estate properties located in the United States and the United Kingdom. Its core business is to provide financing and capital to the long-term healthcare industry with a particular focus on skilled nursing facilities (SNFs), assisted living facilities (ALFs), and to a lesser extent, independent living facilities (ILFs), rehabilitation and acute care facilities (specialty facilities) and medical office buildings (MOBs).

Financial Insights: Omega Healthcare Invts

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Positive Revenue Trend: Examining Omega Healthcare Invts's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 14.05% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Real Estate sector.

Net Margin: Omega Healthcare Invts's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 40.49%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Omega Healthcare Invts's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 2.82%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Omega Healthcare Invts's ROA stands out, surpassing industry averages. With an impressive ROA of 1.21%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Omega Healthcare Invts's debt-to-equity ratio is below the industry average at 1.15, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.