Circle, the company behind the second-most-popular stablecoin in the world, will soon sell shares on the public market after it filed confidential IPO paperwork with securities regulators on Thursday.

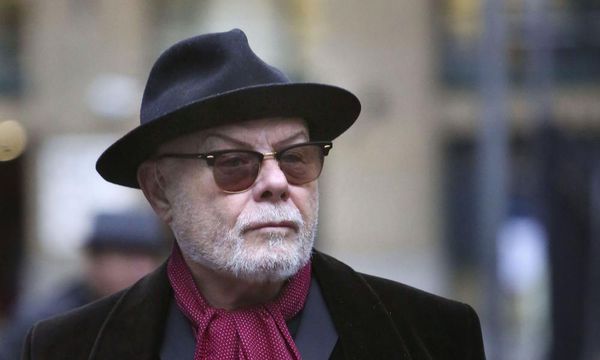

In a statement, the company, led by CEO and longtime crypto industry veteran Jeremy Allaire, said that the number of shares to be offered and the price range have not been determined. The Securities and Exchange Commission still needs to review and approve the company’s filing before the IPO takes place.

The company’s newest effort to go public comes a year after Circle scrapped plans to list shares via a special purpose acquisition company in a deal that would have valued Circle at $9 billion. At the time, Allaire said in a post on X that Circle failing to go public was “disappointing.”

USDC, Circle’s U.S. dollar-pegged stablecoin, has a market cap of about $25 billion and is the seventh-biggest cryptocurrency worldwide, according to CoinGecko. Its biggest direct competitor, Tether, has a $93 billion market cap.

Although it was at one point closing the gap with Tether, last year’s banking crisis turned into a major setback for Circle after it disclosed that $3.3 billion of its reserves were deposited with Silicon Valley Bank.

Circle’s IPO announcement comes a day after the SEC approved 11 applications to create a spot Bitcoin ETF. The ETFs started trading on Thursday and have already crossed $1.2 billion in trading volume, according to Bloomberg Intelligence ETF research analyst James Seyffart.

Some analysts have predicted that the flurry of new Bitcoin financial products will create tens or hundreds of billions of dollars of inflows over the coming year.