Trying to predict where the economy might be headed is often a lot like reading tea leaves. People see what they want to see.

If you ask, for example, an eternal optimist or a politician in power, he or she might tell you that the economy is steady and headed in the right direction.

If you ask a pessimist, or Michael Burry, one of the most renowned bears on Wall Street, he might tell you that the economy is on the fast track to Doomtown.

DON'T MISS: An iconic business in San Francisco just closed after nearly 30 years

Burry has maintained a relatively dour outlook on booms and busts. The "Big Short" investor, who foresaw the 2008 mortgage crisis long before most other investors and analysts, is also extremely bearish on stocks like Tesla (TSLA) -), and on the S&P 500 and the Nasdaq.

Burry and his Scion Asset Management fund earlier in August bought $886 million of put options -- bets on price drops -- against an S&P 500 index fund. Scion also bought $739 million of put options against against the Invesco QQQ Trust ETF QQQ, which tracks the Nasdaq 100.

Scion's bets against two of the market's largest index funds total $1.6 billion -- or 93% of the fund's entire portfolio. So, you could say he's pretty bearish.

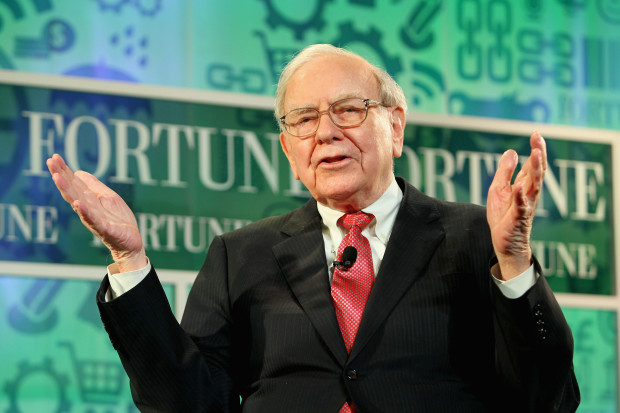

Michael Burry betting against big things is a pretty routine occurrence. But when Burry and Warren Buffett, one of the best investors of all time, seem to be humming the same tune, investors would be wise to listen.

Buffett sheds a lot of stock and buys Treasurys

According to disclosures this August, Buffett's Berkshire Hathaway (BRK.A) -) (BRK.B) -) shed $8 billion of stock. That's a 13% rise in his cash position (which now totals some $147 billion).

Over the past three quarters, Buffett has sold $33 billion of stocks, which amounts to $38 billion more cash in his reserves, ostensibly for a rainy day.

Stephen Hanke, professor of applied economics at Johns Hopkins, says this signals bad news.

The selloff signals Buffett's "anticipation of a recession and the fact that stocks are currently pricey," he said.

"It's also consistent with his long track record of piling up cash in anticipation of storm clouds ahead with the capacity to pounce on bargains once the storm hits."

As he sells off stocks, the Oracle of Omaha doesn't seem overly pessimistic about the U.S.' creditworthiness and about the likelihood it could default. He's been buying up treasury bills as he continues to stockpile cash.

“Berkshire bought $10 billion in U.S. Treasurys last Monday. We bought $10 billion in Treasurys this Monday. And the only question for next Monday is whether we will buy $10 billion in 3-month or 6-month” treasury bills, he told CNBC in early August.

"There are some things people shouldn’t worry about,” he continued. “This is one.”

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.