Despite making sizeable wealth gains during the COVID pandemic, many Latinos are still holding in debt, according to a new study from the Pew Research.

Pew Research previously reported that between 2019 and 2021 U.S. Hispanic households grew their wealth by 42% and had a median net worth of $48,000. However, despite those gains, one in seven Hispanic households remains in debt.

Latino Households are more likely to have debt and less wealth than their White counterparts. According to Pew, one in 10 White households have debt, and they also have five times the wealth of Hispanic households.

Because many Hispanic households remained in debt, they had lower a net worth, a calculation of the difference between the value of assets, like home value and cash, and liabilities, which include debt.

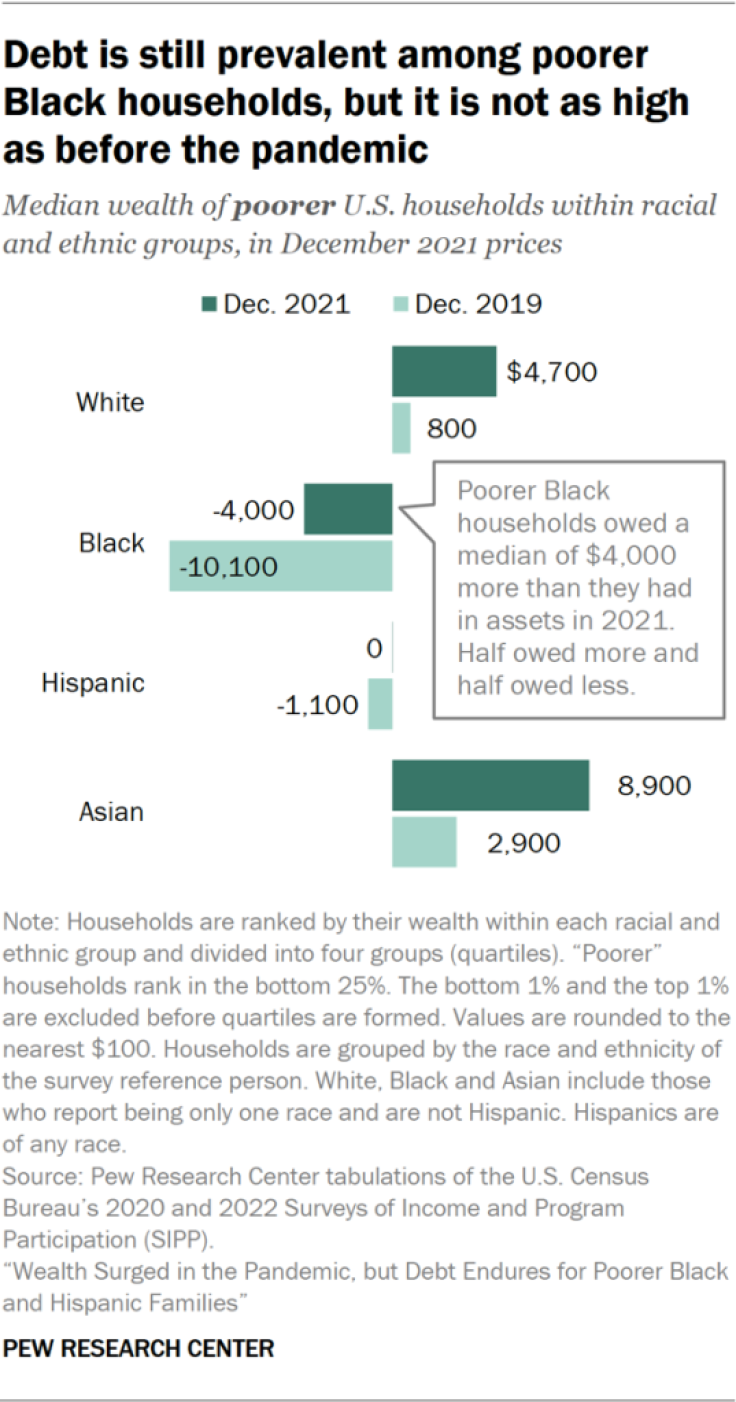

Among the poorest Hispanic households, their financial status slightly improved during the pandemic. The survey found that Hispanic households in the bottom 25% of net worth eliminated their debt. According to Pew, poorer Hispanic households had an average net debt of $1,000 in 2019, but by 2021, they had eliminated it.

Black households were also more likely to have debt than White Americans. According to the survey, one in four black households remains in debt after the COVID-19 pandemic. But like Latinos, Black households managed to lower their net debt between 2019 and 2022. Between those years, poor Black Americans reduced their debt from $10,000 to $4,000.

The reduction in debt for poor households in the U.S. is largely attributed to stimulus payments provided by the CARES Act. According to Pew Research, the stimulus checks increased the after-tax income for U.S. households by 3.5% and also reduced poverty to 9.1% in 2020.

The new Pew study further sheds light on the economic status of Latinos in the U.S. and paints a clear picture of why Latinos are most concerned about the economy, inflation and the labor market for the upcoming election. In prior elections, immigration had been the bigger concern for the demographic.

It also highlights the need for financial education for communities of color, something that JPMorgan Chase's Global Head of Advancing Hispanics & Latinos, Silvana Montenegro, also believes is important and is an area in which her company is investing $30 billion by the end of 2025.

"We don't talk about money at the dinner table. At the moment, 30 percent of Latinos in the U.S. are either unbanked or underbanked," Montenegro told the Latin Times. "Without basic financial education it's hard to create wealth for oneself and to pass it on to others."

© 2023 Latin Times. All rights reserved. Do not reproduce without permission.