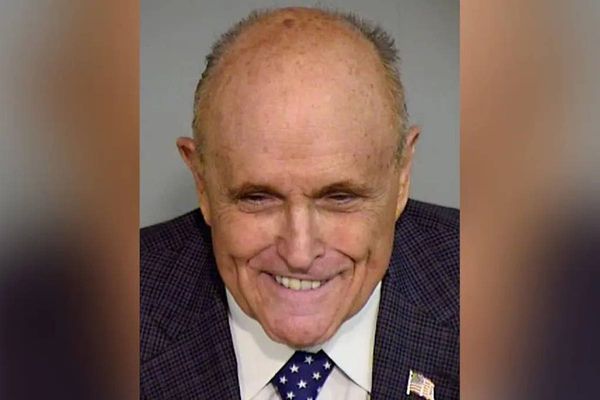

Sir Martin Sorrell

(Picture: PA Archive)Nature abhors a vacuum and so it has proved at S4 Capital.

Sir Martin Sorrell’s new digital marketing group has seen its share price collapse since Wednesday when a brief statement at 4pm informed the City that accounts due at 7am the next morning would be delayed.

Why? Auditors PwC “were unable to complete the work necessary”. No explanation was given as to why or when the accounts might eventually see the light of day. Mutliple inquiries since are met with a simple “no comment”.

This was the second delay in less than a month. The first time around, the company blamed “resource issues” at PwC. This time there was no such wording.

Shares are down by a third since Wednesday. Given the lack of information, the share price slump is understandable. Just what is going on? Better to sell now than wait to find out, investors will think.

The backdrop is important. S4 has grown rapidly through a dizzying deal spree since Sorrell set it up in 2018. The company struck a deal a month last year.

Financial details are thin on the ground at the time of these transactions. S4 usually acquires companies through share-based mergers without disclosing a price. Revenue and profits at the businesses joining the fold are also usually not mentioned.

The companies being acquired are small, meaning S4 is under no obligation to disclose these details. Fuller information eventually comes out in the company’s annual report.

But annual reports come long after the fact and the pace of S4’s deal making means that, while small individually, these transactions add up.

More up to date financials are shared with analysts who cover S4 though inquiries from humble journalists seeking more details are rebuffed. There’s no suggestion of impropriety, but the information does seem closely held.

This opacity can be tolerated when S4 is delivering strong growth, as it did last November when Sorrell reported a 56% jump in third quarter revenues.

But investors will be putting huge faith in the word of auditors to verify that growth. The minute any doubt starts to creep in, a relative lack of transparency becomes a huge issue.

The auditing delay may turn out to be totally innocuous. It may not. Either way, Sorrell should be more up front about how his business works.