Delving into the realm of global commerce, we uncover the powerhouses that dominate the landscape of the world's highest-grossing companies. From retail giants like Walmart and Amazon to energy behemoths such as Saudi Aramco and Exxon Mobil, these corporations wield immense influence, shaping economies and industries. Amidst turbulent times marked by geopolitical tensions and technological disruptions, they navigate a complex web of challenges, from supply chain disruptions to climate sustainability concerns.

Join us as we explore the top 10 highest-grossing companies, dissecting their strategies, resilience, and contributions to the ever-evolving global business arena.

1. Apple

Apple's reign as the world's most valuable publicly traded company reflects its unparalleled ability to innovate and maintain a loyal customer base. With a market capitalization surpassing $2.7 trillion, Apple's success stems from a history of groundbreaking products, from the iPod to the iPhone and beyond. Despite skepticism regarding its post-Steve Jobs era, Apple continues to demonstrate resilience and adaptability, unveiling advancements like cellular-enabled smartwatches and facial recognition technology. Coupled with strategic investments in the U.S. economy, Apple's trajectory remains firmly anchored at the forefront of technological innovation and market leadership, solidifying its status as the pinnacle of corporate success.

2. Microsoft

Microsoft's resurgence as the world's most valuable publicly traded company stems from CEO Satya Nadella's strategic shift towards cloud computing and B2B offerings. Unlike its rivals, Microsoft's diversified revenue base and strength in enterprise software have shielded it from recent tech-stock sell-offs. With a remarkable five-year rally and a focus on innovation, Microsoft's trajectory underscores its resilience and potential for continued growth in the evolving tech landscape.

3. Amazon

Amazon's resurgence as the world's most valuable brand underscores its enduring impact on global commerce and consumer behavior. Despite a 15% decline in brand value, Amazon's unparalleled scale, innovation, and customer-centric approach solidify its leadership position. The post-pandemic scrutiny from consumers reflects heightened expectations, yet Amazon's resilience amidst supply chain disruptions reaffirms its indispensability in the digital age, reaffirming its status as the foremost brand driving market transformation and shaping the future of retail.

4. Nvidia

Nvidia's rise to becoming the third most valuable company in the U.S. highlights its pivotal role in the technology sector, particularly in artificial intelligence. With a market capitalization of $1.825 trillion, Nvidia's innovative AI chips have propelled its stock price to record levels, up 47% this year. As demand for advanced AI solutions grows, Nvidia's dominant market position and anticipated strong performance continue to solidify its status as a leader in the tech industry.

5. Meta Platforms

Meta, formerly known as Facebook, has ascended to become one of the most valuable companies in the world, with its market capitalization surpassing $1 trillion. This achievement underscores its significant impact on the technology landscape. Under the leadership of CEO Mark Zuckerberg, Meta has undergone strategic transformations, including cost-cutting measures and investments in artificial intelligence. Shareholders are bullish on Meta's future prospects, particularly in AI, as the company continues to innovate and expand its offerings. With its market dominance and forward-looking initiatives, Meta's position as a heavyweight in the tech industry is solidified, contributing to its status as one of the most valuable companies globally.

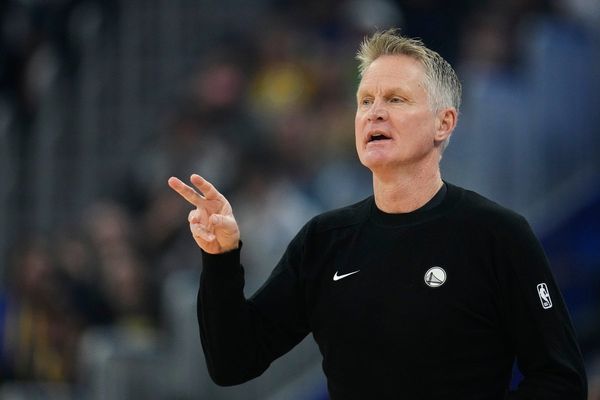

6. Berkshire Hathaway

Berkshire Hathaway's value stems from Warren Buffett's adept leadership and savvy investments. With a market capitalization over $700 billion, it holds diverse assets from GEICO to Apple. Buffett's strategy, using insurance float for investments, consistently yields high returns. Its annual meetings are iconic, attracting investors globally. With succession plans in place, including Greg Abel as heir apparent, Berkshire Hathaway's legacy remains strong.

7. Tesla

Tesla's dominance in the electric vehicle (EV) market, coupled with its expansion into renewable energy solutions like solar panels and energy storage, has propelled its meteoric rise to becoming the world's most valuable automaker. Pioneering innovations in EV technology, such as the Model 3 and Model Y, have reshaped the automotive industry. Additionally, CEO Elon Musk's visionary leadership and Tesla's aggressive global expansion have solidified its position as an industry leader, driving its unparalleled market capitalization.

8. Eli Lilly

Eli Lilly's position as one of the highest-grossing companies globally is underscored by its innovative pharmaceutical products, robust pipeline, and strategic partnerships. With a strong global presence and commitment to quality, the company consistently delivers strong financial performance, attracting investors and driving its market capitalization to impressive heights. Eli Lilly's relentless focus on innovation and expansion ensures its continued success in addressing critical medical needs and maximizing revenue potential.

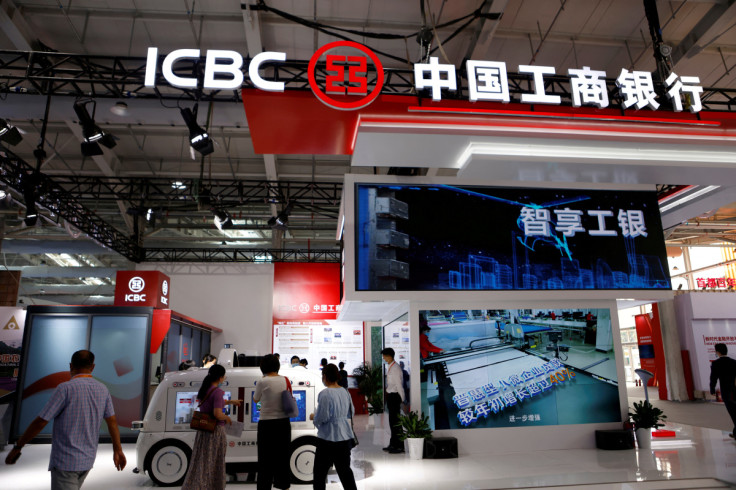

9. Industrial and Commercial Bank of China

The Industrial and Commercial Bank of China (ICBC) emerges as the world's most valuable company due to its staggering balance sheet strength, boasting $160.6 billion in tier one capital. China's ascent in the global banking sector is highlighted by ICBC's prominence, along with three other state-owned giants in the top 10. This shift underscores China's economic prowess, contrasting with the diminishing influence of UK-based banks. Despite recent regulatory actions, China's foray into global banking markets is expected to persist, reflecting its strategic expansion and growing international presence.

10. Exxon Mobil Corporation

ExxonMobil Corporation is one of the most valuable companies in the world due to its robust financial performance and extensive global presence in the oil and gas industry. With significant revenue and net income, ExxonMobil maintains a leading position as the largest refiner of petroleum products, supplying fuel, lubricants, and chemicals worldwide. Its diversified upstream production chains, including deep water, unconventional, heavy oil, and liquefied natural gas, contribute to its market dominance and sustained profitability.

Global titans

The top 10 highest grossing companies of the world represent a diverse array of industries, from technology and finance to energy and healthcare. These companies, with their substantial market capitalizations, robust revenues, and strong financial performances, underscore their global influence and economic significance. As they continue to innovate, expand, and adapt to evolving market dynamics, their positions at the pinnacle of the business world are likely to endure, shaping the landscape of the global economy for years to come.