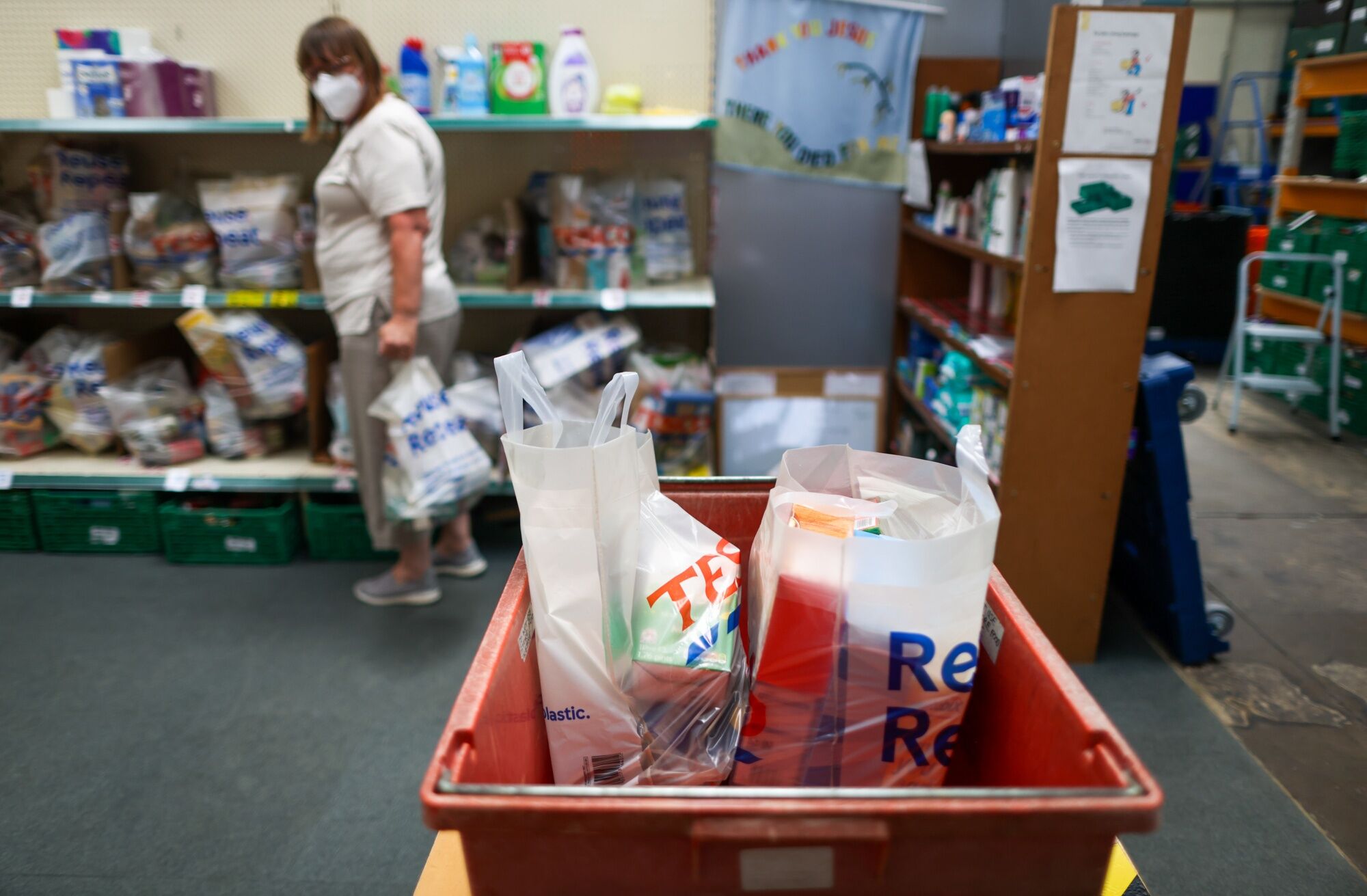

The number of Britons living in destitution could reach 1 million over the next year unless the government takes urgent action to tackle the cost of living crisis, a leading think tank warned.

In a stark assessment, the National Institute of Economic and Social Research said a further 250,000 households will slide into extreme poverty without help and warned that the country will soon be in recession.

To ease the crunch, Prime Minister Boris Johnson’s government needs to provide a £4.2 billion ($5.2 billion) support package to ensure the hardest-hit households can feed themselves, NIESR said.

The UK is facing one of the most severe shocks of major advanced economies, as soaring energy and commodity prices due to the war in Ukraine and tight labor markets drive up inflation. NIESR said RPI inflation will reach 14.4% later this year, the highest level in over 40 years.

The blow will see the economy shrink 0.2% in the third quarter and 0.4% in the fourth, it forecast. The combination of Covid and the war in Ukraine would leave the UK economy permanently 5% smaller.

NIESR Director Jagjit Chadha said Chancellor of the Exchequer Rishi Sunak was to blame for some of the hardship households are experiencing. “Fiscal policy has not done enough and should have been much more ambitious, particularly in the past year,” he said.

The Treasury has provided £22 billion of support for families to help with the crunch, most of it targeted at working households. Johnson hinted at further measures on Tuesday, saying the government “will be saying more about this in days to come.”

NIESR uses the government definition for destitution as a family of four with just £140 pounds to live on after housing costs. In addition, a further half a million people face a choice between eating and heating, it said.

Analysis by Adrian Pabst, NIESR’s deputy director for public policy, showed that the poor will bear the brunt of the cost of living shock. Around 1.5 million households “face food and energy bills greater than their disposable income,” he said.

Boost Needed

In total, the loss of income among the poorest 11.3 million households equates to £4.2 billion more than the median household. To make up some of the shortfall, the government should provide a one-off £250 cash payment to all of those in the bottom 40%, at a total cost of £2.85 billion, NIESR said.

An additional £25 a week uplift to Universal Credit welfare for six months, similar to the £20 a week boost during the pandemic, would further help the poorest 5 million households at a cost of £1.35 billion.

The chancellor has the headroom against his fiscal rules to afford the giveaway and should use the space rather than try to raise the money through a windfall tax on energy companies, Chadha said.

“Windfall taxes are problematic because they create uncertainty about the corporate tax regime,” he said. “Within the current regime we have sufficient fiscal space.”

Stephen Millard, deputy director for macroeconomics and a former Bank of England official, said the central bank had been too slow to tackle inflation. The BOE “should have been tightening last year. Because they weren’t it helped add to the inflation we are now seeing,” he said.

NIESR expects interest rates to get to 2.5% by next year and remain at that level. It forecast CPI inflation to peak at 8.3% in the final quarter and for the economy to grow 3.5% this year, a downgrade of 0.9 percentage points from its previous forecast, made before Russia invaded Ukraine in February.

Next year, the economy will grow 0.8% and inflation will average 2.9% in the final quarter, above the 2% BOE target.

NIESR also downgraded its outlook for global growth. The effect of the war in Ukraine will knock 1 percentage point off GDP, equivalent to around $1.5 trillion of global output.

©2022 Bloomberg L.P.