A one-size-fits-all approach will never be a perfect solution when it comes to designing a plan for your retirement income. As it turns out, there are billions of potential combinations available to do what you want, whether that is creating as much income as possible, leaving a financial legacy, cutting the tax bite or covering inflation.

The best planning system does the best, if not perfect, job in meeting your objectives. Go2Income does that by examining the building blocks of a retirement plan and fitting them together in a way that meets as many of your objectives as possible.

However, when I got the following unique query from one of our article readers, I wasn’t sure that the Go2Income approach I’ve based on my years of experience, with some help from artificial intelligence, could address it.

How to address a challenging retirement question

The question: Can I get a 7% yield on $5 million of retirement savings for the rest of my life without risking my capital?

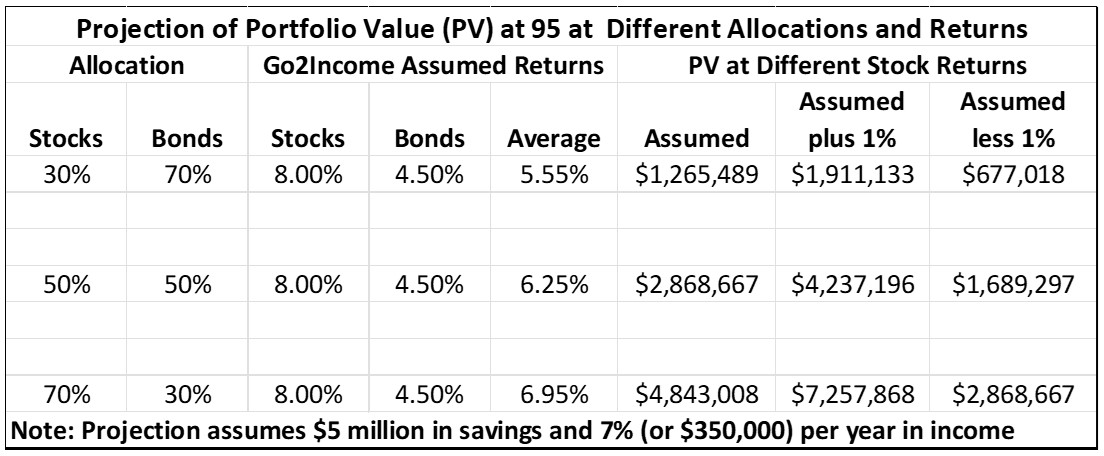

I raised my eyebrows, because 7% is a lofty goal in today’s market. As of this writing, with 20-year Treasuries paying less than 4.5%, we knew the investor would face a lot of financial risk to achieve that objective. In an all-bond portfolio, the investor needs to find an additional 2.5% in yield each and every year. And an alternative of a balanced 30/70 equity/bond portfolio would need to deliver a 12.5% stock market return (vs Go2Income’s assumed 8.0%), in addition to Treasury yields, each and every year. Both work against the goal of minimizing capital losses. This chart covers several scenarios:

You should note that Go2Income’s assumed 8% return is less than the 30-year average of the S&P 500 index (with dividends reinvested) of 10% by a margin of 2 percentage points, since individual investors underperform the average, particularly when there’s a need to liquidate securities.

Comparison to Go2Income plan

To add some perspective, the female investor, age 70, before posing her question had just received and, I guess, passed on our Go2income plan that, based on the above assumptions, produced a 6% starting income, growing by 2% a year. But the portfolio value would only regain that $5 million in savings at age 95. While the plan offered other favorable aspects, like safety of income and a low tax rate, those were not our questioner’s priorities.

I sharpened my metaphorical pencil and crunched the numbers through several versions of the Go2Income planning algorithm. I also had the advantage of something not available in present Go2Income plans: a newly developed program that can consider the value of your home in the plan. So HomeEquity2Income (H2I), which will be unveiled to everyone soon, is also part of the solution we might present to our investor.

With support from our analysts, we did develop a Go2Income plan that consistently produces an economic return equal to 7%, minimizes risk and taxes and delivers a reasonably consistent $5 million economic value.

Go2Income planning with annuities

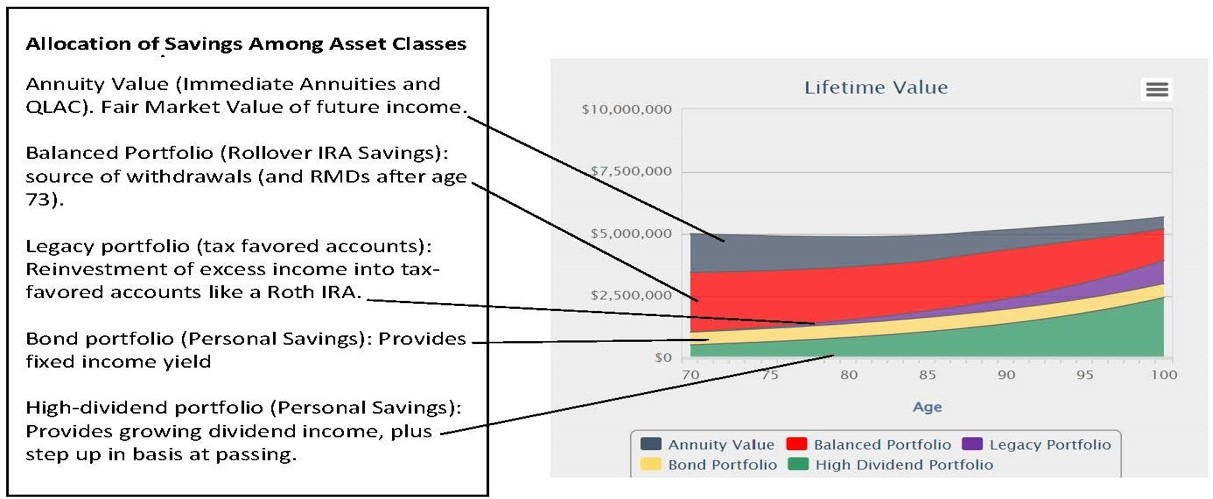

Here’s what happens when we analyze the possibilities and examine the impact of adding different asset classes to the mix. (For a primer on assets and how to consider them for your plan, read my article For Sustainable Retirement Income, You Need These 5 Building Blocks.) Two strategies are particularly important: (1) We allocate a portion of personal savings to an immediate income annuity for higher cash flow and lower taxes, and (2) we broaden the fixed income portfolio beyond high-quality bonds to include an allocation to a fixed index annuity and a high-yield portfolio.

The asset class mix that produces the desired 7% annual cash flow is shown below with its building blocks called out. And while the construction may initially seem complex, it is a safer way for our investor to preserve capital and have the income to spend every year.

And by considering the sources of savings in making the allocations, the plan is tax-efficient:

- Only 60% of the income at the start is taxable

- There is no planned sale of securities with a potential capital gain tax

- 60% of the portfolio is free of income taxes at the investor’s passing

Note that this approach might give up some of the value of legacy at the start because of the form of annuity. That could be protected by life insurance already in place, or the purchase of an annuity with beneficiary protection.

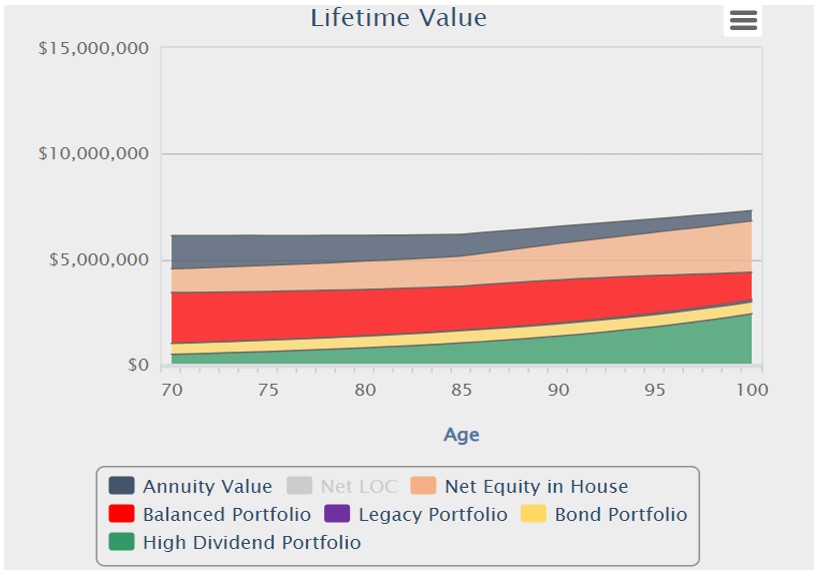

Considering HomeEquity2Income for additional security

Adding H2I to a plan provides a layer of protection that will help pay for late-in-retirement expenses or, if you are healthy for the rest of your life, add to your legacy and even increase your income. This chart shows how H2I gives you peace of mind:

One reason Go2Income works in creating an approach to retirement income is that you choose the goals that will benefit you and your family, and then the algorithm determines the combination of asset classes that do the best job. Like our investor above, you can mix, adjust and ask questions until you are satisfied.

Visit Go2Income to develop a plan — on your own or with our advisers — to produce the income, tax rate, level of risk and amount of liquidity you need and desire. And ask about how H2I might benefit your plan.

Related Content

- How a Fixed Index Annuity Can Manage Retirement Income Risks

- Retirees: Worry Less About Markets, Long-Term Care and Taxes

- How You Might Need to Adjust Your Retirement Plan in 2024

- How Finances Can Improve for Retirees — and the Next Two Generations

- Annuity Payments Are 30% to 60% Higher: Time to Reconsider