Once, there were only your stock and bond portfolios, mutual funds or ETFs as options for your retirement savings. You and your adviser managed retirement risk through asset allocation and pretty much ignored which accounts you were invested in and how much in taxes you paid.

When it came to post-retirement, your adviser used “de-accumulation” software that did Monte Carlo simulations of market performance, as I described in my article Don’t Bet Your Retirement on Monte Carlo Models. The model gave you a probability that your retirement savings would last to a specific age.

If you wanted to reduce the risk of running out of money during retirement, you were told to set a lower income goal and accept a reduced lifestyle. Experts find fault with this “gambling” with your future, along with other issues in current planning practices and assumptions I have addressed in previous articles, such as:

- Average investors don’t get average returns, as discussed in my blog post Annuity Payments Don’t Make Your Retirement, They Make It Better, especially during volatile times. So, simulating plan results with average market returns likely overstates the probability of success.

- The 4% rule for setting your starting retirement income that I covered in my article What’s Your Retirement Number? makes no sense on its face when no two Boomers are alike in terms of age, gender, savings and, most important, retirement objectives.

- The Million-Dollar Retirement Question shows that most planning does not integrate income annuities even though retirees, whether they know it or not, miss having a pension.

- Retirement planning software needs to consider taxes on your various types of savings because Retirement Accounts Are Not All Taxed the Same.

- The value of your home should be part of your retirement calculations, as I wrote in How Your Home Can Fill Gaps in Your Retirement Plan. And with the majority of retirees wanting to age in place, as demonstrated in this AARP Home and Community Preferences Survey, the value of your home and the maintenance thereof must be part of the planning.

Also, over the past 75 years, there has been a dramatic shift in the net worth of individuals as pensions provided by employers have virtually disappeared, 401(k) and rollover IRA savings now represent more than 50% of Boomer savings, and the value of the primary residence for Boomers as a percentage of net worth has reached nearly 25%.

That’s all a lot to digest. To help, this article describes how a new planning model can improve the fortunes of retirees by anticipating and addressing these issues.

What do Boomers want in retirement?

We’ve talked a lot about what investors have told us regarding retirement, and we know for sure that a plan for retirement income is more than about “my money should last to 95 rather than 90.” It’s about long-term care, inflation protection, taxes, unplanned expenses, leaving a legacy and overall risk reduction. While investors are intrigued by the individual financial products they own or are considering, they still yearn for a plan that captures the total picture. We outline that here.

The approach to solving this challenge of finding the all-encompassing plan starts with three things:

- A limited set of basic financial products where we can best deploy the Boomer’s savings

- A set of retiree objectives and standard measures to rank the achievement of an objective

- Planning software (AI or not) that integrates the products to meet the retiree’s objectives

Building blocks of a plan

The elements, or financial product building blocks, of a successful plan are within the reach of everyone who saved during their working years and has owned their home for several years. Annuities and home equity are two elements that, added to traditional investment portfolios, especially improve retirement in the areas of longevity protection, taxation and liquidity.

While most of you are familiar with the investment portfolios above, you will have to learn about the different types of income annuities (immediate and QLAC) and the primary vehicle for accessing the equity in your home — a home equity conversion mortgage (or HECM).

Retiree objectives

Retirees have wanted the same things for generations. The difference today is the range of offerings available and a more sophisticated understanding of how to make them work together.

- Income. Regular monthly income like a paycheck that covers your budget and increases over time to keep up with inflation

- Reduced risks. A plan that assures income for life and lowers the risk of possible reductions in income because of market volatility

- Lower income taxes. A plan that can delay or exclude some income from tax

- Liquid funds. Easy access to funds you need or want, including reserve funds that you can spend without affecting the ongoing income from your plan

- Legacy at passing. Amount paid out at your passing that meets your legacy goals. (By the way, 50% of our Go2Income plan holders want to leave their current savings balance at their passing.)

In the process, the investor needs to set his or her primary goal, e.g. income or legacy, and then use the secondary objectives to refine the plan. Maybe AI can read your mind, but we haven’t discovered how to do that just yet.

Planning software

It’s no longer just you and your adviser talking over options and savings and then fitting them into the products the adviser happens to sell. Both you and the “expert” can take advantage of various types of sophisticated software, some of which you can employ yourself. Then, go over the results with the adviser to make sure you didn’t miss anything.

Importantly, the Go2Income software programs enable you to integrate product elements and then compare different levels of income, liquidity and legacy. They also allow you to select assumptions, which can also be compared, and finally produce reports that align with your retirement objectives and then adjust.

Analysis of results for sample investor

Our sample investor, Sally, is 70 and has $1.5 million in savings (50% in a rollover IRA account) and $1 million in the value of her house (without any mortgage).

She understands that with income annuities added to her plans, she can be a little more aggressive and wants starting income of $96,000 a year — translating to 6.4% of her retirement savings, or 60% higher than the 4% rule. (Together with her $62,000 in Social Security benefits and pension, she’s up to $158,000 in starting income.)

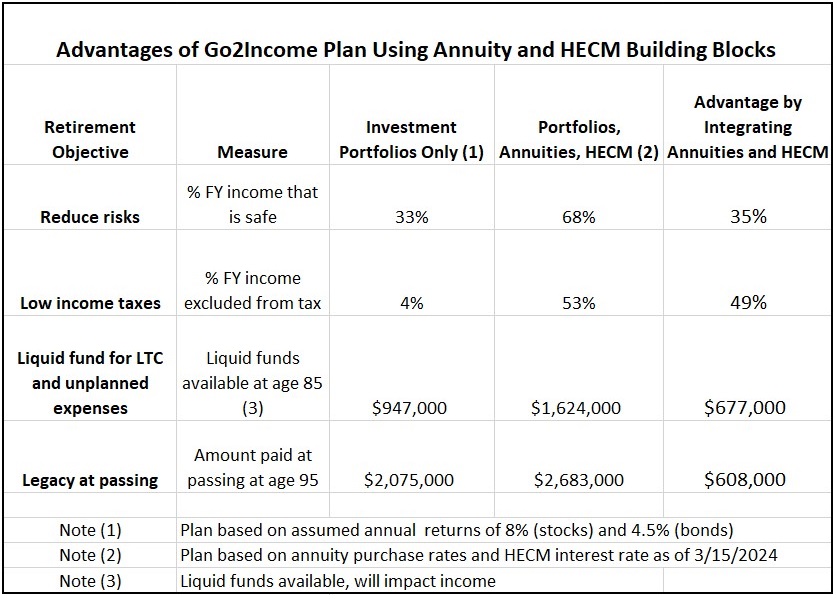

The table below illustrates how retiree objectives can play out when more of the product elements are employed, and in the right proportions. You will see that a line of credit, funded by home equity, provides liquidity for income or unplanned expenses and how income annuities increase safe income and lower taxes.

What do the results mean?

- Reduced risks. Safe income is income that is not generated from a sale or withdrawal of investments dependent on the market value of the investment. The 35% advantage applied to first-year income, besides providing peace of mind, means that the need for active plan management is reduced, and you can be more aggressive in your allocation to stocks.

- Low income taxes. Reducing the amount of first-year taxable income by 49% means an increase in spendable income and also more liquidity and legacy in the long term.

- Liquid funds for LTC and unplanned expenses. The further addition of liquidity via HECM increases the benefits in several areas. The HECM could also produce more income, in comparison to the traditional plan, during market corrections.

- Legacy at passing. While in the short run Sally’s legacy might be lower, in the long run her plan delivers more than the value of current savings at her passing at age 95.

In our next article, we’ll dig a little deeper into what it means in the long term to have lower taxable income, more safe income and more liquidity. Also, we’ll look at plans where the primary objective is legacy rather than income.

How to make the planning process work for you

The keys to the process are to develop a strategic plan using the product elements, a choice of low/medium/high allocations and assumptions and a definition of primary and secondary retirement objectives.

Once you have a strategic plan, you can work with your adviser to develop the tactical plan:

- See if your budget is covered by your plan’s income

- Make selections of securities, funds, fixed index annuities (FIAs) and ETFs within the individual portfolio selection

- Shop the market for the best income annuity or HECM

Remember that you don’t have to implement all at once, but keep your strategic plan as the guidepost for future adjustments and replanning.

Be involved in your retirement income planning

The evolution of retirement planning means you are more active in thinking about and managing your plan. The days of just accepting your Social Security benefits and a pension without having to think too much about it are long gone. That extra effort, however, can translate into more value for you and your family, in the form of additional lifetime income, liquidity and a greater legacy.

Start by requesting a report. Then, make adjustments and talk to your adviser or one of our own specialists to continue your planning until it fits exactly what you want.