The story so far: Trading has ceased completely in one of India’s oldest stock exchanges, the Calcutta Stock Exchange (CSE), on November 28, after the National Stock Exchange (NSE) terminated its contract with the bourse. On November 20, the stock exchange issued a notice to all members asking them to square off open positions in the NSE derivative segment.

The notice was issued after the Calcutta High Court vacated its interim stay on NSE’s decision to terminate its contract with the CSE. The bourse had challenged NSE’s decision claiming that its move would cripple the stock exchange’s operations completely. It also sought time from both SEBI and the NSE to comply to all regulations for extending the contract.

CSE was barred from trading on its platform by SEBI in April 2013 due to regulatory and compliance issues. Since then, CSE’s only function is to provide its members a platform to trade on the NSE. As of date, CSE has 1842 listed companies and 400 registered trading members.

Origins of Calcutta Stock Exchange

Stock-broking in Calcutta (now Kolkata) was first conducted in the 1830s under a neem tree. In 1863, a small premise on Netaji Subhas Road was rented by stock brokers to conduct operations. However, Standard Chartered Bank began constructing their own building on that site, necessitating a shift to a nearby neighbourhood.

Finally, in 1908, an association of brokers was established under the Companies Act 1850, with the name ‘Calcutta Stock Exchange Association’ at 2, China Bazar Street with 150 members. It was the second stock exchange to be set up in India -- and Asia - after the BSE, which was established in 1875.

CSE’s current premises at 7, Lyons Range was constructed in 1928. There is a plan to shift to bigger premises on the Eastern Metropolitan Bypass in Kolkata.

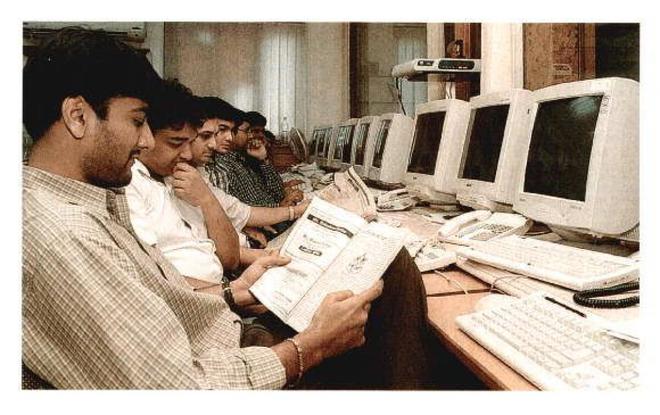

As CSE’s volume in share trade grew, it was granted permanent recognition by the Central government on April 14, 1980, under provisions of the Securities Contracts (Regulation) Act, 1956. In 1997, centralisation of the Indian stock market saw the old manual trading system in the CSE being replaced with the online electronic trading system -- C-STAR (CSE Screen Based Trading And Reporting), ushering in digitisation. Despite this, trading shifted mainly to the NSE and BSE after centralisation.

Currently, apart from CSE, NSE, the Bombay Stock Exchange (BSE), there are four other recognised stock exchanges in the country: The Multi Commodity Exchange of India, National Commodity & Derivatives Exchange, Indian Commodity Exchange, and the Metropolitan Stock Exchange of India (MSE). While MSE’s recognition is set to expire on September 15, 2024, all others have permanent recognition.

Why did CSE and other regional bourses decline?

With the establishment of the NSE in 1994, the stock trading in India’s nineteen regional bourses, including the CSE, considerably reduced. Most operators in these exchanges acquired memberships or became sub-brokers in NSE or BSE or both. As a result, these regional exchanges which had a 45.6% share of the total Rs 2.39 lakh crore turnover in 1995-96 were reduced to just 8.4% of the total volume of Rs. 8.96 lakh crore in 2001-02.

Another reason for their decline is the total ban on badla trading by SEBI in 2001. The ‘badla’ system first used in the 1990s allowed cash market transactions using borrowed funds in Indian stock markets. Smaller bourses thrived on ‘badla’ transactions using them as a work-around for slow paperwork (viz. delay in issue of share certificates). With no proper monitoring by SEBI of such transactions, ‘badla’ was first banned in 1994. However, due to mass protest by stock brokers against the ban, a modified ‘badla’ — which automated these transactions, heavily favouring the NSE — was introduced. The ‘badla’ was completely banned in 2001 and regional bourses lost all their trade to the NSE.

With the loss of revenue and trade, most regional bourses currently exist because of the annual listing fees they collect from the companies listed on their respective Exchanges.

The CSE was already hit by the Ketan Parekh scam in 2001. The infamous stockbroker and his associates rigged stock prices of companies, cooperative banks exclusively listed on the Calcutta Stock Exchange and then dumped these inflated shares using government institutions like the Unit Trust of India (UTI). His Rs 120 crore scam was busted in 2001 when a bear cartel (stockbrokers short-selling company stocks) targeted K-10 stocks – shares inflated by Parekh – crashing their prices and with it, bringing down CSE.

Why was CSE asked to exit by SEBI?

In 2008, SEBI issued guidelines to provide an exit option for Regional Stock Exchanges whose recognition was withdrawn/not renewed or those who wished to surrender their recognition. It allowed Exchanges whose annual turnover was less than Rs 1000 crore, a net worth less than ₹100 crore, and do not have a tie-up with a clearing corporation to voluntarily surrender their recognition within two years. If not, SEBI was allowed to forcefully de-recognise and start exit proceedings of such exchanges.

Between 2013 and 2015, seventeen regional bourses opted to avail the exit option as they failed meet SEBI’s criteria. These include regional bourses in Hyderabad, Coimbatore, Saurashtra Kutch, Mangalore, Cochin, Bangalore, Ludhiana, Gauhati, Bhubaneswar, Jaipur, Pune, Madras, Uttar Pradesh, Madhya Pradesh, Vadodara, OTC Exchange of India and Inter-Connected Stock Exchange. Companies which were listed only on these exchanges were ordered to de-list from them and migrate to a nationwide stock Exchange (BSE/NSE).

In April 2013, SEBI ordered suspension of the CSE’s trading operations on C-STAR due to failure to comply with its regulatory norms, forcing its exit. While CSE had fulfilled two of SEBI’s criteria, it failed to establish or tie up with a clearing corporation. SEBI had refused to grant CSE a time extension on technical grounds. Later, the Calcutta High Court upheld SEBI’s order forcing CSE’s exit – grinding all trading operations on CSE to a halt.

What is CSE’s current state?

As per CSE’s annual report for the Financial Year 2022-23, the Exchange’s Total revenue is Rs 17.88 crore and its profit is barely Rs 4 crore. In 2011, CSE entered into a five-year contract with NSE allowing its members to trade on the latter’s platform, with SEBI’s approval. The contract was automatically extended till September 2021, boosting CSE’s revenue since its trading stalled in 2013.

In 2020, SEBI had questioned the NSE on continuing the agreement despite of CSE’s functioning deficiencies. As a result, the national Exchange terminated its trading agreement with the CSE on July 18, 2023. Though NSE’s move was stayed temporarily by the Calcutta High Court, a division bench vacated the interim stay on November 17. All CSE shareholders have been asked to close all open transactions by November 28 – setting an end date to all of CSE’s trading. These members will now have to de-list from the CSE and take an NSE membership or become NSE sub-brokers.