Even though the Inflation Reduction Act of 2022 is in effect, markets can have a way of determining whether the plan works or not. Not that it’s expected, but if the oil and natural gas markets become even more volatile than they are — with Russia and Europe at odds — it’s a concern if you’re thinking about the possibilities of higher prices.

That’s probably the most obvious example of a reason to be considering an inflation hedge as part of a diversified investment plan. It doesn’t look like cryptocurrencies are making good hedges as once predicted by some. The classic go-to of precious metals might become fashionable again under the right circumstances.

For those who think along these lines, here are four exchange-traded gold and silver miners that may be worth consideration, especially when you see how far they’ve fallen — along with the price of gold and silver — since April. Are these bargains now?

Related: How to Invest in Gold

Newmont Corp. (NYSE:NEM) is the big one among stocks that count in the precious metals sector. When institutions decide to buy more gold and silver miners, this is likely to be first on their lists — it already owns about 85% of the float. With an average daily volume of 8.74 million shares, it’s the kind of liquidity that big firms like.

Newmont is global: It has operations and projects in North America, South America, Africa and Australia. Earnings per share (EPS) for this year are negative by 58.1%. The past five-year EPS growth rate is 39.3%. Shareholder equity is greater than long-term debt, and the current ratio is 2.8. Newmont trades at just 1.53 times its book value. The company pays a 5.28% dividend.

That’s quite the “oversold” relative strength index (RSI), according to the price chart below:

Buenaventura Mining Co. Inc. (NYSE:BVN) is a Peruvian precious metals miner — the official name is Compania de Minas Buenaventura. The company is now trading with a price-to-earnings ratio of 7 at about half its book value. Buenaventrua has been around for 68 years and became the first Latin American mining firm to be listed on the New York Stock Exchange in 1996.

This year’s earnings are up by 187% and the five-year growth rate is 19.2%. Long-term debt is greatly exceeded by shareholder equity. Average daily volume comes in at 1.6 million shares. Buenaventura pays a dividend of 1.29%.

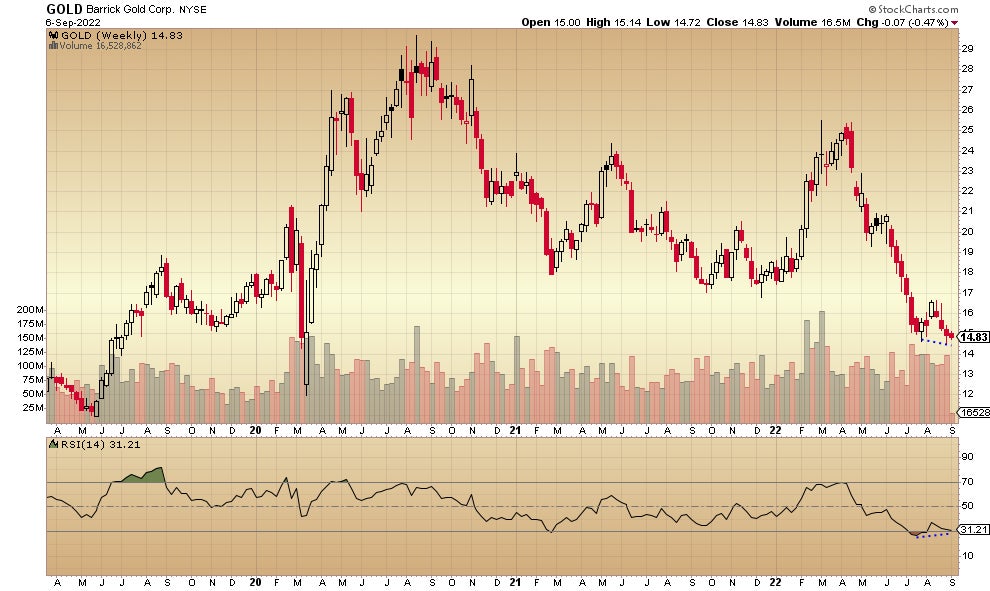

Toronto-based Barrick Gold Corp. (NYSE:GOLD) has operations and projects across Canada, North America, South America and Africa. This is another one favored by large institutional investors (when they’re looking for precious metals miners) with an average daily volume of 21.49 million. Barrick trades at just over book value with a price-to-earnings ratio of 13.19. Earnings for this year are down by 13%. The five-year record is up by 15.1%. This is another miner where shareholder equity exceeds the long-term debt. The current ratio is 4. Barrick investors are paid a 2.7% dividend.

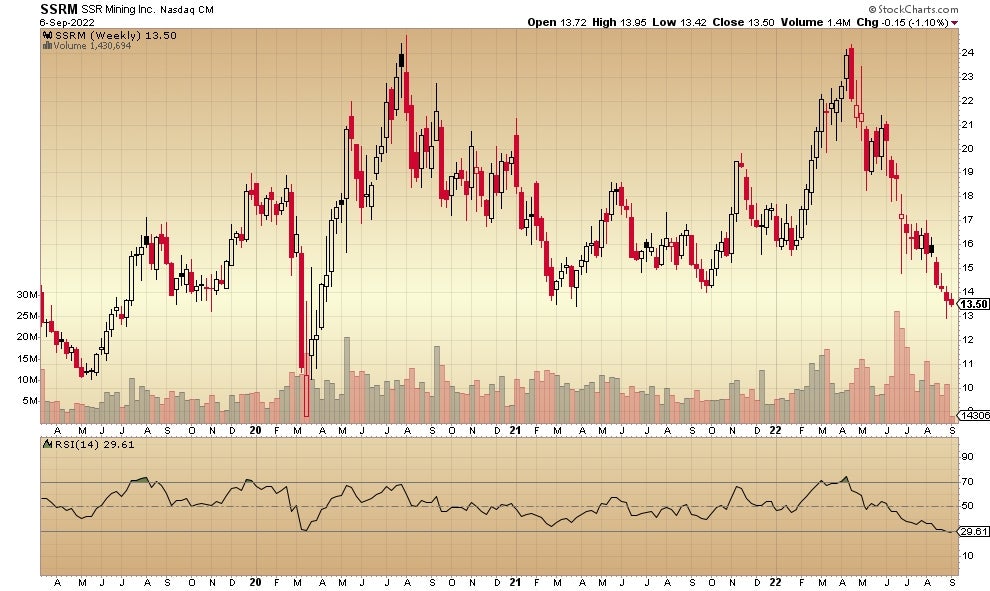

SSR Mining Inc. (NASD: SSRM) is headquartered in Denver with operations in the United States, Canada, Mexico, South America and Turkey. This year’s earnings are up by 74.2%. The EPS growth rate for the past five years is 21%. Long-term debt for the company is vastly exceed by shareholder equity. With a price-to-earnings ratio of 9.77 and trading at just 79% of its book, SSR Mining could be considered a value stock. Its dividend is 2.07%.

Any investor who owns these stocks should keep a close eye on monthly consumer price index and producer price numbers as this sector reacts to those measures.

Check out: How Much is a Gold Bar Worth?

Not investment advice. For educational purposes only.

Image by Cloudy Design on Shutterstock

Charts by StockCharts