The stock market is trading significantly higher midday following the Fed's 50 basis point rate cut. The S&P 500 is up 1.97%, the tech-heavy Nasdaq Composite jumped 2.92%, the Dow Jones Industrial Average increased by 1.48%, and the Russell 2000 Index added 2.15%.

A rate cut makes borrowing cheaper, which can boost company profits and consumer spending, leading to higher stock prices. But Giuseppe Sette, co-founder and president of Toggle AI, has set an alarm on potential future stock market trends.

"A big rate cut in a slowing environment has always preceded a market drop. It's possible we've seen the peak of the market today," Sette said.

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

- Darden Restaurants (DRI) +8.4%

- Advanced Micro Devices (AMD) +7.3%

- Tesla (TSLA) +7.3%

- Monolithic Power Systems (MPWR) +6.9%

- KLA (KLAC) +6.9%

The worst-performing five S&P 500 stocks with the largest midday drop are:

- Ventas (VTR) -2.8%

- Iron Mountain (IRM) -2.7%

- Arthur J. Gallagher (AJG) -2.4%

- Crown Castle (CCI) -2.4%

- Realty Income (O) -2.4%

Stocks also worth noting include:

- Nvidia (NVDA) +5.1%

- Salesforce (CRM) +5.1%

- Apple (AAPL) +3.9%

- Meta Platforms (META) +4.0%

- Taiwan Semiconductor (TSM) +6.2%

Darden Restaurants pops despite weak earnings

Darden Restaurants popped 7% after the restaurant operator announced its fiscal- first-quarter earnings and a partnership with Uber.

The restaurant chain earned $1.75 per share for the quarter ended Aug. 25, missing analysts' consensus forecast of $1.84. Revenue of $2.76 billion also fell short of the $2.81 billion expected.

However, the company maintained its full-year outlook and noted improving sales trends. It also said it has entered into an exclusive multiyear delivery partnership with Uber, set to begin with Olive Garden in late 2024.

Related: Another craft beer, restaurant chain files Chapter 11 bankruptcy

"We operate in a very dynamic, competitive industry and we have proven we can successfully navigate challenging environments due to our strategy," said Darden’s chief executive, Rick Cardenas. "While we fell short of our expectations for the first quarter, I firmly believe in the strength of our business."

Darden Restaurants’ brands include Olive Garden, Longhorn Steakhouse, Cheddar's Scratch Kitchen, Yard House, Capital Grille, Seasons 52, Bahama Breeze, and Eddie V's.

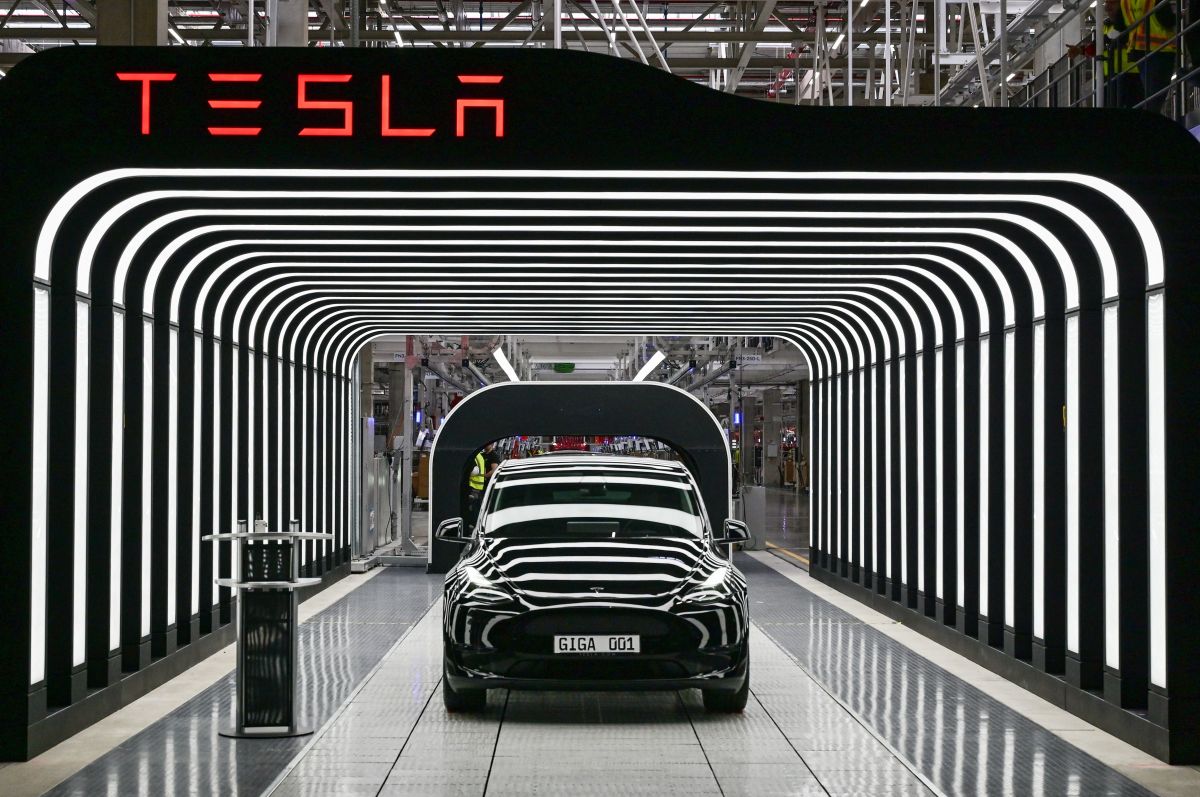

Tesla pops after Fed rate cut

Tesla gained 7% and became one of the top five S&P 500 winners midday after the Fed’s rate cut decision.

A rate cut will likely benefit car stocks as lower interest rates could make car financing more affordable, easing companies’ need to lower prices and increasing demand.

Related: Analyst unveils bold 'Apple-esque' Tesla stock forecast

UBS analyst Joseph Spak today maintained a sell rating and $197 price target on Tesla ahead of the company's Oct. 10 robotaxi event, according to thefly.com. The analyst says Tesla stock might strengthen ahead of the event but he is skeptical about its ability to meet expectations and maintain momentum.

Salesforce ticks higher after analyst update

Salesforce rallied 5% after Truist raised its price target to $315 from $300 and affirmed a buy rating.

Earlier this month, The customer-relations-management-software company announced plans to buy Own Co,, a provider of data protection and management solutions, for $1.9 billion in cash to boost its data security and privacy products. It also said the acquisition would not affect its fiscal year 2025 forecast.

More Wall Street Analysts:

- Analyst says Intel should drop a key business to survive

- Analysts adjust Bookings.com stock price target on travel market

- Analysts place bets on Las Vegas strip casino stocks

Truist said that while estimates remain unchanged, the investment firm is more confident in Salesforce's ongoing profit and cash flow growth. The company's strong capital allocation strategy also suggests a better chance for increased subscription revenue growth, according to a research note pulled by thefly.com.

Related: Veteran fund manager sees world of pain coming for stocks