/Tesla%20Dealership%20with%20Cars%20in%20Lot.jpg)

Tesla (TSLA) is among the largest automobile manufacturers in the world, and has created massive wealth for long-term shareholders. In the last 10 years, TSLA has surged more than 2,100%, while total returns since its IPO (initial public offering) stand at a monstrous 15,400%.

Currently valued at a market cap of $782.48 billion, Tesla shares are down 38% from all-time highs. In the last 18 months, Tesla has been pressured lower by concerns over interest rate hikes, elevated inflation, lower consumer spending, and narrowing profit margins.

Due to rising competition and higher input prices, the company was forced to cut its vehicle prices, driving free cash flow to $1.44 billion in Q2 from $2.84 billion in the year-ago period. According to analyst estimates, the EV giant will end 2023 with adjusted earnings of $3.36 per share, compared to $4.07 per share in 2022.

Despite the pullback, Tesla is priced at 73x forward earnings. The stock currently trades at a premium to its mean price target of $249.72 from analysts - and the consensus rating from Wall Street is a lukewarm “hold.” This suggests analysts think TSLA is a little stretched at current valuations.

Here are three other electric vehicle (EV) stocks that have more upside than Tesla, according to analysts' consensus forecasts.

Is Rivian Automotive Stock a Good Buy?

Shortly after its IPO in November 2021, Rivian Automotive (RIVN) was valued at more than $100 billion. Currently down 87% from all-time highs, RIVN is valued at a market cap of $20.56 billion.

In Q2 of 2023, Rivian increased vehicle deliveries by 59% year over year to 12,640, and revenue rose by 208% to $1.12 billion. Rivian expects to manufacture 52,000 cars in 2023, which should bring in over $4 billion in sales.

This rapid expansion in top line allowed Rivian to narrow its operating loss to $1.29 billion in Q2, compared to a loss of $1.7 billion in the year-ago period. With close to $12 billion in balance sheet cash, Rivian has enough flexibility to expand manufacturing capabilities and benefit from economies of scale. Rivian is expected to report a positive gross margin by the end of 2024, allowing it to narrow its loss per share from $6.34 in 2022 to $3.32 in 2024.

Out of the 21 analysts covering Rivian stock, 10 recommend “strong buy,” three recommend “moderate buy” and eight recommend “hold.” The average price target for RIVN is $28.38, which is 23% above current prices.

Analysts Think CHPT Can More Than Double

Chargepoint Holdings (CHPT) provides electric vehicle charging networks and charging solutions in the U.S. and other international markets. It offers a portfolio of hardware, software, and services for commercial and residential customers.

Valued at a market cap of $1.7 billion, Chargepoint stock is down 90% from record highs.

While sales at Chargepoint rose from $144.5 million in fiscal 2020 to $468 million in fiscal 2023, its cumulative operating losses have totaled $861 million in the last four years.

Due to rising costs, Chargepoint reported a gross margin of less than 1% in fiscal Q2. Despite its less-than-impressive profit margins, investment bank UBS initiated coverage of Chargepoint with a “Buy” rating and a price target of $9, more than 100% above current prices.

According to UBS, Chargepoint has the largest network of Level 2 chargers in North America, with a market share of 50%. It has an expanding network of enterprise customers, which should support the company’s growth strategy. UBS also expects Chargepoint to report break-even EBITDA by Q4 of fiscal 2025 as cost headwinds normalize and operating expenses decelerate.

Out of the 18 analysts covering CHPT, 12 recommend “strong buy”, two recommend “moderate buy,” and four recommend “hold.” The average price target for CHPT is $10.98, which is 155% above current prices.

EVgo Approaches Consistent Profitability

EVgo is another EV ancillary company that operates a direct current fast charging network in the U.S.

Shares of the EV stock popped in early August after the company reported revenue of $50.6 million in Q2, an increase of 457% year over year. It also reported a loss of $0.08 per share. Comparatively, Wall Street forecast revenue at $29.5 million and losses at $0.26 per share in the June quarter.

EVgo now expects sales to rise to more than $120 million in 2023, up from $54 million in 2022. Moreover, its operating cash outflow stood at just $3.2 million in Q2, which suggests the company is close to reporting consistent profits.

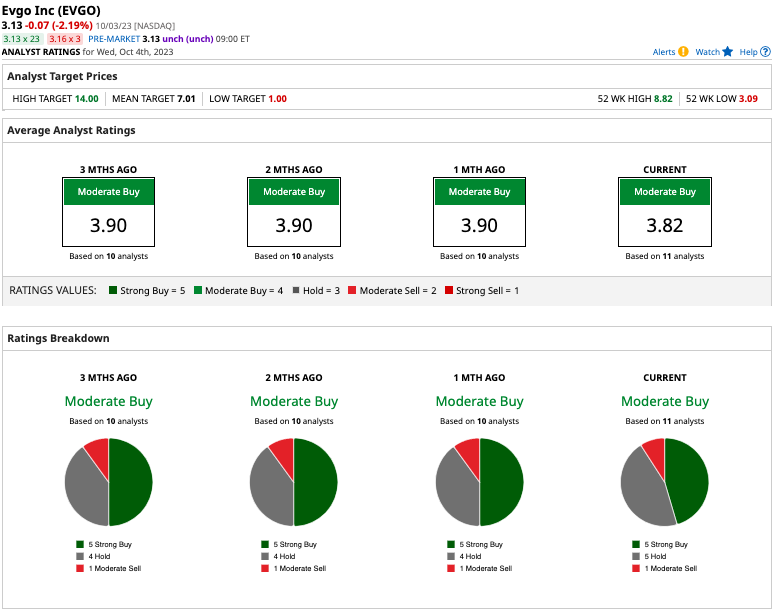

Out of the 11 analysts covering EVGO, five recommend “strong buy,” five recommend “hold” and one recommends “moderate sell.” The average price target for EVGO is $7.01, which is 126% above current prices.