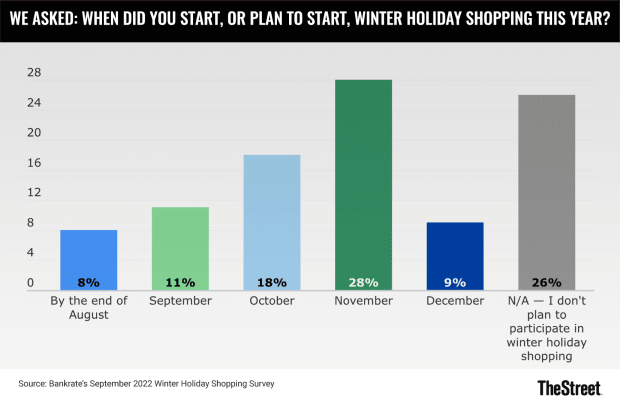

Just like the pumpkin spice craze now seems to begin in August, the holiday shopping period also seems to creep up on us earlier and earlier.

Pumpkins are already popping up by mid-September and, before we know it, the Christmas music will start hitting both small urban shops and large suburban malls.

According to the latest survey of 2,415 shoppers by Bankrate, more than half plan to begin their holiday shopping by October 31. 14% are planning to start in September, 25% in October, and 38% in November.

While starting early and taking advantage of Black Friday and other sales can be a good way to keep the overall bill lower, 27% will still go into debt to give everyone on their list presents.

21% will put holiday purchases on a credit card while 10% will use a Buy Now, Pay Later service and stretch payments out over a longer time.

Spending Too Much On Presents (Blame Inflation)

While we all know the one person who tries to outdo all others with the quantity and price tag of presents, the numbers are more complicated than people simply overspending.

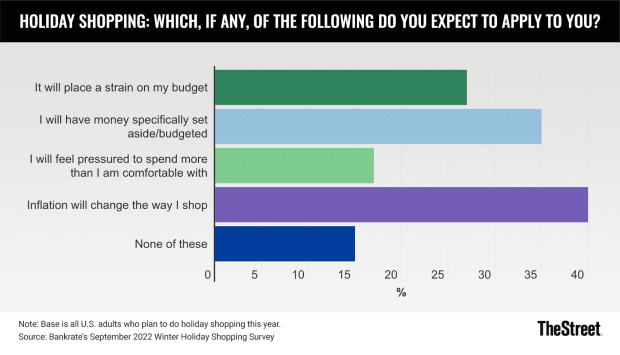

A whopping 84% said that they will look for ways to save money on holiday shopping this year while 40% of winter holiday shoppers said that they would buy fewer items altogether.

Bankrate

A further 52% said they would try to take advantage of more coupons, discounts, and sales.

So why will so many still overspend? In a single word, inflation. The consumer price consumer index rose by 8.5% in July while the price of many common gift items rose even higher.

The crunch is being felt most by those who earn less. That number rose to 45% of those earning below $50,000 per year and 41% of those who earn between $50,000 and $79,000.

Meanwhile, only 33% of those who earn between $80,000 and $99,000 and 34% of those who earn more than $100,000 said that they would be impacted by inflation this holiday season.

"Consumers are still spending, but they’re being especially thoughtful about where each dollar goes," Bankrate's Senior Industry Analyst Todd Rossman said in a press statement.

How To Avoid Debt This Holiday Season

Of those using credit, 38% expect to pay off their bills in full while 21% plan to do it over time. With the average credit card interest rate in the country at 19.7%, that choice can get those who are already struggling to cover the holidays into further financial difficulties.

Bankrate

95% of shoppers said that they would alter how they shop this holiday season in some way. Some solutions presented by Bankrate include taking advantage of various deals and maximizing various points and bonuses offered by credit companies for new sign-ups.

"I'm also a big fan of stacking discounts such as rewards credit cards, online shopping portals, and store coupons," Rossman said.

But for those truly struggling financially, reevaluating what you spend and finding. ways to celebrate the holidays while buying less is the single best way to avoid overspending.

27% said holiday shopping will strain their budget while 17% of those surveyed said that they feel pressure to spend money they don't have during the holidays.

"The easiest way to avoid debt is to not make those charges," the study's authors write. "If you're set on making certain purchases, however, using the right credit card can reduce your overall debt burden."