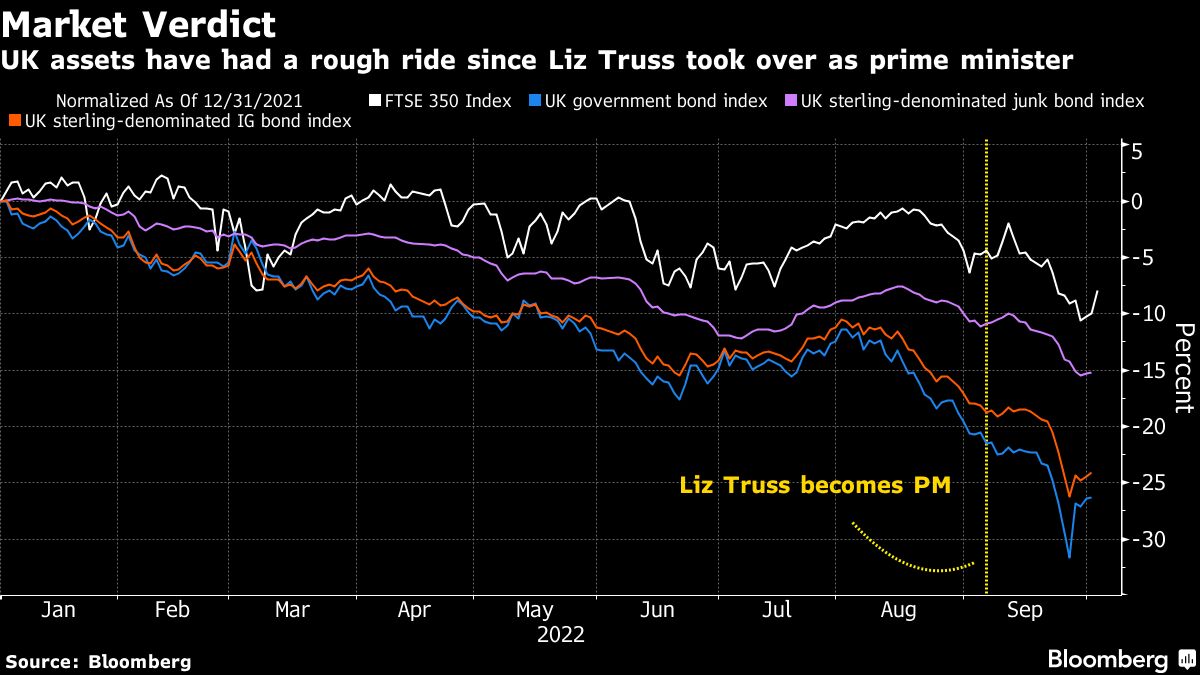

A wild first month for Liz Truss’s government has seen at least £300 billion ($340 billion) wiped from the combined value of the nation’s stock and bond markets.

While assets globally have been roiled by central bank efforts to tame surging inflation, confidence in the UK has been shaken. The September selloff on concerns about the Truss government’s tax cuts saw the pound hit a record low against the dollar, intervention by the Bank of England and a humiliating government climbdown amid questions over credibility.

“The feedback we get from investors is that they consider the UK uninvestable as long as there is such government chaos,” Liberum Capital Ltd. strategist Joachim Klement said in written comments.

Recovering some ground since late September, the FTSE 350 Index -- which comprises stocks in the export-heavy FTSE 100 and the domestically focused FTSE 250 -- is down by about £77 billion since the September 2 close, the last trading day before the ruling Conservative Party chose Truss as its leader, according to data compiled by Bloomberg.

The market value of Bloomberg’s gilt and inflation-linked gilt indexes has lost around £200 billion in that time. That reflects a global bond selloff as well as UK-specific concerns. Last month saw the largest yield spike on 10-year UK government bonds on record. That saw them surpass 4% for the first time since 2010.

Sterling-denominated, investment-grade bonds have lost £26 billion over the same period, dragging down the market value of a Bloomberg index that tracks the securities to the lowest level since January 2014. A gauge of sterling-denominated junk bonds -- of which British companies account for around 90% -- has seen its market value drop by £1.8 billion.

Truss sought to allay market concerns in a speech to her party’s conference in Birmingham on Wednesday. Nevertheless, the pound extended declines after the speech as the dollar rallied.

Amid confusion over Chancellor of the Exchequer Kwasi Kwarteng’s plans to release forecasts on government finances, the government may be pushed into tweaking policy further if those estimates don’t reassure markets, said Christy Wilson, an associate at Katten Muchin Rosenman UK LLP, a legal firm that advises the financial sector.

Emerging Value

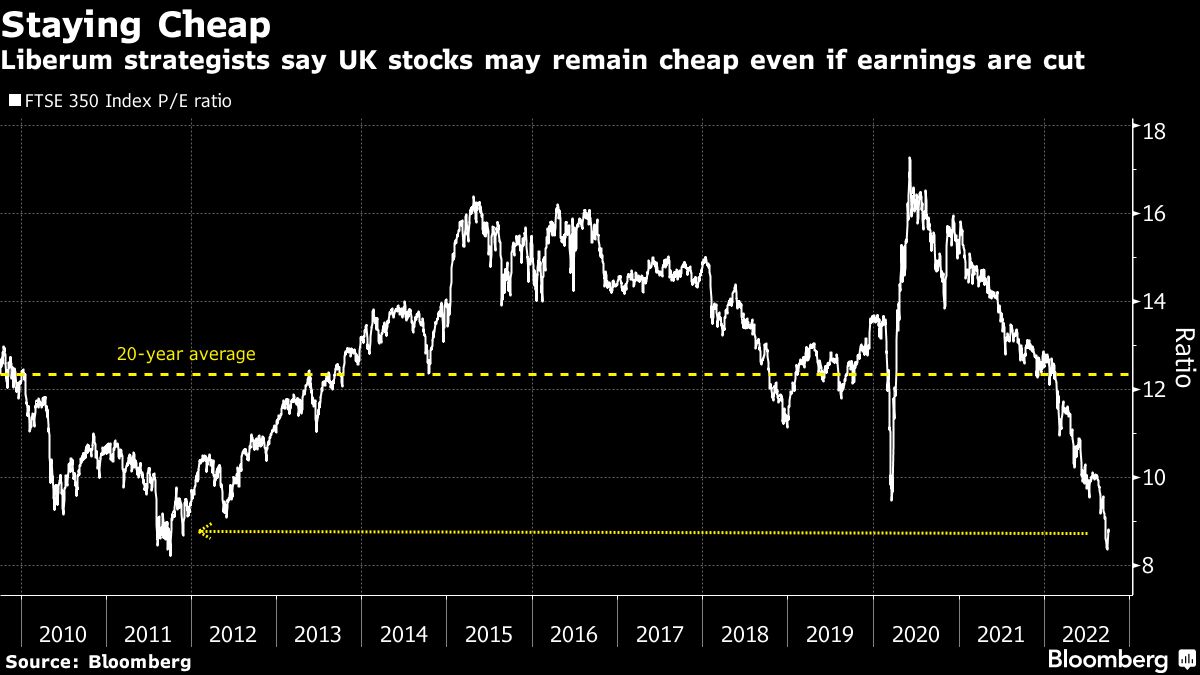

Still, in the wake of the selloff, value is starting to emerge in UK stocks, according to Liberum’s Klement. Even if earnings estimates are slashed by a quarter, both the FTSE 350 and FTSE 250 would be at or below five-year average price-to-earnings ratios, he said.

Some investors are seeing opportunities to build positions. “There is a feeling that stocks are starting to look very cheap, luring some opportunistic investors back to the market,” Victoria Scholar, head of investment at Abrdn Plc’s retail trading arm Interactive Investor, said by email.

As for the pound, it has recovered ground since the mini-budget-driven rout, leaving it trading at around $1.12 after falling to as low as $1.03. However, that should not be taken as a vote of confidence in the government, according to Seema Shah, chief global strategist at Principal Global Investors Ltd, who noted gains coincided with the income tax U-turn.

“Sterling rises might in fact be telling us that investors believe that the Truss/Kwarteng axis can be brought in line,” she said by email.

©2022 Bloomberg L.P.