KEY POINTS

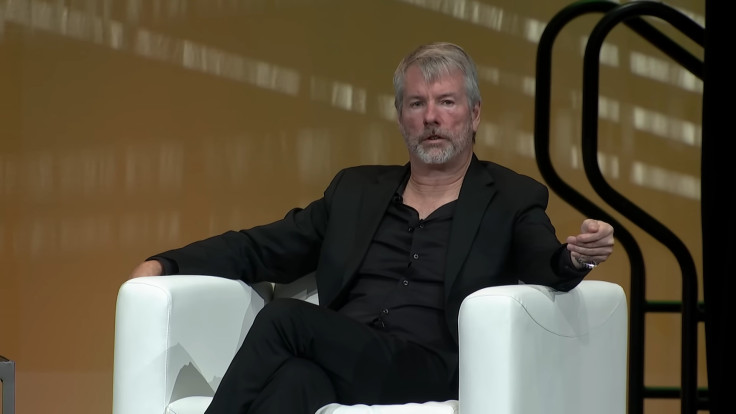

- Michael Saylor is a known Bitcoin bull

- MicroStrategy is currently the largest corporate holder of BTC

- Saylor said MicroStrategy will continue its Bitcoin investment strategy

Michael Saylor, Bitcoin maximalist and executive chairman of MicroStrategy, said the spot Bitcoin exchange-traded fund (ETF) could be the biggest development to happen to traditional finance (TradFi) since the launch of the S&P 500 index fund.

Saylor previously revealed that before MicroStrategy started investing in Bitcoin, it was on the search for a "high-growth digital monopoly," with consistent and substantial growth that could help the company survive government-induced inflation and a tech-driven deflation. The company is now the largest corporate holder of BTC.

MicroStrategy was sitting on an unrealized profit of $2.390 billion when Bitcoin traded at $43,500. The software company holds 174,530 BTC, acquired for approximately $5.28 billion at an average price of $30,252 per Bitcoin.

Saylor, in a new interview, mentioned that a spot Bitcoin ETF approval could be the biggest development on Wall Street in the last three decades.

"It's not unreasonable to suggest that this may be the biggest development on Wall Street in 30 years," Saylor said Tuesday. "The last thing that was this consequential was the creation of the S&P index and the ability to invest in all 500 S&P companies via one trade at the same time."

The $BTC Spot ETF may be the biggest development on Wall Street in the last 30 years. My discussion of #Bitcoin in 2024, Spot ETFs vs. $MSTR, and the emergence of bitcoin as a treasury reserve asset with @KaileyLeinz on Bloomberg @Crypto. pic.twitter.com/QtPdBOhMDr

— Michael Saylor⚡️ (@saylor) December 19, 2023

The executive predicts "2024 is going to be a major bull run for the asset class." He believes the crypto investment vehicle would pave the way for mainstream retailers, as well as institutional investors, to gain access to a "high bandwidth compliant channel" to invest in the "king of crypto."

According to him, the spot Bitcoin ETF would serve as a major catalyst in driving demand, followed by the Bitcoin Halving event in April, which would create a "supply shock."

"I don't think we've ever seen a 2 to 10x increase in demand combined with having and supply in a scarce, desirable asset that people want to hold for a long period of time," Saylor said.

Saylor confirmed that MicroStrategy will continue to invest in Bitcoin, saying, "Our goal is always to find a way to pursue more Bitcoin per share for our shareholders."

The MicroStrategy co-founder was once against Bitcoin and in one of his previous tweets, he predicted that the crypto asset would suffer the same fate as online gambling.

"Bitcoin days are numbered. It seems like just a matter of time before it suffers the same fate as online gambling," he wrote on social media in 2013.