With Bitcoin caught in the throes of its worst slide in years, analysts are wading through any number of indicators to see at what point even more investors might start to throw in the towel.

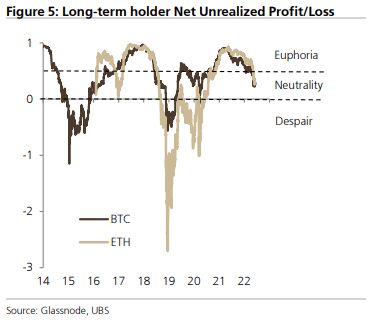

Bitcoin, down about 20% this week, fell to as low as $21,932 on Tuesday, putting it squarely below the average investor cost base of $23,500, according to UBS. That means prices have declined enough to test even long-term holders, who up until now in the 2022 drawdown were largely in the green with their investments.

“Bear-market blues have set in among even the most ardent crypto proponents,” said James Malcolm, head of foreign exchange and crypto research at UBS. “Capitulation can come in many forms. Equally, relief too as we are now in full-blown panic mode, and the bar for a hawkish Fed this week is pretty high.”

One way this could snowball is if miners, whose businesses have been under “significant pressure” due to high energy costs and capex commitments, start capitulating to sell down their holdings of existing coins, he said. Their sales last month coincided with a lurch lower, for instance. “There is little positive news to offset such concerns,” Malcolm said.

A 17% plunge in Bitcoin at the start of the week brought it down to its lowest level since the end of 2020. Other cryptocurrencies were also in the gutter: the MVIS CryptoCompare Digital Assets 100 Index, which measures 100 of the top tokens, dropped as much as 17%, also its lowest point since December 2020.

Meanwhile, the ProShares Bitcoin Strategy ETF (ticker BITO) and the Valkyrie Bitcoin Strategy ETF (BTF) each lost as much as 20%, the most since their inceptions at the end of 2021. Shares of MicroStrategy Inc. fell more than 25%.

Partly, digital-asset investors have been spooked by crypto-lender Celsius Network Ltd. pausing withdrawals, swaps and transfers, though the broader market remains under pressure after an inflation print came in hotter-than-expected last week, meaning that the Federal Reserve will have to be aggressive in its attempts to cool rising prices.

“It does feel like there is more downside to come,” Fiona Cincotta, senior financial markets analyst at City Index, said in an interview. “Down to $20,000 is something that we should be watching for.”

Market-watchers have been obsessed with figuring out who is getting hurt during this year’s drawdown. Many retail investors and institutions had gotten in just over the past year or two. Bitcoin is now hovering around December 2020 levels.

The number of anonymous Bitcoin addresses in the money, meaning those that acquired their holdings at prices below today’s, has reached lows not seen since March 2020, which analysts at Bequant say points to “capitulation.” Elsewhere, strategists at Glassnode say the $20,560 to $23,600 span is where the market might see a “full-scale capitulation scenario.”

Steve Sosnick, chief strategist at Interactive Brokers LLC, is watching the $20,000-$21,000 range because MicroStrategy, a large Bitcoin holder, might have to offload some of its coins at that point. “We’ve taken out many of the prior support levels that we would have established since the run-up in late 2020,” he said in an interview. “When there’s this idea of a looming potential margin-call driven seller out there, yeah, the low $20,000, that’s a real line in the sand.”

Bitcoin hit a high of $19,041 in December 2017, its last cycle. Matt Maley, chief market strategist for Miller Tabak + Co., says that level will be important to watch. It forms the “old” resistance level, which makes it a new key support. “When it broke above that resistance level in 2020, it skyrocketed higher. So it needs to hold that level on this decline,” he said.

UBS’s Malcolm points to a number of hacks and outages, as well as regulators getting more serious about the crypto space. “None of this is to argue that crypto is going to slide into oblivion,” he said. “Yet what it does point to is how the future will look very different. Players will have to embrace regulation and collaborate with existing financial service providers.”

Chiente Hsu, co-founder and CEO at ALEX, a DeFi platform, strikes a hopeful note.

“Crypto is a high-volatility sector. So we feel the ups and downs much more,” she said. “There will be projects gone, for sure, but crypto won’t cause systemic risk.”

©2022 Bloomberg L.P.