KEY POINTS

- Ethereum saw the largest gains in the day among all major cryptocurrencies

- Other altcoins, including $XRP and $ADA, were also in the green

- Some experts believe $100,000 is possible amid positive signals in the Trump trade war

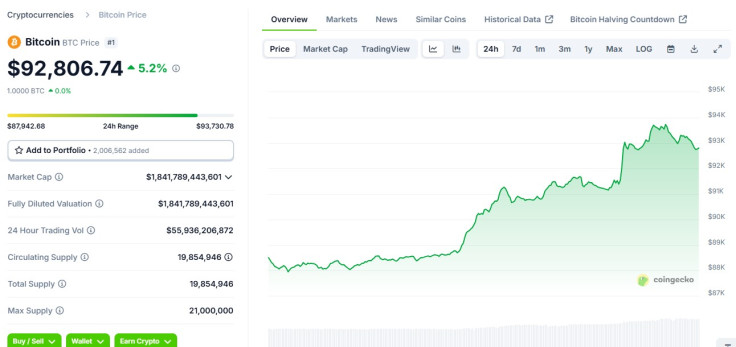

Bitcoin, the world's largest cryptocurrency by market cap, surged to $93,000 Tuesday amid bullish signals and expectations that U.S. President Donald Trump's global trade war will begin cooling off in the coming weeks.

The crypto asset was trading at below $88,000 early Tuesday before it surged to the $93,000 highs later in the day, as per data from CoinGecko.

The digital coin has since slightly pulled back to around $92,800 but remains in the green by over 5% in the day, triggering a wild uptick among other altcoins.

$ETH Outperforms $BTC

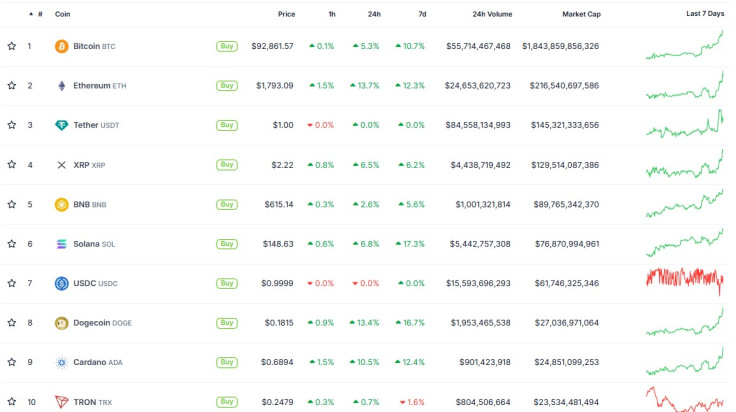

While Bitcoin's spike was undoubtedly the trigger factor for the overall crypto market's 4.5% surge in the last 24 hours, Ethereum outpaced Bitcoin in the day's gains.

The world's second most valuable cryptocurrency saw a 13.7% spike in the day, and top meme coin Dogecoin (DOGE) skyrocketed 13.4%.

All other major altcoins were in the green following Bitcoin's surge, including XRP (6.5%), BNB (2.6%), Solana (6.8%), Cardano (10.5%), and TRON (0.7%).

What Experts are Saying About Bitcoin's Price – $100K Possible

As soon as Bitcoin made significant strides throughout the day, crypto experts and analysts jumped into the conversation, making their projections on how the digital asset's price will go next.

For analysts at crypto market research firm 10x Research, BTC at $100,000 is possible, with key resistance zones between $94,000 and $95,000.

On the other hand, 10x Research analysts noted that while the bullish trend has resumed, it's still best to observe how President Trump deals with his trade war in the coming days.

Tide Turns: Bitcoin $$$ Inflows Reignite Rally - $100,000 Possible

— 10x Research (@10x_Research) April 23, 2025

👇1-10) As anticipated, Bitcoin has resumed its bullish trend.

The next key resistance zone lies in the $94,000–$95,000 range, which aligns with our target for this move.

However, whether this level can be… pic.twitter.com/f1wgilhHe6

The team pointed out that "Trump appears to be backing down on two major fronts," wherein he may be softening his stance on China tariffs and toning down his push for Fed Chair Jerome Powell's resignation.

For Pierre Rochard, the CEO of The Bitcoin Bond Company, the coin's current movement indicates its price discovery dynamics are still "skewed to the upside, underscoring a favorable risk-reward profile."

Crypto's Reactions to Trump Trade War

In recent weeks, it's become clear that crypto is reacting to Trump's trade war.

At one point, Bitcoin plunged to $75,000, dragging most altcoins down with it in the process. The nosedive came after Trump announced new tariffs on Chinese goods.

Over the weekend, BTC prices jumped to $87,000 amid anticipation that some countries may finally seal a trade deal with the U.S.

With hopes running high for trade deals to be announced in the coming days and with Powell potentially safe from Trump's grasp for now, Bitcoin's uptrend is expected to continue, unless devastating news hits the markets again.