The world is facing an unprecedented global crisis, with financial markets in meltdown and mankind heading into the unknown over the coronavirus pandemic.

The whole world is rallying to the cause, with people making incredible personal sacrifices, national health care systems working flat out, governments ramping up spending and central banks slashing the cost of money.

Everyone seems to be pulling out all the stops, with one major exception – investors who are short-selling the markets.

At a time when global policymakers are throwing trillions of dollars into fighting the pandemic and tens of trillions are being wiped off world financial markets, is it right for anyone to profit from the crisis and build a fortune? It is no surprise that there are growing calls for a global ban on short selling to curb the growing instability in world financial markets.

Over the years the world has been through tough times, with the 1987 stock market crash, the 1994 Mexican currency crisis, the 1997 Asian financial crisis, the 1998 Russia debt default and the 2008 global financial crash, but it has shown an amazing propensity to spring back, mainly with the help of some radical policy responses.

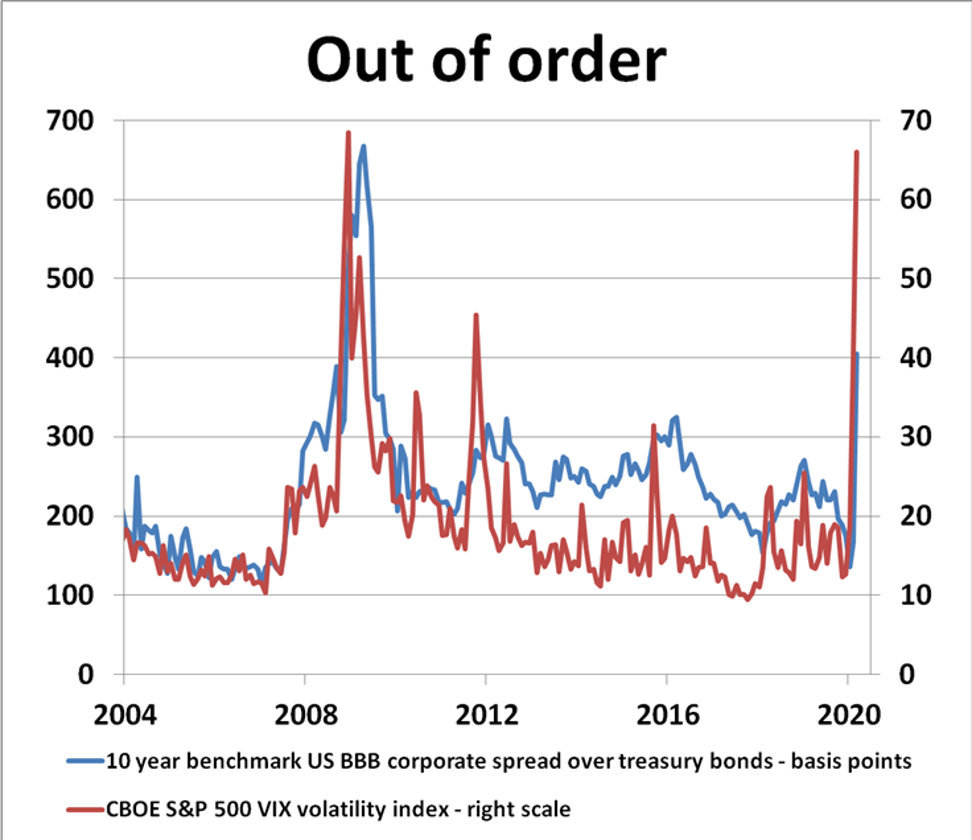

This time could be worse than any of them, with the near-total shutdown of the global economy, a seemingly open-ended health threat and a credit crunch to boot. The explosion in credit market spreads and the sharp rise in fear gauges like the S&P VIX volatility index are symptoms of a global financial system badly out of sorts at the moment.

Global wealth is being crushed, although not necessarily for everyone, especially for hedge funds and highly leveraged speculators with free latitude to short-sell asset markets in steep collapse.

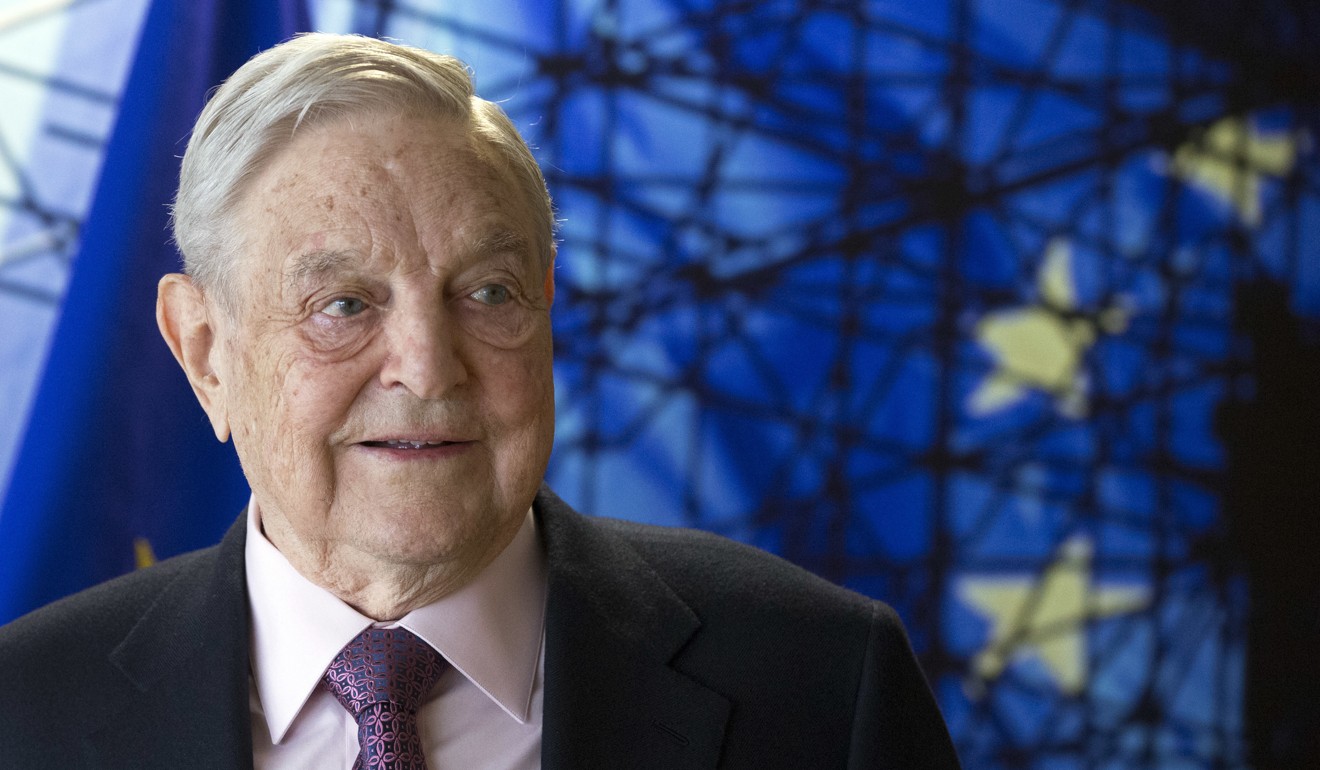

Renowned hedge fund investor George Soros famously made billions out of “breaking the Bank of England” by short selling the pound when Britain crashed out of the European Exchange Rate Mechanism in September 1992.

But, is this the kind of model the world needs when it is down on its knees and running out of options to repair global financial stability? It begs the question whether the activities of the global hedge funds should be more closely regulated or even reined in. It may be OK to make money out of market disorder but not to profit from an abject global tragedy.

World policymakers have enough on their plates right now without having to tackle the chaos caused up by reckless short selling. Unprecedented times require bold policy decisions and global governments should be considering a closely coordinated five-point recovery plan.

The world is crying out for dramatic fiscal reflation, mass monetary mobilisation, an immediate end to the US-China trade war, increased funding for emerging market economies, and an immediate ban on short selling in the equity and credit markets.

In September 2008, the US Securities and Exchange Commission temporarily banned short-sales in nearly 1,000 financial stocks to positive effect by preventing greater market carnage. It certainly worked then and it can work again now.

People around the world are making huge sacrifices to self-isolate in order to help limit the spread of Covid-19, so now it’s up to the global hedge funds to practise self-control to stop the spread of risk instability around the world.

If the hedge fund industry cannot self-regulate then there is a very strong case for tougher government intervention to ban short selling outright. A return to long-only investment, as practised by the broader investment industry, is probably long overdue.

A return to long-only investment, as practised by the broader investment industry, is probably long overdue -

If the global economy has any chance of avoiding a deeper recession and hitting 4-per-cent-plus growth again in the next few years, it is going to take more than sacrifices by the world’s central bank and governments. Financial markets must do their bit as well.

The coronavirus will probably change the world order forever and the global hedge funds must wake up to the new reality of greater responsibility and better governance for all.

David Brown is chief executive of New View Economics