The apparel industry is poised for substantial growth due to increasing millennial budgets, higher disposable incomes in developing markets, and a continued shift to online shopping. The apparel market’s revenue is expected to reach an astounding $1.8 trillion in 2024 and register a compound annual growth rate (CAGR) of 2.8% between 2024 and 2028. Leading the pack is the U.S., projected to dominate the market with a staggering $359 billion in revenue this year.

Amid these promising industry prospects, two well-known apparel companies, Levi Strauss & Co. (LEVI) and Guess, Inc. (GES), are riding high on the wave of their latest financial victories, which topped analysts’ expectations and sent their shares soaring.

Moreover, both companies are highly committed to returning shareholders' value through dividend payments, making them an attractive catch for investors seeking steady passive income.

But which dividend stock is the better pick? Let's find out.

The Case for Levi Strauss Stock

With a market cap of $8.6 billion, San Francisco-headquartered Levi Strauss & Co. (LEVI) has emerged as one of the largest brand-name apparel companies and a global leader in jeanswear. The company is renowned for designing and marketing jeans, casual wear, and related accessories for men, women, and children.

Shares of Levi Strauss have soared roughly 27.5% on a YTD basis, substantially outperforming the broader S&P 500 Index’s ($SPX) gains of 5.8% during the same time frame.

Earlier this month, the company declared a dividend of $0.12 per share, payable to its shareholders on May 23. The company offers an annualized dividend of $0.48, resulting in a 2.23% dividend yield. Levi Strauss maintains a healthy dividend payout ratio of 46.7%. In fiscal Q1, the company returned around $73 million to its shareholders, encompassing both dividend payments and share buybacks.

Levi Strauss Beats on Q1 Earnings

Levi Strauss stock rose after its fiscal Q1 top and bottom lines beat Wall Street expectations, despite year-over-year declines in both metrics. Investors focused instead on strength in direct-to-consumer (DTC) sales, which offer higher margins than wholesale.

The company reported Q1 revenue of $1.6 billion on April 3, down 7.8% annually, but marginally surpassing analyst estimates. Its adjusted net income declined to $103 million, or $0.26 per share, but beat the Wall Street estimates by 23.8%. Adjusted free cash flow rose significantly to $214.4 million, while total liquidity was approximately $1.5 billion as of Feb. 25.

The company projects net revenues to increase between 1% and 3% annually, while adjusted EPS on a diluted basis is anticipated to range between $1.17 and $1.27. Analysts tracking Levi Strauss expect its fiscal 2024 EPS to reach $1.27, up 15.5% year over year, and increase further by 15% in fiscal 2025 to $1.46.

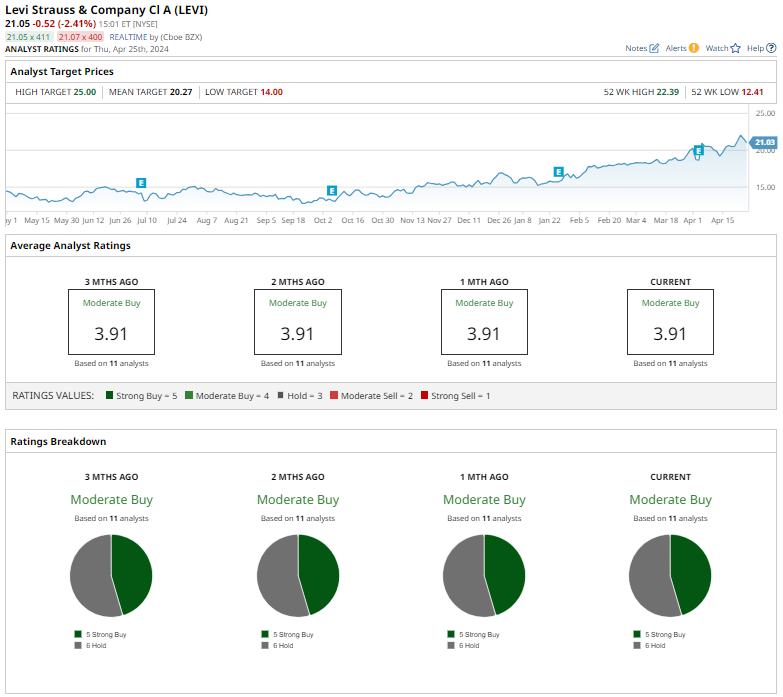

Levi Strauss stock has a consensus “Moderate Buy” rating in the analyst community. Out of the 11 analysts covering the stock, five have a “Strong Buy” recommendation, and the remaining six give it a "Hold.”

While the stock is trading at a premium to its average analyst price target of $20.27, its Street-high target of $25 indicates 18.9% upside potential.

The Case for Guess Stock

Valued at approximately $1.4 billion, California-based apparel company Guess, Inc. (GES) is known for its diverse product portfolio, including jeans, pants, dresses, activewear, and accessories. The company distributes its products through various channels, including DTC sales, wholesale, licensing, and retail websites.

Like Levi Strauss, shares of Guess have outperformed the broader market, returning 11.5% on a YTD basis.

The company scheduled a $0.30 per share quarterly dividend payment on May 3. GES offers an annualized dividend of $1.20, translating to a 4.6% dividend yield. Furthermore, Guess maintains a conservative dividend payout ratio of 34.7%, allowing ample room for growth initiatives and potential dividend increases in the future.

Additionally, Guess' Board of Directors endorsed a special cash dividend of $2.25 per share payable on May 3, citing the company's strong fiscal Q4 performance, which topped management’s expectations and Wall Street’s forecasts.

Guess Beats Q4 Earnings Projections

On March 20, the company reported Q4 net revenue of $891.1 million, up 9% year over year, which beat the Wall Street estimates by 4.3%. Its adjusted net earnings of $110.8 million, or $2.01 per share, surpassed analyst projections by 29.7%. According to CEO Carlos Alberini, Guess’ disciplined approach helped the company deliver $330 million in operating cash flow, $248 million in free cash flow, and a year-end cash position of $360 million - all above management’s expectations.

Moreover, Guess stock rose a notable 6.1% on April 1 following news of a $200 million share repurchase program. CEO Alberini emphasized the company’s commitment to enhancing shareholder returns, highlighting its solid capital structure, healthy cash flow, diversified business model, and distinctive growth platform.

Management projects Guess’ revenue to increase between 11.5% and 13.5% in fiscal 2025, while adjusted EPS is anticipated to range between $2.56 and $3. Analysts tracking Guess expect its fiscal 2025 EPS to decline to $2.93 before returning to growth with an increase of 8.2% in fiscal 2026.

Guess stock has a consensus “Moderate Buy” rating. Out of the five analysts covering the stock, two have a “Strong Buy” recommendation, and the remaining three have a "Hold” rating.

The average analyst price target of $33 indicates 28.6% upside potential from the current price level, while the Street-high price target of $37 suggests 44% upside potential.

LEVI Vs. GES: Which Stock is the Better Buy?

With the fashion industry set for continued growth, Levi and Guess are ready to capitalize on the burgeoning market with their diverse fashion offerings.

While both stocks rose after revealing their stronger-than-expected earnings reports and have “Moderate Buy” ratings, investors will pay a much steeper premium for Levi’s earnings at current prices than they will for Guess. Guess trades at 8.40 times earnings and 0.51 times sales – lower than Levi Strauss, which trades at 21.63x and 1.42x, respectively.

Guess looks like the better stock to buy, with more upside potential expected than Levi Strauss, and a higher dividend yield - especially after you account for those generous special dividends.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.