/Amazon_com%20Inc_%20%20logo%20on%20building%20by-%20HJBC%20via%20iStock.jpg)

Amazon (AMZN) stock hasn’t had the best start this year, struggling to gain momentum despite the company’s strong financial performance. Uncertainty in the broader market and concerns over potential changes in U.S. trade policy have weighed on investor sentiment, keeping AMZN shares under pressure.

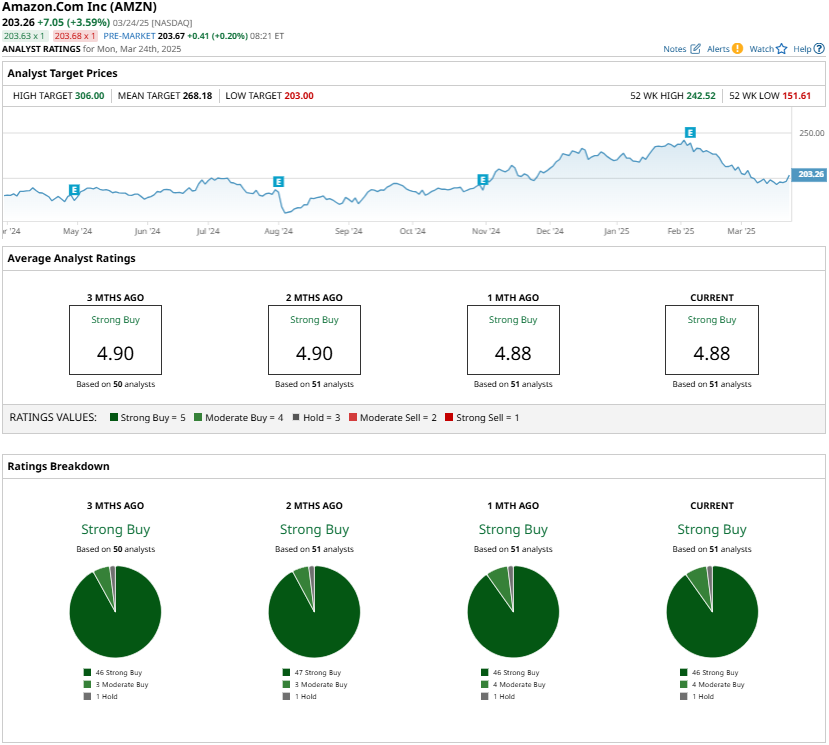

Yet, Wall Street analysts remain confident in Amazon’s prospects. With an average price target of $268.18, analysts suggest the stock could climb more than 31% over the next 12 months.

As analysts’ bullish outlook signals a potential buying opportunity, let’s look at three catalysts that could lead to a rebound of about 31% in AMZN stock from current levels.

Reason #1: E-Commerce Momentum to Drive Growth

Amazon’s e-commerce segment continues to thrive, reflecting resilience and steady growth despite macroeconomic uncertainties. The company’s strategy of expanding its product selection, offering competitive prices, and enhancing convenience has fueled consistent unit sales growth. One of its latest initiatives, Amazon Haul, has already gained momentum among U.S. customers, offering ultra-low-priced products in one easy-to-shop destination. This move positions Amazon to attract a broader customer base and further solidify its dominance in online retail.

A major driver of Amazon’s growth has been faster and more efficient delivery. The company has reduced delivery times, which is increasing sales and boosting its Prime membership base. Faster delivery is a key value proposition for Prime members, making it a key area of focus for Amazon’s long-term strategy.

Cost efficiency remains another pillar of Amazon’s growth story. The company has been optimizing its fulfillment network to drive operational efficiency and profitability. By regionalizing its U.S. fulfillment operations and revamping its inbound logistics, Amazon has been able to place inventory closer to customers. This has led to lower per-unit transportation costs and reduced packaging waste. Furthermore, Amazon’s continued efforts to optimize last-mile delivery are paying off, resulting in a second consecutive year of cost reductions on a per-unit basis while increasing delivery speed and expanding product offerings.

Amazon’s e-commerce business appears well-positioned for sustained and profitable growth. As the company expands its offerings, refines its inventory placement, scales up its same-day delivery network, and integrates advanced robotics and automation, investors can expect higher sales and improved margins.

Reason #2: Advertising Is a Fast-Growing Revenue Stream

Amazon’s advertising division is proving to be an increasingly important driver of the company’s growth. In the fourth quarter of 2024, the segment generated $17.3 billion in revenue, marking an 18% increase from the previous year. Amazon’s advertising business is now running at an annualized revenue rate of $69 billion, more than double the $29 billion it achieved just four years ago.

AMZN's advertising segment's growth is driven by sponsored products, which remain the largest contributor to Amazon’s ad revenue. With ample room for expansion, this segment is expected to continue its upward trajectory. The company is also seeing promising growth from newer advertising avenues, particularly in streaming services. Its Prime Video advertising business has shown significant growth and strong momentum that will likely sustain in 2025.

With a strong foundation in sponsored products and a growing footprint in streaming, Amazon’s advertising business is positioned for continued expansion.

Reason #3: AWS Is a Major Profitability Driver

The company’s cloud computing platform, Amazon Web Services, continues to deliver impressive growth and is a key driver of its profitability. The segment accounted for over 58% of its overall operating income in 2024. In Q4, the AWS segment reported revenue of $28.8 billion, marking an 18.9% year-over-year increase.

The shift towards cloud computing solutions has significantly accelerated AWS’s expansion. Its comprehensive suite of services, robust security framework, and extensive partner network enable AWS to capitalize on the ongoing shift from traditional on-premises infrastructure to cloud-based solutions. Additionally, AWS is set to benefit from the growing demand for generative artificial intelligence (AI) workloads.

Amazon’s focus on enhancing operational efficiency within AWS is expected to further drive profitability, solidifying its position as a growth engine for the company.

Final Thoughts

Amazon stock is a compelling investment backed by multiple high-growth segments. Its thriving e-commerce business, rapidly expanding advertising division, and dominant AWS unit provide a strong foundation for future growth. With these catalysts in place, the potential for a 31% surge in AMZN stock over the next 12 months is well within reach.

Wall Street analysts have a “Strong Buy” consensus rating on AMZN stock.