Persistent geopolitical uncertainties and the Fed's aggressive interest hikes have led to massive tech sell-off lately. However, continued digitization and increasing dependence on technology solutions should drive growth for the tech sector. In addition, strong corporate earnings and increasing investments in tech upgrades should help revive investors’ sentiment about the technology sector.

According to data from Bain & Company, "born tech" companies have contributed to 52% of total market value growth since 2015, whereas 20% of market value growth has come from companies with a tech-led strategy. According to IDC, the technology industry is on pace to exceed $5.3 trillion in 2022.

That’s why today we're highlighting 3 exciting stocks from our Top 10 Small-Cap screen, which is just 1 of the 10 screens in our POWR Screens 10 service (more on that below). PCTEL, Inc. (PCTI), Photronics, Inc. (PLAB), and Xperi Holding Corporation (XPER) are quality small-cap tech stocks that deserve a place in investors’ portfolios.

PCTEL, Inc. (PCTI)

Headquartered in Bloomingdale, Illinois, PCTI and its subsidiaries offer industrial Internet of Thing devices (IoT), antenna systems, and test and measurement solutions worldwide. The company designs and manufactures precision antennas and industrial IoT devices that are deployed in small cells, enterprise Wi-Fi access points, fleet management, transit systems, and equipment and devices for the industrial IoT. It has a market capitalization of $79.05 million.

PCTI's revenue increased 27.3% year-over-year to $22.54 million for the first quarter ending March 31, 2022. Its Non-GAAP operating income grew 200.9% from its year-ago value to $319.00 million, while its Non-GAAP net income improved 128.6% from its prior-year quarter to $304.00 million. The company's EPS grew 100% year-over-year to $0.02.

In April, PCTI announced a strategic partnership with Stargent IoT, an Internet of Things (IoT) company providing IoT solutions for an array of use cases for smart manufacturing, process automation, and asset tracking. This alliance will enable end-to-end remote monitoring solutions to monitor various conditions, including detection of air quality, temperature, relative humidity, acceleration, angular rate of change, magnetic field, range, and sound.

Analysts expect PCTI's revenue to increase 13% year-over-year to $24.50 million in the second quarter (ending June 2022). The company's EPS is expected to grow 63% year-over-year to $0.44 for fiscal 2022. In addition, it has an impressive earnings history, as it surpassed the consensus EPS estimate in three of the trailing four quarters.

PCTI's POWR Ratings reflect this promising outlook. The company has an overall rating of B, which translates to Buy in our proprietary rating system. The POWR Ratings assess stocks by 118 different factors, each with its own weighting.

PCTI is also rated an A grade for Sentiment and Value. Within the B-rated Technology - Communication/Networking industry, it is ranked #6 of 55 stocks.

To see additional POWR Ratings for Stability, Momentum, Quality, and Growth for PCTI, click here.

Photronics, Inc. (PLAB)

With a market capitalization of $1.39 billion, PLAB and its subsidiaries engage in the manufacture and sale of photomask products and services internationally. The company provides photomasks that are used to manufacture integrated circuits and flat panel displays (FPDs) and to transfer circuit patterns onto semiconductor wafers, FDP substrates, and other electrical and optical components.

PLAB's revenue increased 28% year-over-year to $204.51 million for the second quarter ending May 1, 2022. Its operating income grew 150.4% from its year-ago value to $52.11 million, while its net income attributable to PLAB improved 183.5% from its prior-year quarter to $29.84 million. The company's EPS rose 188.2% year-over-year to $0.49.

Analysts expect PLAB's revenue to increase 20.4% year-over-year to $192.37 million for the second quarter ending April 2022. The consensus EPS estimate of $0.35 during the same period indicates a 105.9% improvement year-over-year. In addition, it has an impressive earnings surprise history, as it surpassed the consensus EPS estimates in all of the trailing four quarters. The company's shares have gained 19.8% year-to-date and 65.9% over the past six months.

PLAB’s strong fundamentals are reflected in its POWR Ratings. The stock has an overall A rating, which equates to Strong Buy in our POWR Ratings system. The stock also has an A grade for Growth and a B grade for Value and Sentiment. In the B-rated Semiconductor & Wireless Chip industry, it is ranked #6 of 95 stocks.

In total, we rate PLAB on eight different levels. Beyond what we've stated above, we have also given PLAB grades for Quality, Stability, and Momentum. Get all the PLAB ratings here.

Xperi Holding Corporation (XPER)

XPER, together with its subsidiaries, functions as a consumer and entertainment product/solutions licensing company worldwide. It has two operational segments, the Intellectual Property Licensing segment, which primarily licenses its innovations to companies in the entertainment industry under the Adeia brand; and the Product segment, which includes Pay-TV that delivers user experience (UX) solutions. It has a market capitalization of $1.81 billion.

Last month, XPER and LAPIS Technology Co., Ltd., a ROHM Group subsidiary, announced an agreement that includes a technology transfer of Adeia's DBI Ultra die-to-wafer hybrid bonding know-how to support the development and deployment of the technology into LAPIS's product portfolio. The agreement also includes Adeia's foundational hybrid bonding patent portfolio license.

In April, TiVo, a wholly-owned subsidiary of XPER, announced that its prominent streaming products, TiVo Stream 4K and TiVo Stream OS, have expanded their premium Live TV offerings through integration with YouTube TV. Through this integration with YouTube TV, the premium live streaming service, TiVo can improve its consumer experience by offering TiVo Stream 4K users to stream more than 85 channels of live sports, entertainment, and news.

For the first quarter ending March 31, 2022, XPER's revenue increased 16.2% year-over-year to $257.42 million. Its operating income increased 409.4% year-over-year to $52.97 million, while the non-GAAP net income amounted to $102.68 million. The company's non-GAAP EPS amounted to $0.92.

The consensus EPS estimate of $0.38 for the fourth quarter ending December 2022 indicates a 25.2% improvement year-over-year. Analysts expect XPER's revenue to increase 1.7% year-over-year to $223.19 million in the third quarter ending September 2022. Moreover, it has an impressive earnings history, as it surpassed the consensus EPS estimate in three of the trailing four quarters.

XPER's strong fundamentals are reflected in its POWR Ratings. The stock has an overall A rating, which equates to Strong Buy in our POWR Ratings system. The stock also has an A grade for Growth and a B grade for Sentiment and Quality. In the B-rated Semiconductor & Wireless Chip industry, it is ranked #5 of 95 stocks.

In total, we rate XPER on eight different levels. Beyond what we've stated above, we have also given XPER grades for Growth, Value, Momentum, Stability, and. Get all the XPER ratings here.

Want more stocks like these?

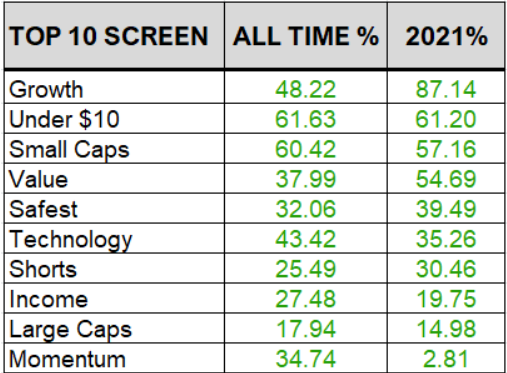

These three stocks are just a fraction of what you will find in our coveted Top 10 Small-Cap strategy. And the small-cap strategy is just a fraction of what you get with our popular service; POWR Screens 10.

POWR Screens provides 10 market beating strategies with exactly 10 stocks each. Truly something for every investor with verified performance.

Learn More About POWR Screens 10 >>

PCTI shares were trading at $4.21 per share on Friday morning, down $0.05 (-1.17%). Year-to-date, PCTI has declined -23.98%, versus a -12.88% rise in the benchmark S&P 500 index during the same period.

About the Author: Spandan Khandelwal

Spandan's is a financial journalist and investment analyst focused on the stock market. With her ability to interpret financial data, she aims to help investors evaluate the fundamentals of a company before investing.

3 Small-Cap Tech Stocks to Buy Right Now StockNews.com