They say it’s never too late to start learning. Especially if it’s about how to handle money. A survey done by OnePoll for BOK Financial revealed that 85% of parents believe their children should learn the value of the dollar and how to manage it before they become teenagers. And 82% of respondents agreed that financial literacy starts at home.

One mother on TikTok shared her strategy to teach her kids about handling money. But not everybody agreed with her. “I charge my kids rent and utilities,” Samantha Bird Shiloh claimed in her video, which got mixed reactions from netizens. Read on to find a more detailed description of how she teaches her kids financial literacy and what people think about her approach.

Bored Panda got in touch with Samantha, and she was kind enough to answer a few questions for us. We asked her what inspired her to start advising other parents on how to teach their kids about personal finances and what tips she would give to those who are looking to start educating their children. Read our conversation with Samantha below!

More info: Instagram | TikTok | Free Quickstart Guide

Teaching kids financial literacy from a young age can be beneficial

Image credits: Oleksandr P / Pexels (not the actual photo)

This mother shared her method, saying that she makes her three kids pay for rent, utilities, and food

“I said I charge my kids rent and utilities and the internet kind of freaked out. Some of you were mad mad, and some of you get it. But let me explain.”

Image credits: samanthabirdshiloh

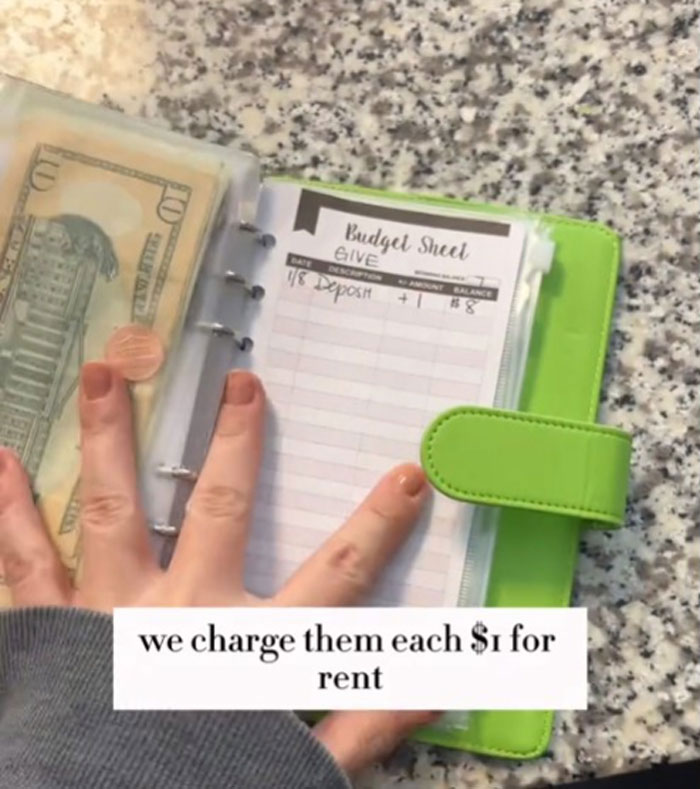

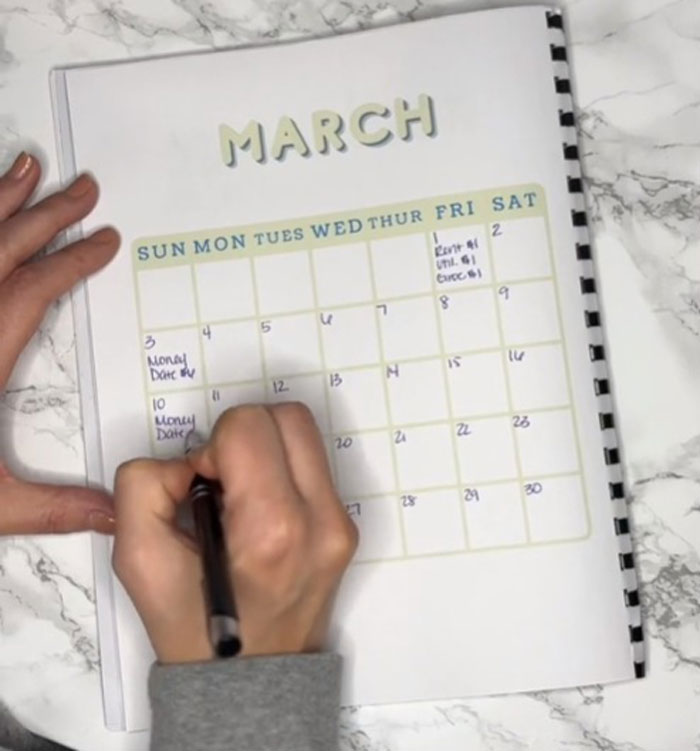

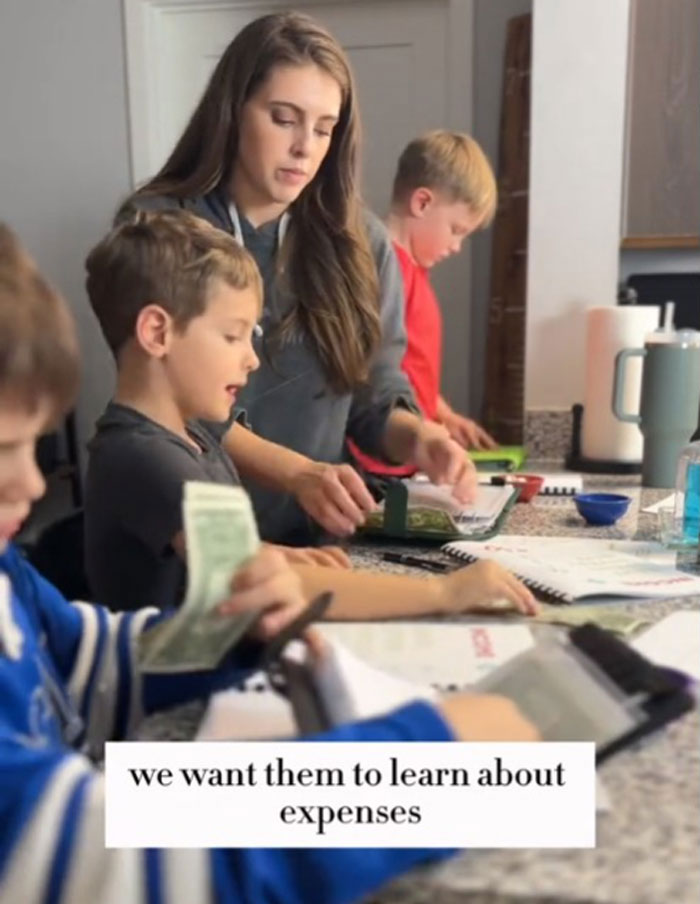

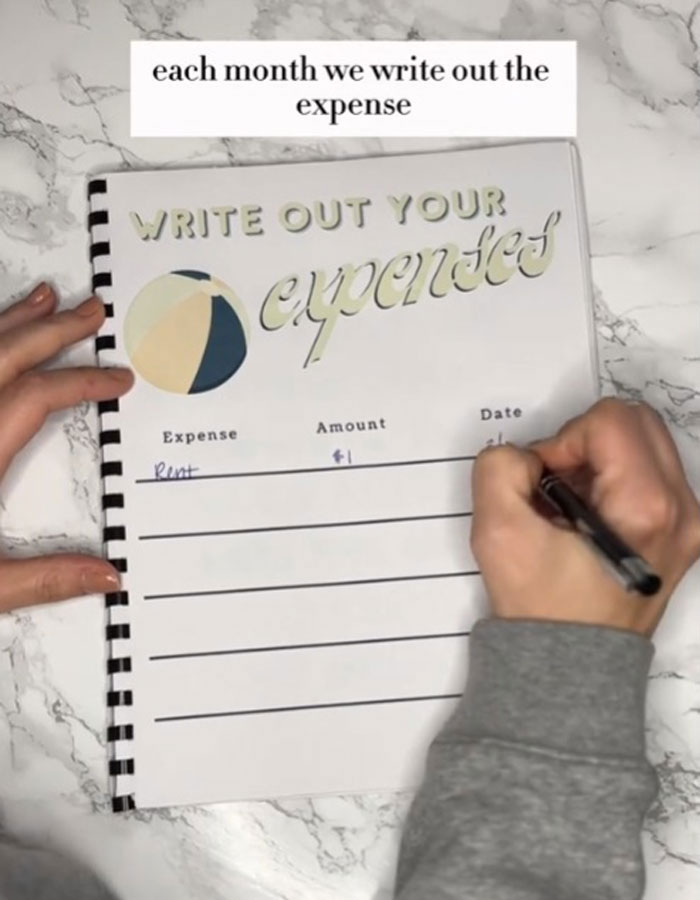

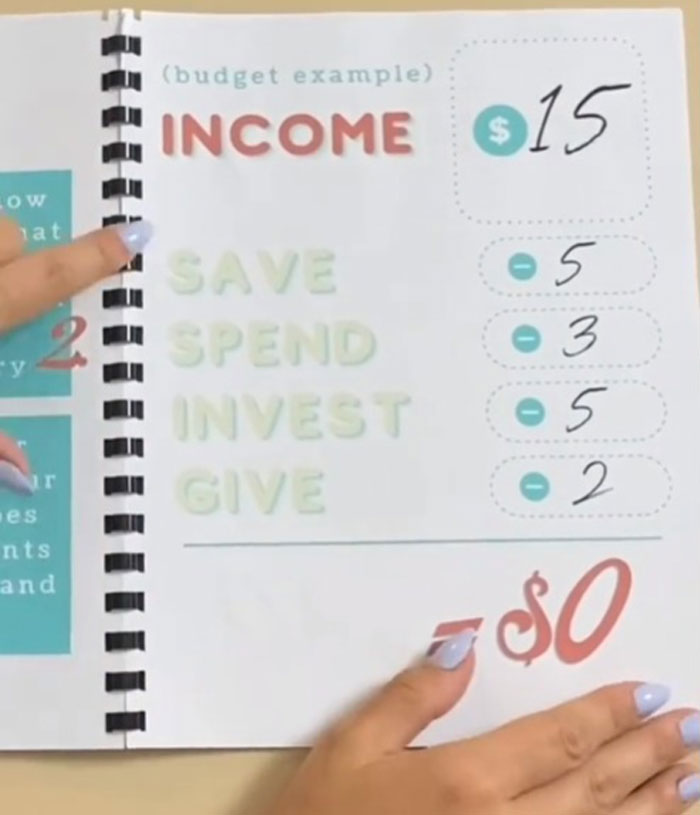

“We charge our kids rent and utilities. My kids get $6 a week for their allowance for chores that they do day to day. $1 per week is expected to go toward their expenses. We charge them each $1 for rent, $1 for groceries and $1 for utilities on the first of each month. They track it on their budget trackers and other spending or categories happen after those payments. They set that dollar in a separate envelope for utilities and then at the beginning of the next month, we charge them for their bills. We want them to learn about expenses and bills and a safe environment now.”

Image credits: samanthabirdshiloh

Image credits: samanthabirdshiloh

“We can simulate paying bills. I charge them once a month for rent and utilities and groceries $1 each. The rest of the money that they earn goes to them to decide to use how they choose.”

Image credits: samanthabirdshiloh

Image credits: samanthabirdshiloh

Image credits: samanthabirdshiloh

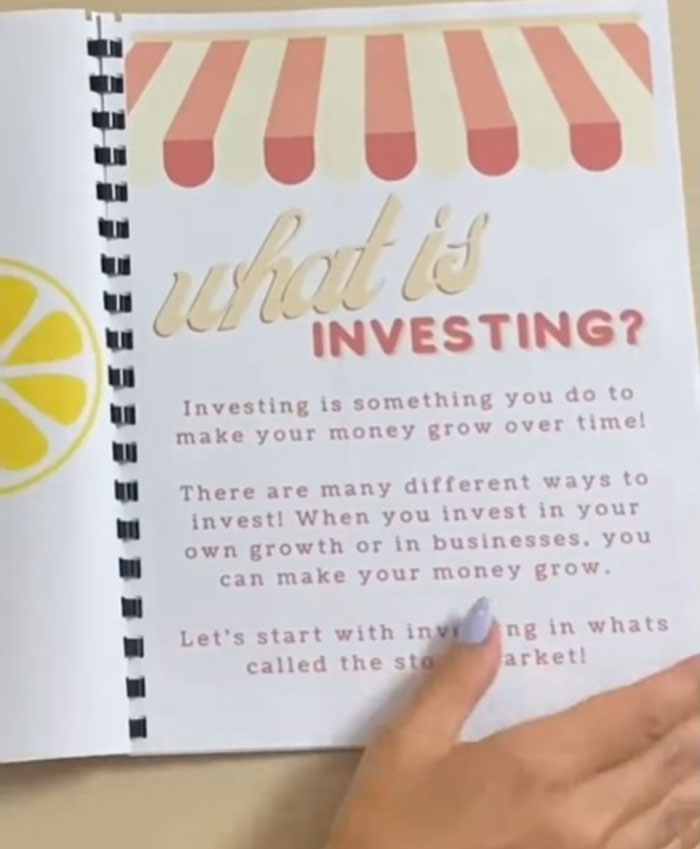

“We encourage them in all different categories such as investing, saving, giving and spending.”

Image credits: samanthabirdshiloh

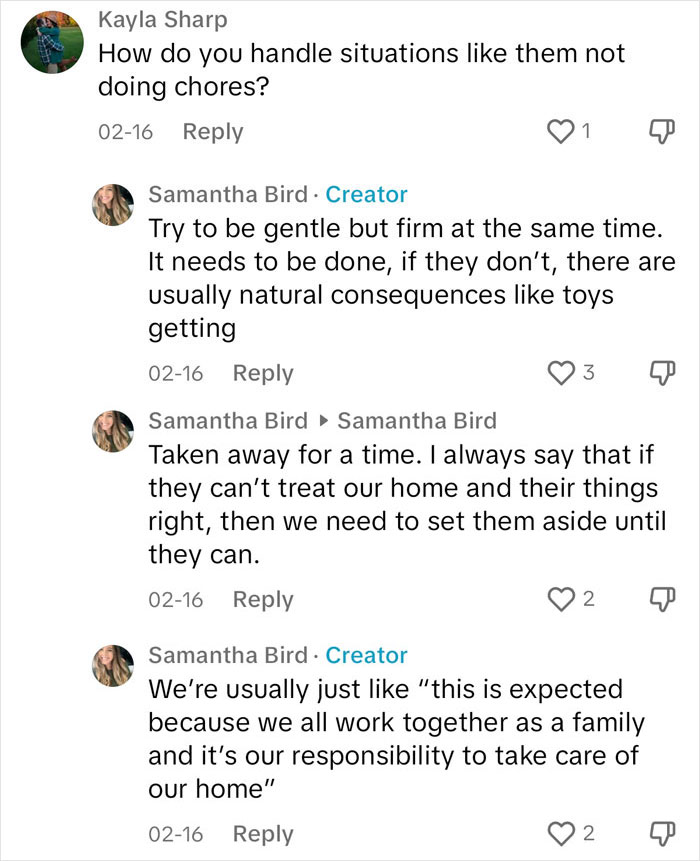

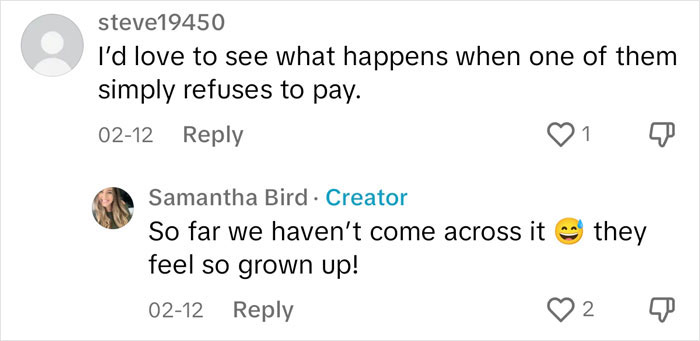

“Why don’t I clear up some common questions that I got.

The first question, what happens if they don’t pay their bills? Nothing, because they’re children. I don’t evict them, as many of you suggested, we work with them to make sure that they set aside enough money. It’s not a problem that actually comes up.”

Image credits: samanthabirdshiloh

“The second question, how old were your kids when you started doing this? I started teaching them about money within the past year, but we’ve talked about money with them their entire lives the same way we would talk about any other tool we’re trying to equip them with. Having healthy relationships, having strong self esteem, positive boundaries, this is no different. It’s just a tool in their tool belt as they get older.”

Image credits: samanthabirdshiloh

“I would rather give my children some money to work with and learn valuable skills than them have to figure it out on their own when they’re adults and the stakes are much higher.”

Image credits: samanthabirdshiloh

Image credits: samanthabirdshiloh

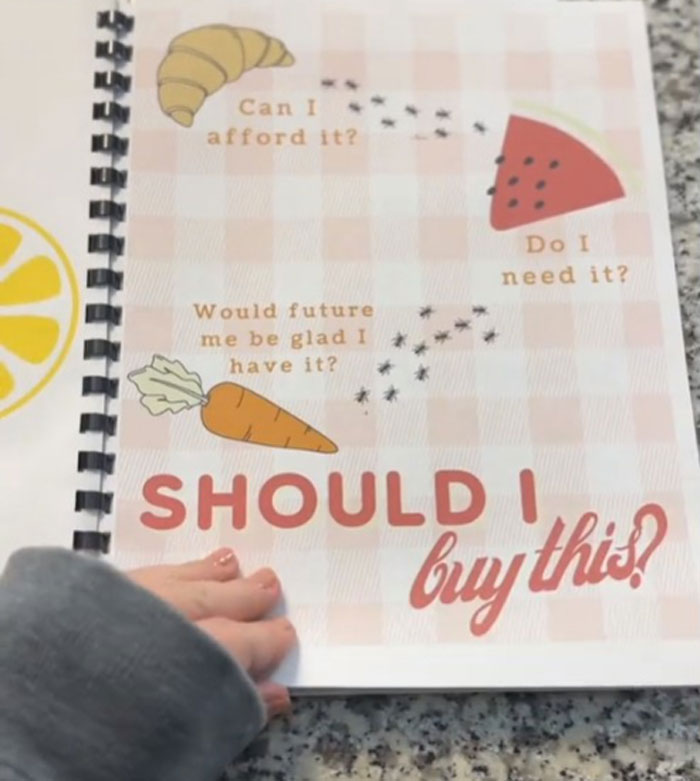

“My boys love doing this. We talk about their money for half an hour each week and then they get to color in their savings trackers or watch their investments and take their spending money to the store with them. This is light-hearted and fun before anything else. They’re gonna have positive associations with managing their money and being responsible.”

Her video about how her boys are learning to budget racked up over 5 million views

@samanthabirdshiloh We increased the boys allowance to accommodate them paying “mock” bills. I want them to have a sense of responsibility and learn how to manage expenses in a safe environment now! #budgeting #finacialfreedom #parenting #kidstiktok #kidsoftiktok #kidspersonalfinance #financetiktok #moneytips #debtpayoff #debtfree #debtfreejourney #debtfreecommunity #investingforkids #investing #personalfinancetips #moneymindset #moneymanifestation ♬ original sound – Samantha Bird

Samantha also clarified her teaching strategy in another video

@samanthabirdshiloh I didn’t expect this to be so controversial, but here we are 😅 #budgeting #finacialfreedom #parenting #kidstiktok #kidsoftiktok #kidspersonalfinance #financetiktok #moneytips #debtpayoff #debtfree #debtfreejourney #investingforkids #investing #personalfinancetips #moneymindset #moneymanifestation ♬ original sound – Samantha Bird

Image credits: Julia M Cameron / Pexels (not the actual photo)

The mother says she wanted her kids to get the financial literacy education she and her husband didn’t have

Samantha told Bored Panda why she started sharing personal finance advice for parents and kids on TikTok. “I was inspired to start sharing because there were so many things that myself and a lot of my friends didn’t know about money, and it severely impacted us as adults.”

“I wanted to teach my children how to manage their money in a healthy and responsible way while they were young so that it became second nature to them. I knew that there had to be plenty of other parents like me who hoped for something better for their children, and so I started sharing my journey.”

In fact, in one of her videos, Samantha shares how she and her husband found themselves in a “massively messy” financial situation because nobody taught them how to handle money when they were younger. “We just made mistake after mistake and had no idea how to a) responsibly manage the money that we had, or b) grow our money in any sort of capacity.”

After reading a lot of books on the topic, she came to the conclusion that the rich teach their kids about wealth very differently. “Things like investing and drawing a business – those types of things were suddenly available to me in ways that I had never quite realized before.”

Image credits: olia danilevich / Pexels (not the actual photo)

Samantha has some advice for parents who are looking to start teaching their kids about money

As her kids are aged 6, 7, and 9, Samantha says that teaching her boys the basics of being responsible with money is not without its challenges. “Right now, the challenge I’m facing is that my boys are all at different levels.”

“I have two [who] are really excited about investing and earning, and one is focused on learning to save. So I’m likely going to change my approach up here soon and start teaching them more individually at times.”

We also asked Samantha to share her top three tips for parents who want to start their financial education journey with their kids. “The absolute very first tip I would give is to make the process as fun as possible. We all are motivated toward things that are enjoyable, so if you can make learning about money fun and lighthearted, your children will be engaged and want to learn!”

“The second tip would be that if these skills aren’t second nature to you yet, learn alongside your children,” the creator adds. “It’s great for them to see you grow, adapt, and learn as well so that they understand that financial education is lifelong!”

“And lastly, I would say to remember your end goal. The idea is to help your children be financially literate and healthy adults,” Samantha emphasizes. “That means that mistakes now don’t mean as much – they can grow and learn through them. Letting your kids learn through experience is great!”

Image credits: Karolina Grabowska / Pexels (not the actual photo)

Financial experts say that early education about financial literacy is crucial for having better financial habits in adulthood

Teaching kids how to handle money is not only about them building wealth when they’re adults. It’s also about them having a healthy relationship with money. And kids are almost never too young to start learning about money – parents might even start educating them at the young age of two or three.

Dorothy Singer, Ed.D., a senior research scientist at Yale University in New Haven, Connecticut, says that simply by playing store, kids can learn the basics of commerce. It’s a great way for children to understand that people have to pay for goods with money.

When the kids get a bit older, around five or six, parents can start explaining to them how money in the real world works. Jennifer Seitz, director of education at Greenlight, a banking and investing app for kids and teens, told CNBC how parents can educate kids at the store by telling them why they’re picking the best price or using a coupon.

“At an early age, kids are developing their ability to focus and prioritize, as well as understand trade-offs you’re making to choose one thing instead of another,” she explained.

By the age of seven to nine, parents can introduce kids to the concept of banks, telling them about saving and interest. That’s where learning about what they want and what they need comes in. Experts advise teaching kids to save up their allowance and let them prioritize how to spend it.

Even if they make mistakes and choose to spend all the allowance in one go, for example, don’t treat that like a failure. This is the time kids shouldn’t be afraid to fail and learn since the stakes are still low.

“Kids who have room to make mistakes and learn with their money can build more financial resilience and better money habits for the future, supporting their overall wellbeing as their independence grows,” Financial Wellbeing Consultant Mariah Hudler writes.

Some folks disagreed with her methods, saying the kids might be too young for this

Others praised the mom for educating her kids about finances from an early age