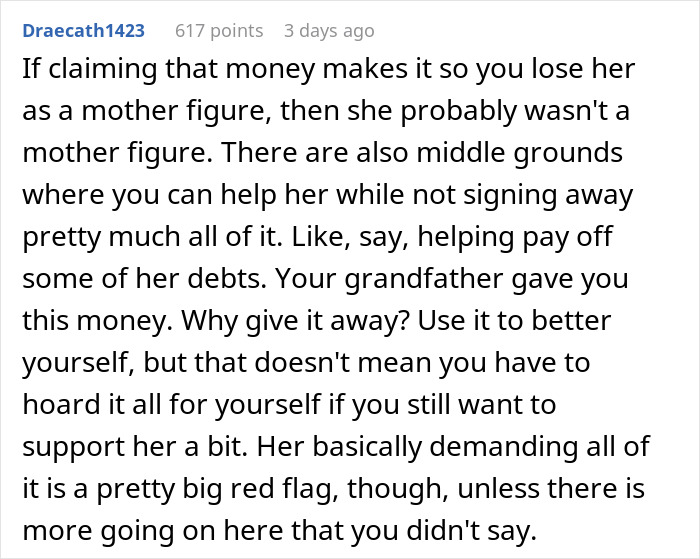

Families are supposed to stick together through thick and thin, but, as with so many things in life, money often ends up causing its fair share of issues. Entitlement, jealousy and just plain, old pettiness can very quickly get in the way and create its fair share of drama and intrigue.

A netizen discovered that they had inherited over six figures from their grandfather, only to learn that their grandmother wanted them to sign it all over. So they asked the internet for some advice. We reached out to the person who made the original post via private message and will update the article when they get back to us.

Getting a sizable inheritance is generally a pretty good thing

Image credits: rfaizal707 (not the actual photo)

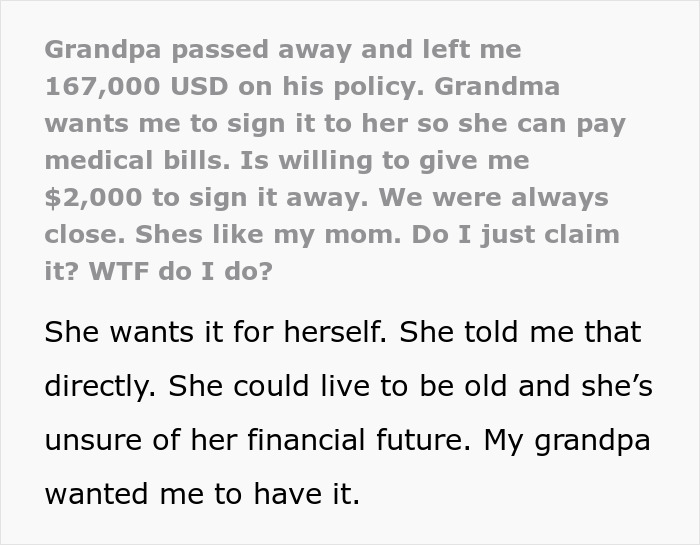

But one person ended up wondering what to do after their grandmother asked them to give over their inheritance

Image credits: AboutImages (not the actual photo)

Image source: gill_flubberson

Inheritances can often cause a lot of stress when not managed properly

Image credits: Mikhail Nilov (not the actual photo)

Attitudes towards money can vary, but generally, when struck with a major windfall, most folks simply do not know what to do. After all, the taxes, risks and even relational issues of money might all come at once and be entirely new. Many people sort of panic and start making impulse decisions without evaluating the risks.

This is why the number one piece of advice is to take a deep breath, slow down and then make a plan. Stories like this are also more evidence as to why it can be smart to keep quiet about a windfall. While the grandmother would no doubt find out about the inheritance, the person asking for advice should prepare themselves for more folks to come out of the woodworks if they start flaunting around six figures. Too often, family members start to see one person’s money as, somehow, their money and they develop a feeling of entitlement.

The average inheritance in the US comes out to be about $46,200, according to the Federal Reserve. However, this might be heavily skewed by some folks inheriting massive, generational wealth and assets, so the real number for an average, working class person is most likely to be considerably lower.

Getting rid of debt is pretty often the best move one can make

Image credits: Andrea Piacquadio (not the actual photo)

It doesn’t take a genius to realize that $167,000 is considerably higher than even the upper estimate for an average. Importantly, even when the line of inheritance is very clear, the actual movement of funds can take months or even years, as it goes through something called probate. This is simply the court making sure everything is in order before money is sent one way or another.

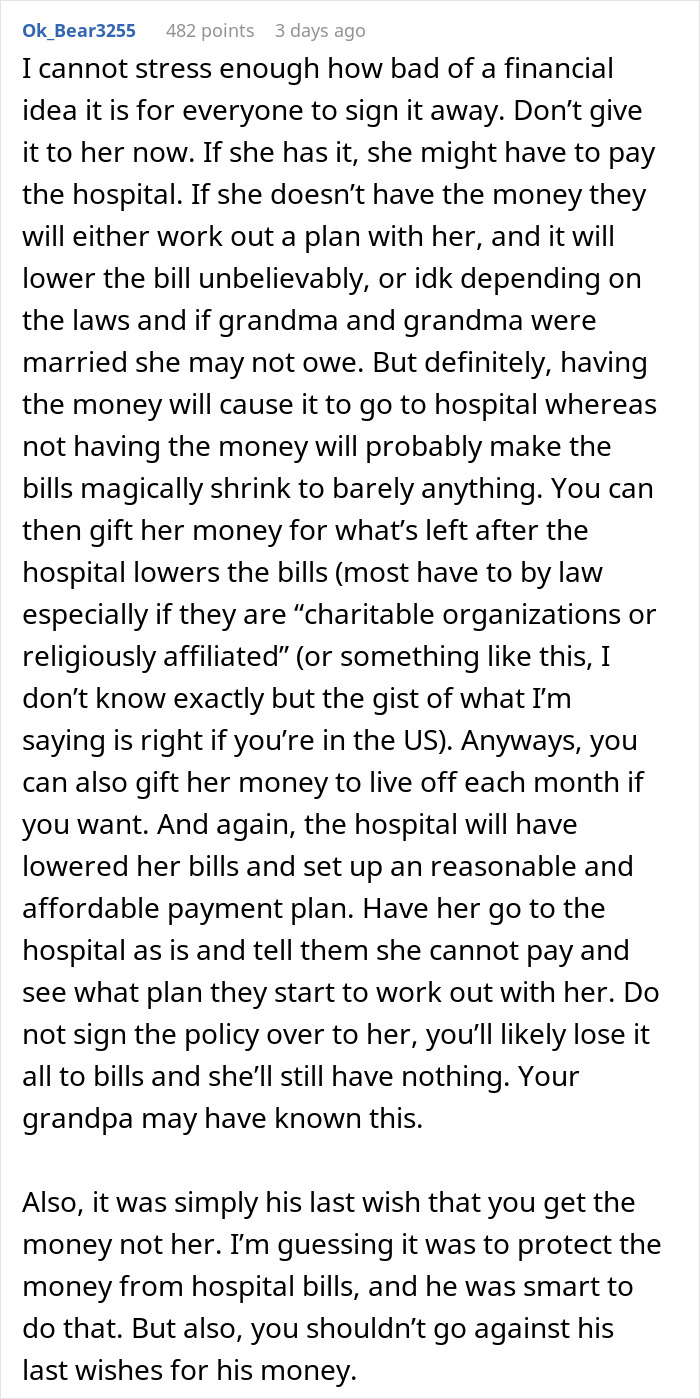

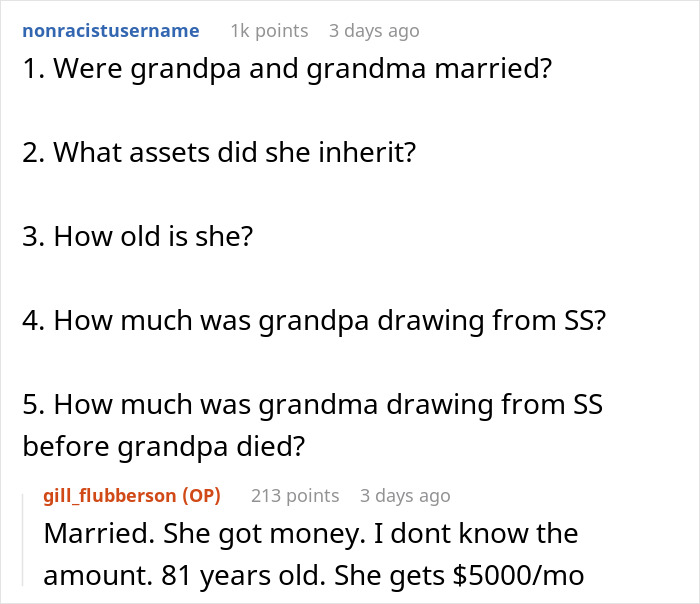

So this is one more reason the person in this story should perhaps stick to their guns. The grandmother is already 81, albeit healthy, according to the second update. Signing the inheritance over only for them to quickly pass would just lock up the money in the courts for even longer. Furthermore, as some commenters noted, there must be a reason the grandfather wanted the money to go to his grandchild. We don’t know the details, but family drama and money are a very normal combination, unfortunately.

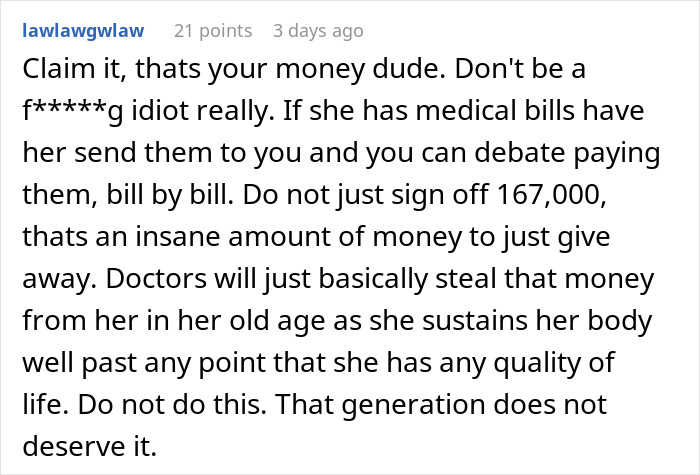

However, one thing nearly every bit of financial advice agrees upon is the importance of paying off debt quickly and efficiently. The person in the story is still working on a mortgage. The grandmother neither has any real debt, nor has any medical debt. There is nothing against wanting to live comfortably for the rest of one’s days, but she seems to already have a decent pension.

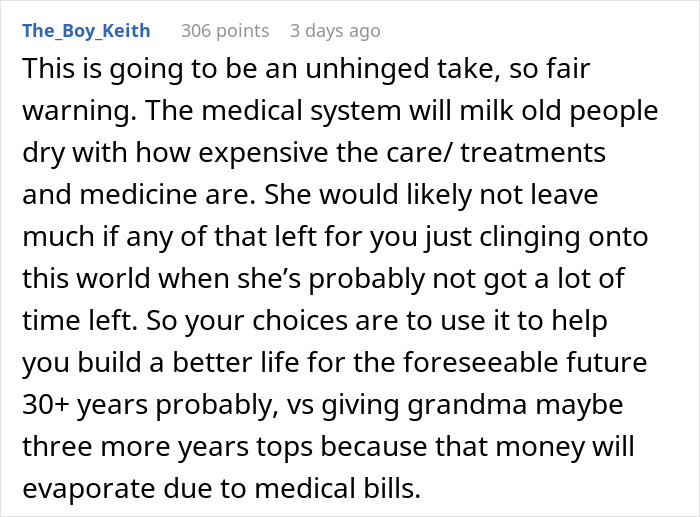

After all, allowing this person to just own their home without a mortgage (or at least a significantly reduced one) seems like a better long-term investment for the entire family. However, the real sticking point is that she “threatens” to no longer be a maternal figure if she is not given the money. This is a red flag of red flags. This bears all the hallmarks of a truly terrible relationship.

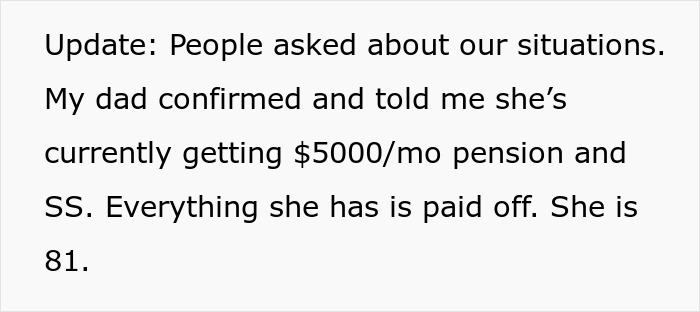

Some folks needed more information

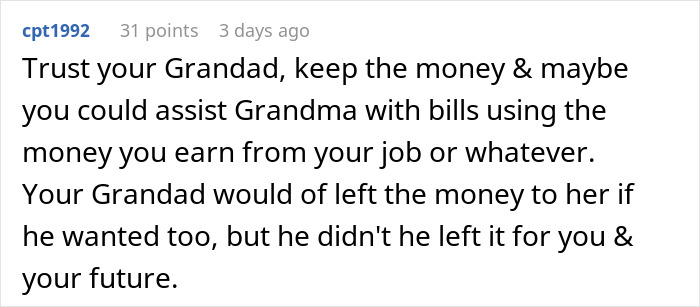

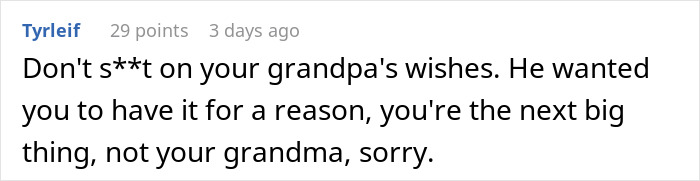

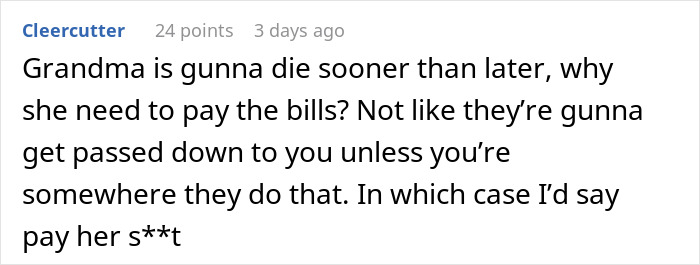

Many readers were surprised at the grandmother’s demands