A year ago, China held its first major international auto show since it lifted its COVID lockdown restrictions, and the world was stunned to learn just how far ahead the country is now on electric and connected vehicles. Now it's 2024 and the country's big auto show returns to Beijing, and not only is the Chinese car market more intense than ever, and the so-called "foreign" automakers aren't taking things lying down, either.

It's going to be an action-packed show, and InsideEVs is there on the ground this year. That kicks off this midweek edition of Critical Materials. Also on today's dance card: how Volvo pulled off the EX30 despite trade tensions with China, and Ford faces its own tough earnings call.

30%: Beijing '24 Will Show That China's EV Market Is Still A Knife Fight

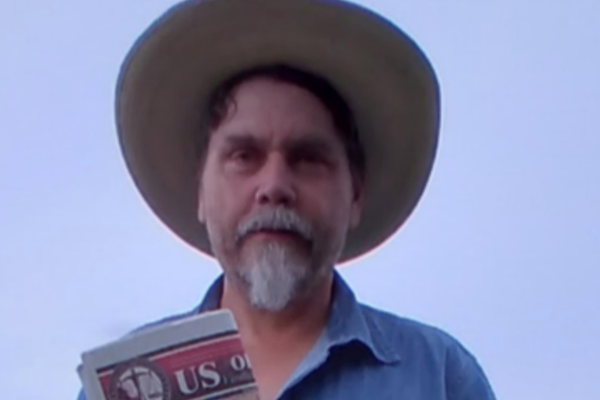

Our man Kevin Williams is on the ground at the Beijing Auto Show as a guest of the Geely Group, and he will have dispatches during and after this crucial industry event. After all, the Chinese EV market is more cutthroat than ever, with an overabundance of car brands duking it out over an ever-slimming piece of the pie, and Western and other Asian automakers seeking to regain lost ground before they become completely irrelevant there.

Our colleagues at Motor1 UK have a roundup of all the most important debuts at the show this year, and there are a lot of them. BMW, Honda, Volkswagen and Nissan are just some of the automakers with a concept or new car presence in China this year, not to mention countless Chinese brands you've possibly never heard of—but might in the next few years.

Here's Reuters to explain:

Some 700 exhibitors are expected to turn up at the fair, which starts on Thursday. Many will have visited last year’s industry gathering in Munich, where mainland brands including BYD and Xpeng, threw down the gauntlet with a fleet of sophisticated, cost-competitive electric cars. China’s homegrown companies ended the year with a larger combined share of the domestic market than foreign badges for the first time since the country’s 2001 entry into the World Trade Organization.

The counteroffensive has started. Overseas automakers are expected to unveil as many as 30 previously unseen cars at the show, Bloomberg reports. Volkswagen, the biggest player in China, will unveil six new models. Elon Musk joined the fray on Sunday, saying he could launch Tesla’s flagship “full self-driving” software in China “very soon”. Toyota and Nissan Motor teased plans for concept cars and local collaborations.

The Chinese market alone is crucial: it’s the world’s biggest with sales of 22 million vehicles last year, according to the China Passenger Car Association. But the rise of its battery-powered brands also made the country the world’s largest car exporter in 2023, shipping nearly 5 million units.

We're keeping an eye on quite a few things at the show this year.

60%: How Volvo Made The EX30 Happen

The Volvo EX30 is already a worldwide hit, and it's not even for sale yet in the United States. And when it does land here, it'll be sold for about $35,000 starting. How exactly did Volvo's parent company Geely Group pull that off? Once again, it shows the strength of what China's auto industry can do, Reuters explains again:

The $35,000 window sticker of Volvo's compact SUV hits a sweet spot in the U.S. market, where most buyers cannot afford most EVs. The competitive price reflects an unusual combination of Geely's China-specific cost advantages and Volvo's ability to skirt U.S. tariffs on Chinese cars because it also has U.S. manufacturing operations, according to interviews with four sources familiar with Volvo and Geely's strategy and several U.S. trade policy experts.

The EX30 will be among only a handful of China-made cars sold in the United States, none of them from Chinese brands. Vehicles from China currently face a 27.5% tariff and increasingly strident calls for higher trade barriers from U.S. automakers and their political allies.

But Volvo is eligible for tariff refunds under a law that awards them to firms with U.S. manufacturing operations — such as Volvo’s South Carolina plant — that also export similar products, according to U.S. trade law experts and a source familiar with Volvo's tariff-avoidance strategy.

The U.S. government does not release details of tariff refunds to individual companies.

Asked about tariff refunds, a Volvo spokesperson said the company pays all legally required duties on cars and parts. She said Volvo, though owned by Geely, is independently operated and designs its cars in Sweden.

That loophole may be hard to pull off again and with subsequent models. But for now, it's giving Volvo and Geely a cheap foothold into the U.S. market—exactly the situation that American automakers and their lobbying groups are afraid of.

90%: Ford Earnings: EV Losses, Pro Gains

Tesla's Q1 earnings call made all the news yesterday—and we will have more to say about that today—but Ford is expected to make waves with its own event tonight. Here's Barron's on what we expect:

In February, the company guided full-year 2024 operating profit of $10 billion to $12 billion. Ford generated an operating profit of $10.4 billion in 2023.

Those are all the aggregated numbers. Investors get a little more detail from Ford because, in 2023, Ford started reporting numbers for the traditional gasoline-powered business called Ford Blue, the EV business called Model e, and the Ford Pro commercial business.

Model e lost $1.6 billion in the fourth quarter of 2023 and lost $4.7 billion for the full year. Wall Street projects a Model e loss of $5.5 billion for 2024. Investors would like to see losses shrink with management controlling spending as industry sales of battery EVs slow.

Ford breaks out the financial results for its electric, gas and Pro divisions separately, and those have often made the automaker a target among investors for its huge losses while battery production and R&D ramp up. It's a situation I find a bit unfair since nearly all automakers are losing money as they scale up EV operations, whether they admit it or not; Ford is just more transparent about the costs involved, and that makes it a punching bag from time to time.

100%: What Do You Want To See From The Beijing Auto Show?

We have a tight schedule at the show and we're also (hopefully) shooting video there too. Let us know what you're interested in from the show. What stories, models and brands do you want to hear more about? We'll do what we can.