Stocks ended mixed on Wednesday as investors braced for Nvidia's fourth-quarter results, which blasted through Wall Street's expectations.

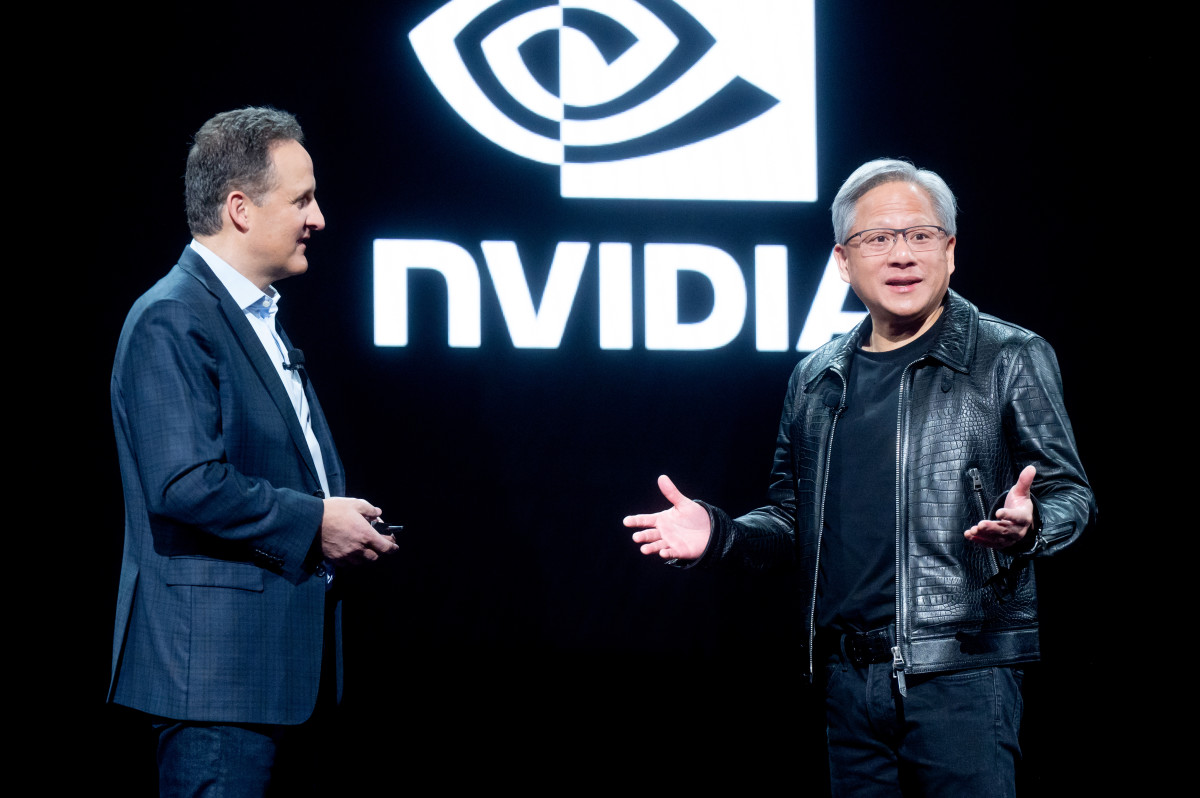

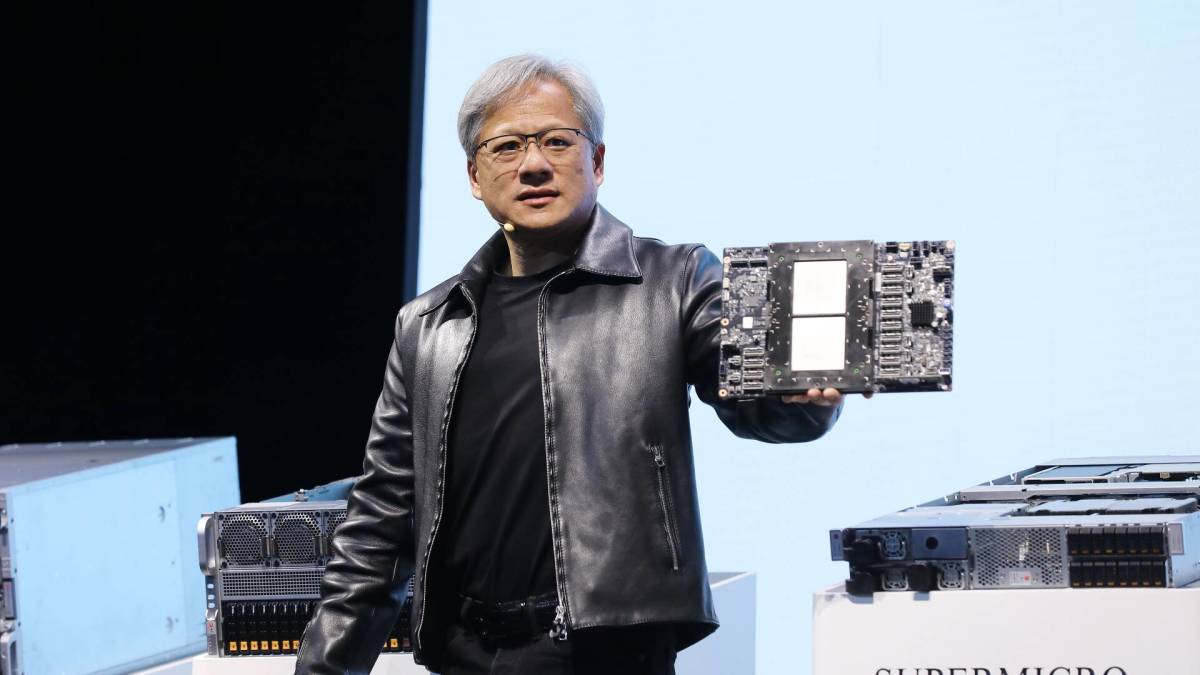

Nvidia, which Goldman Sachs has dubbed "the most important stock on planet earth," beat Wall Street's expectations.

Analysts expected Nvidia (NVDA) to post a bottom line of $4.64 per share, a 427% increase from the year-earlier period, with revenue more than tripling (up 240%) to $20.62 billion.

Instead, Nvidia reported earnings of $5.16 per share, up 486%, on revenue of $22.1 billion, up 262%.

Related: 5 keys to Nvidia earnings — 'The most important stock on planet earth'

The company's earnings were 88 cents a share on $6.1 billion in revenue a year ago.

Data Center revenue for the fourth quarter was a record, up 40% from a year ago and 27% sequentially.

GAAP and non-GAAP gross margins are expected to be 76.3% and 77.0%, respectively, plus or minus 50 basis points, while GAAP and non-GAAP operating expenses are expected to be roughly $3.5 billion and $2.5 billion, respectively.

Looking ahead, Nvidia said it expects revenue to range plus or minus 2% to $24 billion, ahead of the consensus for $22.03 billion.

Shares reacted positively early in post-market trading, gaining 7%.

Shutterstock-Glen Photo

For the broader market, the Dow Jones Industrial Average closed up 0.13% to 38,612, while the S&P 500 also gained 0.13% to 4,981. The tech-heavy Nasdaq lost 0.32% to 15,580.

Separately, the Fed's January policy meeting minutes were released on Wednesday.

They suggested officials were confident that interest rates had likely peaked but remained divided concerning when the first round of cuts was likely to begin

"The Fed minutes are showing that we’re still likely a few meetings away from a rate hike," said Rob Swanke, senior equity strategist for Commonwealth Financial Network.

"While there’s some dissent within members that show concern over being too restrictive for too long, most are more concerned about the possibility that rates stay high," he said.

Updated at 2:06 PM EST

Peak rates ... but maybe for a while

Minutes of the Fed's January policy meeting suggested officials were confident that interest rates had likely peaked, but remained divided with respect to when the first round of cuts were likely to begin.

"Participants highlighted the uncertainty associated with how long a restrictive monetary policy stance would need to be maintained," the minutes read.

Stocks moved lower in the wake of the minutes, which the market is reading through a hawkish prism following last week's hotter-than-expected January inflation report, with the S&P 500 last marked 9 points, or 0.18% lower, into the final hours of trading.

Benchmark 10-year note yields, meanwhile, edged 2 basis points higher to 4.323% while 2-year notes were pegged at 4.664%.

* FED MINUTES: MOST OFFICIALS NOTED RISKS OF CUTTING TOO QUICKLY

— Carl Quintanilla (@carlquintanilla) February 21, 2024

@JohnSpall247 #FOMC pic.twitter.com/ZaHbr5YhYm

Updated at 11:40 AM EST

The sun always shines on TV

Solaredge Technologies (SEDG) tumbled in early trading, and were last marked 14.4% lower at $72.12 each, after the renewable energy firm issued softer-than-expected current quarter revenue guidance of between $175 million to $215 million.

"We do not expect significant changes in the residential market dynamics in the U.S. until such time as interest rates decline," said CEO Zvi Lando. "In addition, the market should improve as installers are able to benefit from the various incentives offered by the IRA."

$SEDG This energy solar stock is dropped 14% after the maker of inverters and other solar-power equipment reported a drop of 65% in fourth-quarter revenue and said it expects first-quarter revenue of $175 million to $215 million, a decline of 77% to 81% from a year earlier. "The… pic.twitter.com/QcUHPKUdpx

— Marty Chargin (@MartyChargin) February 21, 2024

Updated at 10:14 AM EST

Cautious start

Stocks are in a bit of a holding pattern into the start of Wednesday trading, with the S&P 500 slipping 8 points, or 0.17%, and the Dow marked 54 points to the downside.

The Nasdaq, meanwhile, is down 71 points, or 0.45% as markets await the hugely-anticipated Nvidia report after the close of trading.

TAIWAN 🇹🇼 $NVDA keeping the whole $51+ TRILLION $SPY $SPX $NDX $QQQ world levitated. Wrap your head around that. How healthy is a market dependent on only 1 stock. As of last Friday, $NVDA accounted for 34+% of $NDX gains year to date. 🤪👇 pic.twitter.com/T9hZFHfjGi

— Sebastián (@SebastinPatron3) February 21, 2024

Updated at 8:33 AM EST

Palo Bajo?

Palo Alto Networks (PANW) shares are down nearly 25% in pre-market trading after the cybersecurity group issued a disappointing near-term revenue outlook tied to a major strategy shift that is has triggered a host of price target and downgrade changes from Wall Street.

Related: Analysts race for new Palo Alto Networks price targets as shares plunge

Stock Market Today

Nvidia's (NVDA) fortunes, which are closely linked to both the market's recent rally and the broader prospects for AI-related technologies, will be in sharp focus later today when the group publishes both its January quarter earnings and near-term revenue outlook.

Dubbed "the most important stock on planet Earth" by Goldman analysts, Nvidia has powered around a third of this year's 6.06% gain for the Nasdaq 100 and, along with its Magnificent 7 peers Microsoft (MSFT) , Amazon (AMZN) and Meta Platforms (META) it has helped drive around 75% of the S&P 500's total return.

Analysts expect Nvidia to post a bottom line of $4.64 per share, a more than fivefold increase from the year-earlier period, with revenue surging more than 240% to $20.62 billion.

Nvidia shares, which have risen more than 44% so far this year, were marked 1.8% lower in premarket trading to indicate an opening bell price of $682.30 each.

Amazon shares will also be in focus after the tech and e-retailing giant was pegged to replace Walgreens Boots Alliance (WBA) in the Dow Jones Industrial Average at the start of trading on Feb. 26.

Amazon shares were last marked 0.7% higher at $168.26 each while Walgreens fell 2.9% to $21.66 each.

Away from stocks, benchmark 10-year note yields were little changed from last night's close at 4.273% ahead of today's Fed minutes, which will detail discussions around the central bank's January rate meeting. In addition, a $16 billion auction of new 20-year notes is set later in the session.

"Traders will be quite cognizant of any key language or dissension of Fed presidents when the minutes are released," said Jay Woods, chief global strategist at Freedom Capital Markets. "It could be telling when it comes to thoughts of a continued pause vs a cut or maybe even, dare I say, another hike at future meetings."

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was last marked 0.04% higher at 104.133.

On Wall Street, stocks are set for another softer open following last night's tech-led declines, with futures tied to the S&P 500 suggesting an opening-bell pullback of around 14 points.

Futures tied to the Dow are indicating a 76 point decline while those linked to the Nasdaq are set for a 110 point retreat at the start of trading.

In overseas markets, firm gains for stocks in China, powered in part by the country's ongoing moves to stabilize trading and kickstart the world's second-largest economy, helped the regionwide MSCI ex-Japan index rise 0.11% into the close of trading.

Japan's Nikkei 225, meanwhile, ended 0.26% lower in Tokyo, led by outsized declines for chip and tech stocks ahead of Nvidia's earnings report today.

In Europe, HSBC shares tumbled more than 7% in London after the bank posted record full-year profit but missed analysts' estimates after taking a $3 billion hit tied to its exposure in China.

Britain's FTSE 100 was marked 0.88% lower in early London trading while the regionwide Stoxx 600 benchmark fell 0.13% in Frankfurt.

Related: Veteran fund manager picks favorite stocks for 2024