Pharmaceutical giant AstraZeneca PLC (AZN) is a specialist in cancer treatments. In fiscal year 2023, it derived $18.4 billion and 40% of its sales from oncology products.

So it’s not a surprise that the company decided to move into the latest, next-generation treatments for cancer - radiopharmaceutical drugs. On March 19, AstraZeneca announced it will buy Canadian drug developer Fusion Pharmaceuticals (FUSN) for $2.4 billion. The deal involves a $2 billion upfront cash transaction, with a total transaction value of $2.4 billion based on contingent, further payments.

Fusion Pharma is developing “next-generation” radioconjugates, which deliver a radioactive isotope directly to cancer cells through precise targeting using molecules. This reduces the damaging side effects to healthy cells of traditional radiotherapy.

Fusion’s most advanced therapy is called FPI-2265, which is currently in a mid-stage trial to treat patients with metastatic castration-resistant prostate cancer.

Radioconjugates Are Hot

Keep in mind that between 30% and 50% of patients with cancer today receive radiotherapy at some point during treatment. AstraZeneca has been working on other approaches to develop more targeted cancer treatments, including antibody drug conjugates and radiation therapies, for a long time.

The deal gives the company a foothold in this new market, which has seen increasing interest since 2021, when data from Novartis (NVS) showed that its radiopharmaceutical drug Pluvicto (lutetium vipivotide tetraxetan) extended survival for prostate cancer patients. Novartis also has Lutathera, which treats neuroendocrine tumors - a rare form of cancer in the digestive tract.

The Novartis drug, Pluvicto, was approved in 2022 and the sector has seen a number of deals since. Those deals included the $1.4 billion acquisition of Point Biopharma by Eli Lilly (LLY) and a $4.1 billion deal for RayzeBio by Bristol-Myers Squibb (BMY) last year.

While AstraZeneca has several approved drugs that are antibody drug conjugates — a new, targeted form of chemotherapy — it has not developed radioconjugates, also known as radioligands. So there is logic behind the deal for Fusion.

Here’s a very brief explanation of radioligands: There are three parts to a radioligand: the ligand, the medical isotope, and the linker. The ligand is a chemical compound that is designed to specifically bind to receptors overexpressed in tumors. The medical isotope emits high-energy particles that damage the DNA of the cells within the tumor, leading to cell death. The linker attaches the medical isotope to the ligand, enabling the isotope to be delivered to the tumor.

AstraZeneca will take over Fusion’s manufacturing and supply chain. As you can see, making radioligand drugs is a complicated process. There is the need for nuclear generators to create isotopes that often have short half-lives. Actinium, the radioactive element on which Fusion’s drug is based, has a half-life of just 11 days.

The difficulty in manufacturing was seen with Novartis, which struggled to meet demand for Pluvicto last year after the FDA identified quality control issues at its manufacturing sites, leading to shortages. So AstraZeneca will have to invest in increasing Fusion’s manufacturing capacity from its existing site in Ontario.

AstraZeneca’s Other Endeavors

Earlier in the month, on March 14, AstraZeneca said it would acquire endocrine disease-focused Amolyt Pharma for $1.05 billion in cash. This is a bid to boost its rare diseases portfolio, since France's Amolyt is currently in late-stage development on a therapy for hypoparathyroidism called eneboparatide.

The deal includes an $800 million upfront payment and an additional contingent payment of $250 million based on achieving a specified regulatory milestone. Phase III trial results for Amolyt’s eneboparatide are expected next year, with a possible launch soon to follow. The therapy has blockbuster potential, generating a few billion dollars in annual sales.

Revenue from AstraZeneca's rare diseases portfolio is already growing rapidly, boosted by the $39 billion acquisition of Alexion in 2021. Revenue from this segment grew to $7.8 billion in 2023, up 12% year-over-year.

In February, AstraZeneca unveiled a trial success in the treatment of lung cancer, with its leading drug slowing progression of the disease at an early stage. In a trial, its best-selling Tagrisso drug showed a “statistically significant and highly clinically meaningful” improvement in preventing the progression of a version of the most common form of lung cancer.

The trial covered patients with non-small cell lung cancer, the most common form, who have a so-called epidermal growth factor receptor mutation. This mutation is prevalent in 10% to 15% of cases in the U.S. and Europe, and up to 40% in Asia.

Tagrisso has been approved for use alongside chemotherapy in the U.S. to treat the same form of lung cancer at an advanced stage, where it extended progression-free survival by almost nine months. The drug earned $5.8 billion in sales in 2023 — 13% of AstraZeneca’s total oncology sales — making it the company’s highest earner.

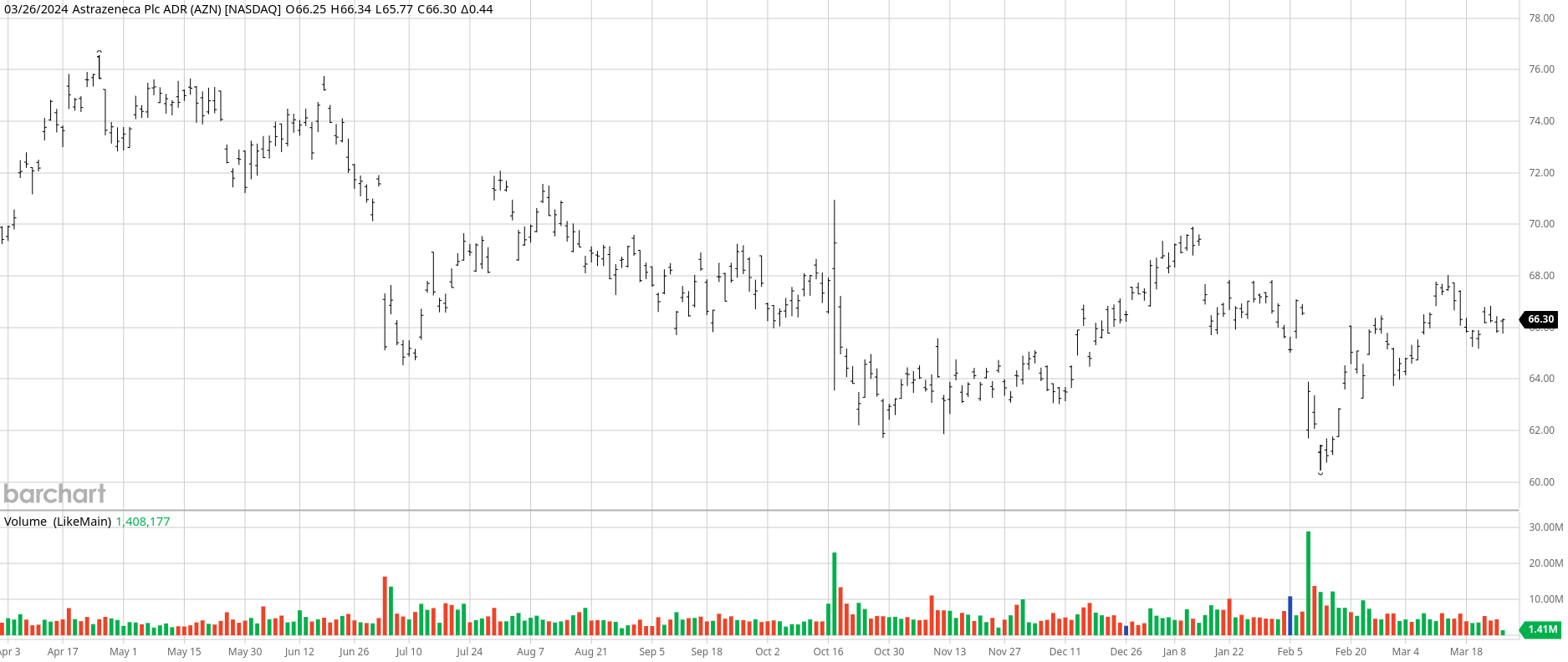

Bottom line — AstraZeneca is doing very well. Yet, the stock is down 1.5% year-to-date and 2.3% over the past year. Wall Street is giving us an opportunity to buy a very high-quality pharma company on the cheap.

I expect existing key products, strong pipelines, and contributions from recent acquisitions to drive growth going forward. While the deals for Amolyt Pharma and Fusion Pharma were relatively small, they will help to further strengthen AstraZeneca’s pipeline in the high profit-margin oncology and rare disease segments, providing support to long-term growth.

AZN stock is a buy under $66.