The restructuring of the Nissan Motor Co. and Renault SA partnership isn’t the legacy Carlos Ghosn had in mind.

Monday’s announcement that Renault will gradually reduce its stake in Nissan is a repudiation of the former chairman’s plans to more closely unite an alliance the disgraced former auto titan spent almost two decades building. Instead, the companies are choosing more independent paths to navigate the technological and geographical shifts reshaping the global car industry.

Renault is splitting into two main businesses, one focused on electric vehicles and another on automobiles with legacy combustion engines. Nissan has long sought greater independence since Renault saved it from financial ruin with a well-timed cash injection in 1999 and sent in Ghosn to turn the business around.

The workaholic Brazilian-Lebanese executive, who spent much of his time jetting between the carmakers’ headquarters and factories, was the glue holding together the alliance, which expanded in 2016 to include Mitsubishi Motors Corp. Before his shock arrest in 2018, Ghosn was aiming for a grand coalition of automotive enterprises to take on industry leaders Toyota Motor Corp. and Volkswagen AG, as well as embracing electrification and self-driving.

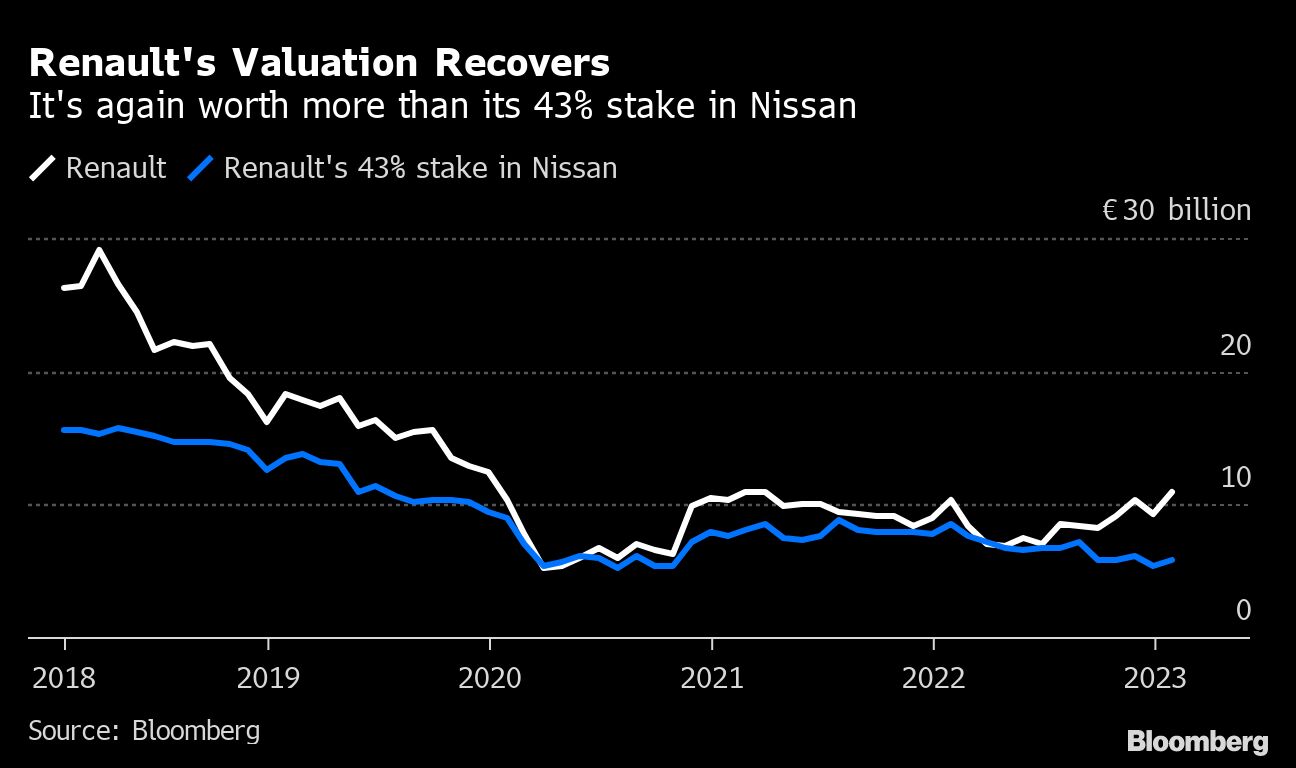

Just a year ago, Renault’s market capitalization was lower than the value of its holding in Nissan, one sign that it was no longer working as intended. But in the interim, investors have bought into Chief Executive Officer Luca de Meo’s vision for Renault’s future, almost doubling its market value from a March low.

The carmaking world has changed since Ghosn was arrested for financial crimes — he denies the charges — and purged from the companies he once dominated. Nissan, for one, is worth less than half of what it was under him, and the three alliance automakers have lost $28.5 billion combined in market value.

Nissan posted its biggest loss in 20 years in the fiscal year following the arrest, and it has slipped to become Japan’s third-largest carmaker after Toyota and Honda Motor Co.

While Renault and Nissan benefited by using their joint-purchasing power to drive down costs for parts and raw materials, they never figured out how to make full use of their engineering resources to build common car platforms.

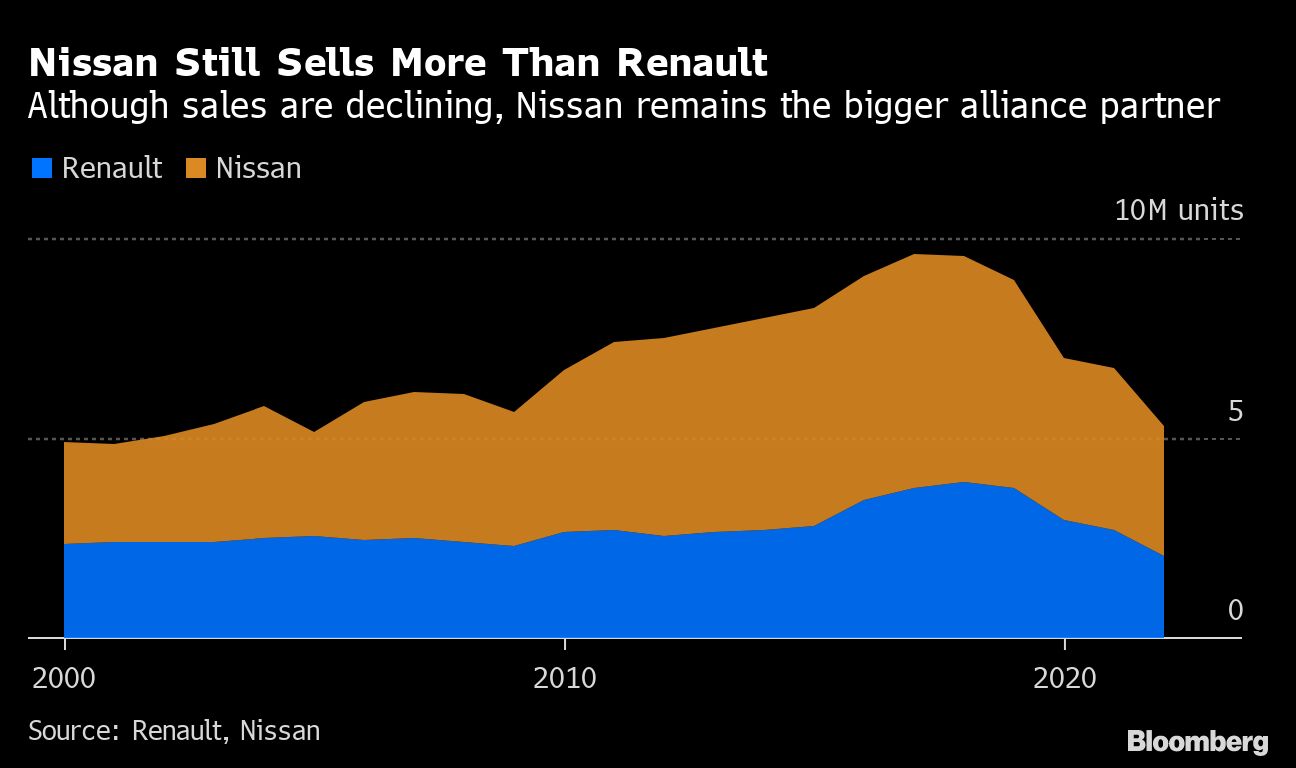

Nissan remains the bigger partner in the alliance, outselling Renault. The Yokohama-based company is making a big, long-term bet on solid-state vehicle batteries, an as-yet untested technology in the mass market. Together with Mitsubishi, Nissan is also making and selling electric mini vehicles, lining up against Chinese manufacturers and others pushing aggressively into the area.

The charges filed against Ghosn and former director Greg Kelly have been a distraction for Nissan, as well as a lengthy internal probe and the former chairman’s dramatic escape from Japan at the end of 2019. Negotiations to revamp the alliance have sucked up management resources at a time when Nissan has a noticeable lack of new models to appeal to car buyers.

Ghosn’s arrest also led to the exit of several alliance executives, most notably Jose Munoz, who is now Hyundai Motor Co.’s chief operating officer. Hyundai is outselling Nissan globally and has become the world’s third-largest carmaker.

The saga also triggered management turmoil at Renault that left the French carmaker without a permanent CEO for 20 months. Thierry Bollore was appointed soon after Ghosn’s arrest, but lasted just a year, and was followed by interim leadership until de Meo took over in mid-2020.

The Ghosn years were also marked by Nissan sending hundreds of millions of euros into Renault’s coffers via dividends. The payouts halted three years ago when Nissan went on an aggressive cost-cutting drive, a painful loss of income for the French carmaker, and were only recently restored at a much lower level.

Ghosn’s voluntary pay cut in 2011 after new disclosure rules in Japan triggered efforts by Kelly and others to find ways to retain and pay him after retirement, according to testimony given during criminal proceedings against Kelly and Nissan. That trial concluded last year with Kelly exonerated of most charges and Nissan paying a fine.

The former alliance chairman asserts that he was ousted because he sought to bring the companies closer together. While there’s evidence to back the claims, his efforts clearly backfired.

Ultimately, Ghosn’s visions — including bringing Fiat into the alliance — never came to pass.

©2023 Bloomberg L.P.