/cmdtyView%20Stock%20Photo%201.png)

Tech stocks have experienced an impressive rally in 2023, and the Nasdaq Composite ($NASX) had its third-best first-half performance ever. However, Chinese tech giant Alibaba (BABA) is up merely 7.8% for the year, and has lagged not only U.S. tech stocks but also its Chinese tech peers like Baidu (BIDU).

Alibaba stock hit its all-time high in 2020, then fell in both 2021 and 2022. While tech stocks in general underperformed markets in 2022, the sector was overall quite strong in 2021. BABA’s price action has trailed that of its U.S. tech peers for almost three years now - and at one point last year, it even fell below its 2014 initial public offering (IPO) price.

Why has Alibaba stock underperformed its tech peers?

Alibaba’s troubles began in November 2020 when China suspended the IPO of Ant Financial, an affiliate company of Alibaba. The IPO was set to become the biggest listing ever, and would have helped Alibaba monetize its investment as the company holds a third of its stake in Ant.

What followed was a broad-based tech crackdown in China, with Alibaba arguably among the worst affected. China’s zero-COVID policy and the structural slowdown in the economy did not help matters. Following the rollout of those tech-targeted regulations, and amid the ongoing US-China tech war, valuations of Chinese tech stocks have declined considerably.

Alibaba is also losing market share in China. Last year, its yuan-denominated sales increased only 2%, falling short of overall growth in the country’s online retail sales. Also, its U.S.-dollar-denominated revenues fell year-over-year for the first time ever.

What has BABA done to chart a comeback?

Alibaba has taken multiple steps to revive its fortunes. The company has announced a restructuring and divided the business into six units. It has also gotten into generative AI and launched its own chatbot to take on the likes of ChatGPT. Alibaba also increased the size of its stock buyback program to capitalize on the crash in its share price.

Also, the macro environment in China seems to be changing for the better when it comes to tech. That's good news for Alibaba, which was fined a record $2.8 billion amid the company's tech sector crackdown.

China warms back up to tech companies

Recently, Beijing has dropped multiple hints that not only is the tech crackdown over, but it is warming up to domestic tech companies in a bid to shore up its sagging economic growth. A government policy document released earlier this month said, “The private economy has become a new force to promote Chinese modernization and an indispensable foundation for high-quality development.”

The report added, “The system and mechanism to promote the development and growth of the private economy should be further fine-tuned to boost its confidence and vitality.”

For those following China’s crackdown on private enterprises, the policy document would seem nothing short of a U-turn. Separately, the country is looking to support its economy, especially private consumption.

I believe that Alibaba is a bet on multiple high-growth industries like ecommerce, cloud, and generative AI – as well as a play on China's economy, as the company gets most of its revenues from the country.

Why Alibaba stock looks like a good value buy

Here are the four reasons why I find Alibaba stock a good buy at these levels.

- Firstly, the worst of the slowdown looks over for Alibaba, and analysts expect its revenues to rise by 9% each in the current and the next fiscal year. Analysts expect the company’s earnings to rise 20% in the next fiscal year, which looks like a healthy growth.

- Alibaba’s business reorganization will help add shareholder value as the company intends to list the businesses as separate entities. The real value of some of these businesses might not be fully reflected in Alibaba’s current stock price, and the “sum of the parts” valuation could be higher than the current valuation.

- China also seems to have ended the regulatory probe of Ant Group and imposed a nearly $1 billion fine on the company. Alibaba could eventually list Ant which would help it unlock value.

- Alibaba stock trades at a forward price-to-sales multiple of 1.84x, which is considerably below the five-year average of 4.46x. Its price-to-earnings-to-growth (PEG) ratio is 0.71x which looks quite attractive. Usually, a PEG ratio below 1x is seen as a sign of undervaluation.

Wall Street analysts are quite bullish on Alibaba's stock

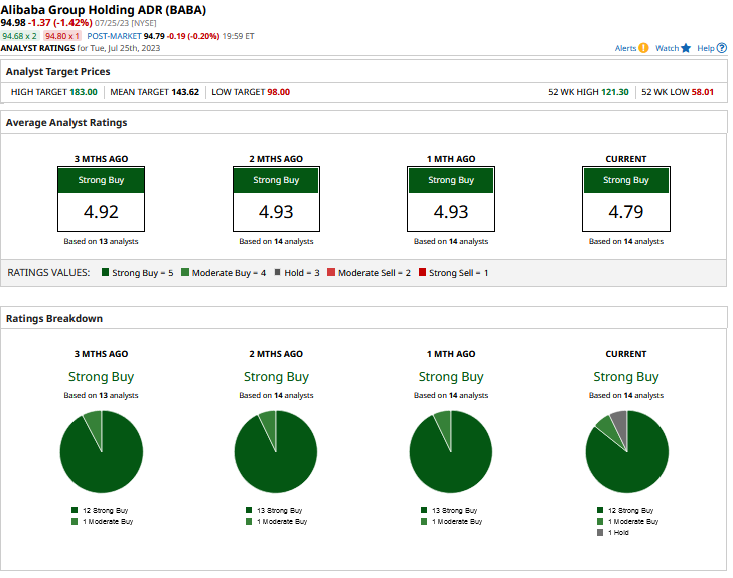

Wall Street analysts currently rate Alibaba’s stock a Strong Buy:

Of the 14 analysts that cover BABA, 12 rate it a Strong Buy, 1 a Moderate Buy, and 1 a Hold. None of the analysts has a Sell rating on the stock and it even trades above its Street-low target price of $98. The mean target price of $143.62 is a premium of 51% to current levels, while the Street-high target price of $183 implies a return potential of a whopping 93%.

Steve Weiss, managing partner of Short Hills Capital Partners, is of the view that BABA has limited downside at these levels. He said that he has bought more BABA shares and called it one of the “cheaper stocks.”

From a valuation perspective, BABA indeed looks cheap, especially as the valuation of U.S. tech stocks has run ahead after the humongous rally in the first half of 2023. While I believe that the valuations of Chinese tech stocks might not revert to their previous highs anytime soon, China’s quick pivot from its tech crackdown back to embracing the sector will help support a re-rating of Chinese tech stocks like BABA in the short- to medium-term.

On the date of publication, Mohit Oberoi had a position in: BABA , QQQ . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.