Effective budgeting requires having a clear understanding of your income and expenses, setting realistic goals for yourself, and developing good money habits.

But some people, for one reason or another, skip on all the work and when the results aren't what they would like them to be, they become frustrated, blaming circumstances or external factors rather than addressing their own choices.

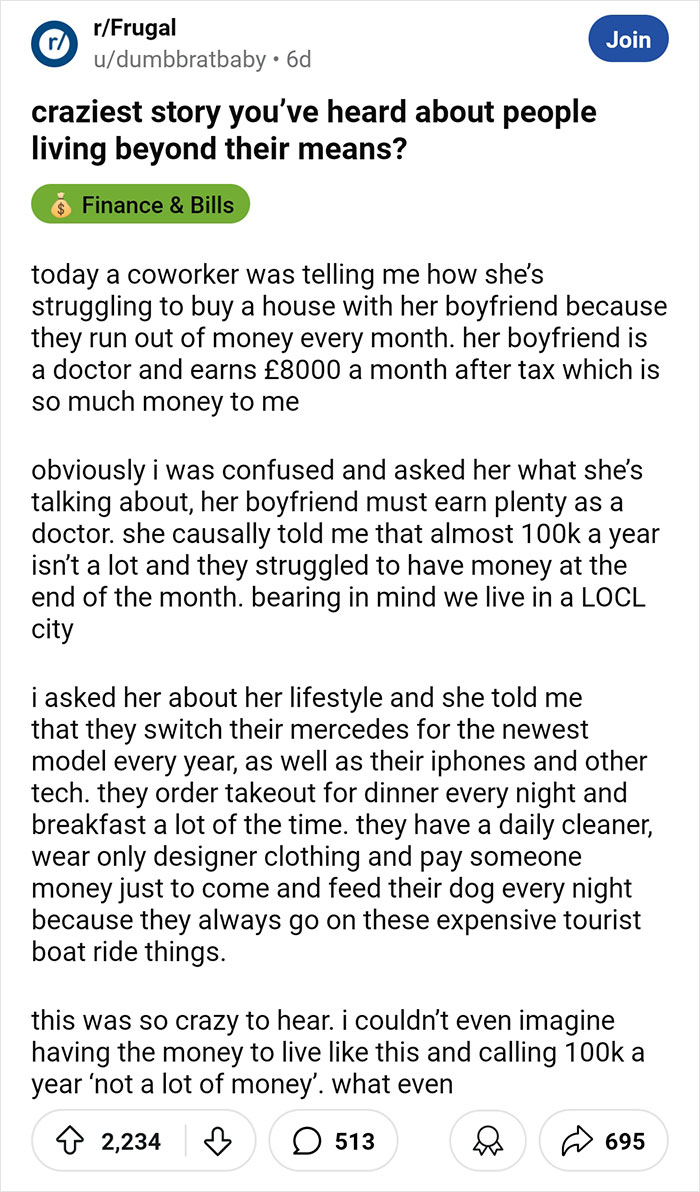

So Reddit user Dumbbratbaby made a post on the platform, asking its 'Frugal' community to share the craziest stories they've heard about folks living beyond their means.

#1

This reminds me of something I read years ago where someone on a huge salary was complaining that they had nothing left over when you factored in private schools for their kids, expensive and prestigious extracurriculars, tutors, maintenance costs of their luxury home and cars, etc, ie that the rich lifestyle was leaving them paycheck to paycheck.

And someone said "yeah it's amazing how little money is left over when you choose to spend it all."

Image credits: soaringseafoam

#2

I had a coworker (teacher) tell me one day that she was gonna have to quit teaching and try to find a better paying job because her family wasn't making enough money to support themselves. They had a household income of $120k. This was 10 years ago in the rural south.

They had a huge house, over $100k worth of vehicles, designer clothes and were constantly going on foreign vacations.

I made half of their income and was able to buy a house, have a car payment, fund retirement, take a decent vacation or two and still save money.

Its not what you make, its what you keep.

Image credits: tngman10

#3

I went to college in Texas in the early 80s and some students had parents who were in the oil business. The oil business has a pronounced boom bust business cycle. So you’d see kids who one semester are living in the most expensive dorm and have a brand new car and wasting money like crazy going to Cancun on weekends and stuff like that, and then the next semester, their dad’s broke and they’re working in the dorm cafeteria and struggling to get by.

That definitely influenced me to never assume my income level was going to last forever. Always plan for the next recession, because it’s coming sooner or later.

Image credits: EdwinaArkie

#4

Watch Caleb Hammer youtube channel. Completely broke people go into debt to buy stuff on amazon and order takeout multiple time a week. I had to stop watching because of how rage inducing some episodes were.

Image credits: DrunkenSeaBass

#5

My cousin works at walmart and her husband is on disability. but some how they're able to take their family of four on a cruise every year..Yet they were b***hing about not making ends meet during the month because they ran out of food stamps.

Image credits: MarshmallowFloofs85

#6

I lived through it with my ex husband. After turning a certain age he started to get a monthly settlement of $1200 for the rest of his life from a lawsuit involving circumstances surrounding his birth. There had also been a lump sum when the suit was settled but his mother squandered that (mental illness and spending issues).

This was over ten years ago and we had just left college. $1200/month was more than I was making a month and would have nearly covered all our rent/bills a month, meaning anything we made over that would have been perfect for saving, vacations, etc.

But we never had anything extra. We had a shared bank account for bills but also separate accounts, and he never had anything to save. I could see he bought a lot of video games and tech like new phones, but otherwise I didn't know where the money was going and he wouldn't say/said he didn't know. We managed but never got ahead of bills or went on trips.

It wasn't long before he finally told me he was looking into how to sell something like 10 years of the settlement payments for a lump sum to "get out of debt and start fresh." I stressed that was an AWFUL idea and he said he wouldn't do it.

Then he revealed a gambling addiction. I knew he liked scratch tickets and won often but had no idea the extent of it. He was using rent and bill money for gambling and putting bills on credit cards. I told him he needed to get into therapy and we had to work on this and if he lied to me again about it I would leave. A year later he still wasn't in therapy, and he revealed he lost the monthly settlement because it turned out the payment loan (that he was still looking into) invalidated the settlement. And also he was even deeper in debt because the gambling was ongoing behind my back. So I left.

Image credits: ironysparkles

#7

I know of a couple where the man owned a very successful and innovative company and the wife stayed home with their kid. They both drove fancy cars, dressed really well, their kid was in all brand-name clothing, they lived in a beautiful house on a mountain that was nicely furnished, went out to fancy restaurants and flashed money.

Well, turns out, he was using his company CC to pay for a lot of personal things, so much so that he eventually got kicked out of his own company by the shareholders. They eventually separated and she told me that everything was a facade. All the nice things were bought on credit, the cars were a lease, the house they scoped up for cheap rent from some foreign investors.

They built up this image that was fake and eventually divorced due to money and alcoholism that started when he got booted from his company.

Image credits: buzzybeefree

#8

A friend recently shared the following TRUE story of his family's finances:

My friend makes a little over $100k per year.

My friend has contributed to his IRA for many years.

My friend received a moderately large (over $100k) inheritence a few years ago.

In the last 5 years my friend has squandered everything! The inheritance is spent. The IRA has been drained. My friend spent about $700k over the last 10 years on (too many) vacays and other financially questionable things. My friend wants to retire but cannot.

Image credits: dudreddit

#9

This story is all too common.

I live in Chicago and I’m astounded by the number of luxury cars I see driving around… statistically speaking, those cars are way out of budget for the majority of people driving them.

When you compare the average national income against the average national car payment it paints a stark reality. Most people are living way above their means. A persons car reflects how they see themselves and their attitude towards spending… it’s not a big leap to think someone driving a luxury car is also shelling out on other luxury goods or experiences.

$100k a year isn’t bad in a city center like Chicago, it’s above the average, but it’s not enough to sustain a luxury lifestyle like that. I make around that, and live comfortably, but I don’t drive anything crazy and I don’t spend like crazy either.

A majority of the people I see driving range rovers or Mercedes are probably a couple missed paychecks away from having to downgrade their lifestyle drastically.

Image credits: Uncle-rico96

#10

I used to work in a bank. I saw someone once with 100K in credit card debts, mainly due to his poker addiction. High income but he was pissing it down the drain by trying to become a pro poker player.

Edit: I also remember the clients who would regularly want to withdraw hundreds in cash and spend it without a trace. Nearly everyone accepts card or cheque here in France, besides d**g dealers and prostitutes...

Edit again: I just remembered someone spending 3K per month on a Lamborghini lease whilst living in rental accommodation. Some of these people driving around in super cars don't own s**t.

Image credits: John198777

#11

There was a family in my neighborhood who had a nice house and nice cars and clothes, went on nice vacations, etc, and one day, they told us they were moving in with her parents because the house was being foreclosed on. I was shocked I didn’t see any austerity measures ahead of the foreclosure. I never heard them say something like, “ We are having a staycation this year to save money” or “We can’t go out for dinner tonight” or “We are selling one of the cars”. Nothing like that. They just spent like usual until they hit a wall. Crazy.

Image credits: smartbiphasic

#12

A friend just told me that she’s in “debt” right now because of too many Uber Eats orders……. I don’t even know what to say lol.

Image credits: Outrageous-Yak4884

#13

Mum ringing me up this morning asking me to transfer money because she ran out of her depression/anxiety pills..after meeting a new man and going in daily car trips to cafes and shops all over the state..and not working because she’s going to pull the ‘mental health card’. I said no, I’m not enabling her and for her to ask my older brother because he lived with her rent free for 10 years and got everything paid for so he ‘owes’ her a bit which will pay for the pills.

Image credits: Ok-Computer-1033

#14

Not to go into too much detail but my wife is a Dr, 2 of her colleagues on the same level as her cannot afford to retire (67 & 74) both are miserable. Spent every dime, go to Europe twice a year etc etc, when I met them and they asked what I do just said I retired at 40, that went over like a lead balloon.

Image credits: IDontKnow_JackSchitt

#15

I work at a factory and know for a fact 95% of the employees make between $21.50 and $25.50. The number of brand new $80,000 - $100,000 trucks in the parking lot astonishes me every single morning.

#16

We bought a cheap fixer upper a few years ago. A guy in the family inherited more money than our house was right after we bought. He blew it all, had some kids. We showed him several houses he could have paid cash for. He said they weren't good enough and his kids were recently in a homeless shelter with his ex. His grandmother leased new cars that were about what our house cost. Saved zero for retirement. Just blew all her money. Now when they get together they talk about the economy and my head almost explodes because neither has an understanding of how money works.

Image credits: Distributor127

#17

The US government. $35 trillion in debt. Crazy.

Image credits: perplexedparallax

#18

I know a wealth manager who doesn't name names, but talks about clients having a net worth of 8 figures who, if they don't change their spending habits, will run out of money at some point. When he suggest they drop one of their country clubs or sell a 3rd home that they rarely use, they claim they just can't because they're afraid of what their friends would think of them. It's nuts.

#19

One of my friends has a dad who is well paid, really high up in a tech company. He makes a lot of money and her family spends a lot of money. They eat out almost every night, have a vacation home, his wife has so much clothing she uses the 6 closets in her house to store it all, they give vehicles away and always buy brand new ones, & buying people insanely expensive gifts. But her dad is lost why his coworkers (who are more frugal) are retiring but he cannot afford to. (Lucky my friend took after her aunt/godmother who is very frugal so she won’t be unlearning all those bad behaviors).

Image credits: tellitlikeitisnot

#20

Friend of a friend makes six figures in the computer science industry. Lives with parents doesn’t pay rent. Very little bills. Somehow she overspends SO MUCH every month that at 23 she’s 50k in debt and complains that she never has money. Genuinely f*****g mind boggling.

#21

I remember as a teenager walking past someone's really big and fancy house in a neighborhood my rich friend lived in. In the driveway was a very expensive car. One of the curtains was halfway open and I saw milk cartons and bare cable spools around the living room. No decor, no nothing. Just a big house and a fancy car with almost nothing inside. The people had lived there for quite some time so it wasn't that they'd just moved it.

That stuck with me.

Image credits: Historical-Gap-7084

#22

When I talked to my supervisor at the time about why I was looking for another job, explaining that I couldn’t afford to start a family without either a much higher wage or employer-sponsored health insurance, she told me not to worry about my excel spreadsheet and that she is still paying credit card debt from when her kids were young.

Her oldest was 10.

Uuuummmm yeah that is EXACTLY why I will continue to worry about my excel spreadsheet. No way in hell I’d put myself in that kind of financial situation.

Image credits: MissDriftless

#23

My first housemate in college. It was student housing, you basically got a room with a small kitchen and then a bathroom shared with one other person, two rooms + bathroom per floor, 6 rooms per house. She rented two units so she wouldn’t have to share a bathroom (the second room was in use as a closet). She told me she got 1000€ per month allowance but racked up 1-2k € in credit card debt each month as well (which her parents threatened every month to stop paying, but they never did).

For context: I lived off 600€ a month and paid for everything myself (rent/food/utilities etc). That was a rather tight budget but I managed. She didn’t even have to pay rent (her parents did that), the 1000€ was only for food & fun. Absolutely broke my brain because I had weeks where I wasn’t sure if I had enough food for the week (I always managed somehow, but barely) and then she was complaining to me that her dad threatened to cut her off again but ‘it was so unreasonable and unrealistic to expect her to live off only 1k per month’. She never got why I couldn’t join her for whatever frivolous spending spree she had planned (‘just ask your parents for more money’) and then couldn’t grasp that not every parent has 3k€ (or any amount really) to throw away each month :’)).

Image credits: yeniza

#24

My brother went to an extremely expensive/ exclusive high school on scholarship in SoCal. (I believe tuition was around $30,000 a year at some point back in 2008-2012).

At the beginning of the his freshman year (August of 2008), whenever we dropped him off there were so many “luxury” cars in the parking lot, he came home with stories of parents with huge mansions vacations blah blah blah. At the end of the year (after the recession hit) there were nothing but Toyotas and a reduced student body population. ???.

Image credits: md151015

#25

Knew a guy who was a shift manager of a Whataburger and somehow leased 2 Lincoln Navigators back in 2009.

I'm pretty sure the 2008 economy collapse was due to really stupid s**t like this.

Image credits: odin_the_wiggler

#26

There is this girl i know. she's almost 30. quits jobs after a few months cause they are all "toxic" (they ask her to come in on time), she moves in with each boyfriends she dates within 2-3 months, then breaks leases and moves again. all of that costs money she doesn't have. she always goes on trips, right now is in Italy for 4 weeks (while unemployed since summer) and puts it all on her credit card. while also buying a huge amount of clothes and brand stuff.

Image credits: lenuta_9819

#27

I have a friend who got their apartment while making $6 less than they have been making for the past 6 months and had the same bills (car, insurance). But now they're complaining that they can't even afford a cat. And they've denied my help in creating a budget (humble brag but I have a really excellent system that's worked for everyone I've made it for). They make a few dollars less than I do and say they can't even put money into retirement... Yet go out on fancy dates and constantly buy new clothes every month and go out every weekend night and some weekdays. I'm just so amazed when people don't budget correctly. The other day they said they bring home 1k a paycheck so I'm pretty sure they're lying about their finances, that does not track with that they told me their hourly wage is. People who don't spend wisely stress me out.

Image credits: sp00kyboots

#28

Buying a new car every year sometimes twice a year, while taking a loss every time they trade in their 1yr “old” vehicle.

Image credits: 1man1mind

#29

Friend of mine straight up evades tax in his exceptionally well paying job. (6 figures for 3 days a week) He has a contractor job where he’s supposed to pay his own tax but hasn’t lodged in about 5 years. Even without paying his 40% to the government, he runs out of money every month. Zero savings. Owns a huge deluxe camper trailer, a car, 2 jet skis and a motorbike. Doesn’t own a home, but has spent 3 times what our deposit was on vehicles since I met him two years ago.

He spends all his money on big boy toys, luxury items for his kids and SAHM partner, and meal kits/ ready made meals instead of groceries. It’s wild.

Currently thinking of buying a big fishing boat.

Image credits: pairii

#30

I see people using car service apps and delivery apps all the time as an "investment in themselves", or "not depriving myself" like it's some kind of self-care. If you spend $10 in delivery fees and markup on a meal that you could have picked up around the corner in 10mins walk time, your time better be worth $60/hr or more. Otherwise, order for pick up....or better still, cook your own egg sandwich or open a can of soup.

People do not look at the long term impact of what that money could do. I'm not sure if the tools just aren't available or readily taught, but $200 a month can do a lot more than go into the pockets of Uber investors.

#31

My in-laws make more than both my husband and I and they have 3 kids, have 3-4 atv’s (replace every few years and get loans for them), have a pop-up camper trailer (still have loan on it), pay thousands for sport events for the kids a year (fine ok the kids enjoy the sports stuff), spend money on tons on firearms and ammunition to go hunting as well as licenses and processing fees, have 3 vehicles (2 which are on loans and 1 they owe us money for), buy name brand of most things and even custom order things.

They live way above their means and had the audacity to ask us for $11k for their oldest kids second semester. Absolutely did not save anything over the last 19 years.

Image credits: OhmHomestead1

#32

I knew someone who had a condo they were about to lose to foreclosure.Two adults working full time at decent jobs somehow couldn't afford the $400 mortgage payment. The wife was spending at least $300 (more like $400) a month in her daily special treats at coffee shops. I suggested she buy bulk pastries and make coffee at home. She was absolutely shocked I would suggest such a thing. They paid less than $50,000 for that unit during the financial crisis and lost it to foreclosure. Right now, 15 years later it's worth $450,000.

On the other hand I had a boss who was very good with money, even though she was dirt poor growing up. She owned a condo by 25 and a house in a great neighborhood by 35. She opened several successful businesses. When it came to buying a huge house in a very upscale neighborhood she stopped going to the coffee shops daily and started making her breakfast and coffee at home so she could save some money. She bought a huge beautiful foreclosed house for 700,000. It's now worth more than 2 million, probably approaching 3.

Boss sacrificed strategically throughout the years to set herself up for a snowball of success. The people who lost their condo to foreclosure could have substantial net worth right now but chose 2X daily chocolate croissants and extra foam caramel mocha frapalattes instead for instant gratification instead.

I hate the "stop buying coffee and eating avocado toast" rhetoric we hear just as much as everyone else but if the condo people had actually stopped, they would have a really nice condo right now and instead they are renting.

Image credits: danidandeliger

#33

I have an aunt who is going through a divorce and moved into a retirement community.

Some of her money is still tied up in the divorce process, and she lives on social security for income. She goes to the local food bank for food, and hasn't had internet service installed because she says she can't afford it.

Yet, she leases a car for $550 a month and can't say no when her granddaughter asks for a $70 pair of leggings or $100 shoes.

Sometimes I want to help her because she's a very loving aunt, but I also wonder if I'd just be enabling her to keep spending on the wrong things.

Image credits: Inevitable_Tone3021

#34

My dad bought a $40K Mercedes back in 1982. In today's dollars that would be around $130K. He later got bored of it and bought an $80K BMW in 1989, that would cost around $205K in today's money. He also over leveraged himself to his eyeballs, using his rental properties as collateral to fund his business ventures. He also would arbitrage the payment to his suppliers in order to speculate and buy more real estate as his suppliers would let him do NET 90 or longer the more he bought. The house of cards fell apart during the recession of the early 1990s as business slowed down and rental tenants left the area due to companies closing/downsizing. If he had listened to my mom and tried to not stretch himself so much, he would be sitting on at least 4 paid off houses in the California Bay Area. Total home value would be in the high 7 figures range right now. Instead, he ended up dying with about $700K in debt due to a combination of using his house as a piggy bank and failing to file/pay some taxes.

There were a host of other issues wrong with him, but it's from his example that I decided to be the polar opposite. Now at 43 (roughly the same age he started his business empire), I instead lived a modest frugal lifestyle with the aim to FIRE. I'm actually going to go into retirement/semi-retirement soon, whereas my dad ended up working into his 70s until illness caused him to become bed ridden and later die.

#35

My parents.

They are both in their 60s. Joint income is around 160k.

They moved 3 times in 5 years- each time buying a new house.

They had a home built last year. It was around 400k.

They both are planning "to work until they die" so it's okay.

My dad has no 401k or 403b. My mom stopped contributing to hers 15ish years ago.

#36

I know someone who made about 50–60k a month as a during Covid. This guy built a 2 million dollar home put his kids in the best private schools wife stayed at home yet they had a nanny 6x a week. He had a a Porsche and a new F150. Well Covid ended and the market kinda tanked. He went from 50k to 27k and then the big customers son got into a different brokerage and became her rep which kicked him out so it dropped him to 7-8k per month. He worked 12 hours a day and was over weight and now has type 2 diabetes wife left him and took the kids. Lost his home/porsche and the wife’s 4 runner. Ended up with 3500 in child support payments. And here is the kicker of all kickers. He ended up in a fit of rage at the office and got fired our company took his book of business and then fired him. This all happened from February and he got fired 3 weeks ago.

Image credits: Filthybjj93

#37

We run an AirBnb. Shockingly, the most spendthrift guests (number of nights stayed, food wasted, property damage leading to fines) are the ones with the more modest means.

One guy, who works at a not very lucrative profession, was spending 2x times standard rent just experiencing local airbnbs. It was wild to me, since they seemed to be spending a windfall that they disclosed (unprompted).

Image credits: Dinner8846

#38

My mother in law "retired" 3 years ago. In that time she's blown through in excess of £300,000. She inherited about £100k from her mothers death, the rest was her lifes savings.

According to her her pension lasts until she dies, it doesn't, the paperwork says a maximum of x years... She'll run out of money by next year.

#39

Some idiot from my hometown had over $60k in student loan debt and decided to move out from living with his mom, save almost nothing every month, and smoke weed all the time. He also swapped out his car for a fancy model he didn’t need.

#40

Someone I know is a stay at home parent and her husband is a GP (partner in a practice). She doesn't actually claim to struggle, but does makes reference to living off their one income as if it's a bit of a challenge. She'll say things like, you know, we have to be a bit careful with money these days since I'm not working. And it'll be things like "I almost said no to going on Tasha's ski weekend to Italy for her birthday!"

One of the issues is most of their social circle is other doctors and most of them think nothing of dropping £2k on a ski weekend for a friend's birthday. I guess it skews your idea of what is average spending.

#41

My friend did like financial consoling and credit consoling, it was part of EAP plan employers can get for their employees.

A couple, both doctors came in . They made like 600k + together and in a low cost area.

They had like 1 million in students loans but this really shouldn't be an issue when you are making 600k . However as soon as they started collecting a pay check they

Bought a giant expensive home then furniture and appliances,, 3 new luxury vehicles , an RV , a boat , Rolex watches and a bunch of other stuff on credit.

He even said just weird things like their direct TV package was like 300 a month, he was like "you must be a sports fan or something" and the husband was like "no but I just wanted the best package so I got the most expensive one .

After drawing up a budget they basically had $400 a month, meaning this was what they could use to buy food, gas , entertainment, clothes ECT. About a $100 a week .

He said both of them just kept saying like "we make $600k a year how are we this broke "

They also were very resistant to selling the RV or Boat. He was finally like "you can't afford the gas it takes to tow your RV ! Do you like camping in your driveway?".

#42

A kid (maybe early 30’s) works at the same company I do. I do the accounting and HR, so I know how much he makes and it’s a decent wage. He’s not rich by any means but could easily afford an apartment, etc. His girlfriend, small child and him live in a car. The owner found out, offered to let him park in one of our lots because they are secure at night and help him with a deposit/first/last on a place if that’s the issue. Not a loan just pay for it.

Kid still sleeps in his car with his family and takes days off to go fishing and asked for a week off next month when elk season starts. Like WTAF?

My boss asked my opinion on giving him a couple more bucks an hour. He already makes pretty close to the top of the pay scale for his job. I advised against it because it’s not helping him. If the offer of a place to call home doesn’t help, 80 extra bucks a week isn’t moving the dial.

#43

My husband told me about 6 months ago about a story his boss told him . His bosses wife ran into an old friend and in the course of chatting the friend mentioned how they’d just bought a house and was worried about the mortgage repayments cos it was more than the rent they paid . In talking about expenses the friend mentioned they spent about $2000 a week on groceries , for a family of 4 . How ????? Foods expensive here yes but even eating lobster every day it wouldn’t add up to that much . And it wasn’t on eating out either , they cooked every meal . The only thing I could think of was they smoked heavily and you can buy those in a supermarket here and there about $50 a pack . But still , $2000 a week ??????? How ???????

#44

I have a coworker who just moved here mention his rent is $6K a month. In comparison my wife and I pay $2K. He and I are both pretty well paid, but he has to be making more than I am - still that has to be eating up most of his take home.

#45

I see heart surgeons working in their 70’s. The saying the more you make the more you spend must be true.

#46

I worked with a guy who was making $80k and struggling to get by. I hired him and he became top salesman and was making $400k per year for several years…he was still living paycheck to paycheck. $30k watch here, extravagant vacations there; just didn’t know how to dial it back.

#47

My aunts family always looked down on my mom for being single. They would spend more than they had so they could appear rich and successful. One day, she got caught embezzling from a child's sports team. I also highly suspect she started a fire in her kitchen so she could get a new one paid for by insurance (not sure if insurance did pay for it but she got her new kitchen).

#48

When I worked at a hole in the wall, we hired a guy purely because he was the same ethnicity as the chefs (lol). Dude was hella couch surfing, and always made the worst possible choices via lizard brain wants. Hardly had appropriate clothing. Dude dead a*s bragged to me about his Gucci belt he bought for like 300.00.