A number of on-chain metrics show that 2022 has turned out to be the worst bear market Bitcoin (CRYPTO: BTC) has ever seen.

What Happened: In the latest edition of its weekly on-chain data analysis, Glassnode described the year-to-date period as “the most significant bear market in digital asset history.”

The report noted that both Bitcoin and Ethereum (CRYPTO: ETH) have traded below their previous cycle all-time highs for the first time in history.

“Deviation below the 200-day MA is so large, that only 2% of trading days have been worse off,” stated the analysts.

The market has recorded the largest ever monthly decline in realized cap, coupled with exceptionally large relative and absolute losses.

“Only 3.5% of trading days have seen larger capital outflows.”

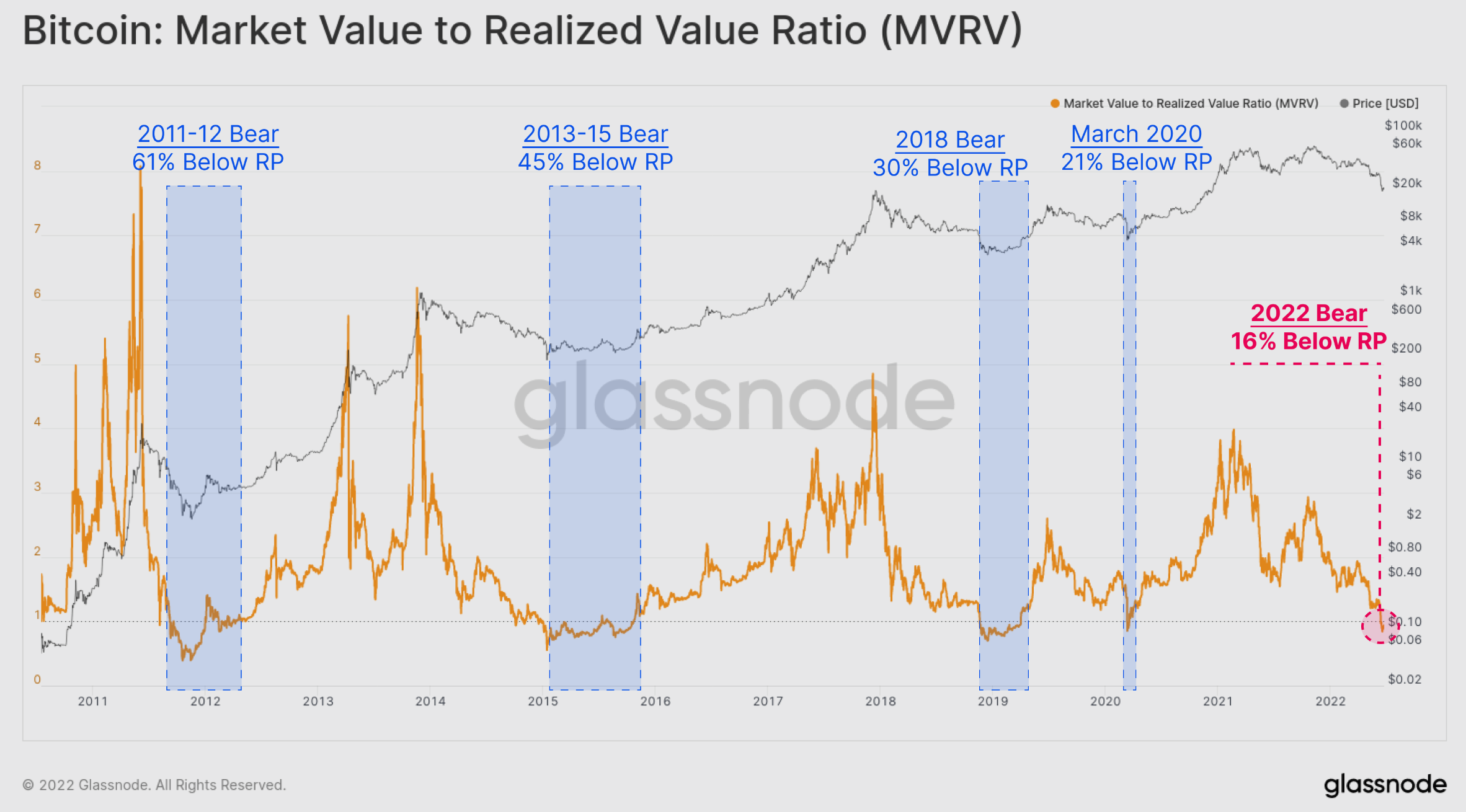

The report also found that spot prices are trading at an 11.3% discount to the realized price, meaning that the average market participant is now underwater on their position.

When evaluating market value to realized value (MVRV) over time, Glassnode found that spot prices traded below realized prices only 604 days out of 4,160 daily closes.

See Also: IS BITCOIN A GOOD INVESTMENT?

“Many on-chain and market performance metrics have reached historically, and statistically significant lows … Even under this relative and statistical framework, we can largely confirm the severity of the 2022 bear market,” concluded the report.