A new report by the Department of the Treasury reveals that American taxpayers have paid an eye-watering amount since the Internal Revenue Service updated its rules regarding tax credits on EV purchases on January 1st.

Related: Tesla hit with 'unexpected delay' for delivery of newest model

According to a recent report, the Internal Revenue Service (IRS) has received about 100,000 time of sale reports since January 1st, and reimbursed auto dealerships $580 million in advance point-of-sale consumer EV tax credit payments under the newly implemented ruling.

On January 1st, the IRS' updated Code Section 30D went into effect, where qualifying buyers under certain income thresholds can get up to $7,500 tax credit applied to the purchase price of qualifying North American-assembled new EVs that meet certain sticker price restrictions, or up to $4,000 for a used EV price at or below $25,000 that is at least two model years old.

The current offer is a more convenient and enticing offer than in previous years, where EV buyers had to claim their credits as part of their tax returns the following year.

According to the government, the Internal Revenue Service has received more than 85,000 sale reports for new EVs, with over 90% of buyers opting for the $7,500 tax credit to be applied to their new car's purchase price. Additionally, the IRS has also received more than 15,000 sale reports for used EVs, with over 75% of buyers opting for $4,000 off the purchase price of their new-to-them vehicles.

“Demand is high four months into implementation of this new provision with American consumers saving more than half a billion dollars,” Treasury spokesperson Haris Talwar said in a statement.

Though the new regulations have put more EVs out on the road, many electric models on the market lost their eligibility for tax credits due to the Treasury's strict FEOC guidelines designed to keep the EV supply chain close to home — keeping a select few eligible for the $7,500.

More Business of EVs:

- A full list of EVs and hybrids that qualify for federal tax credits

- Here’s why EV experts are flaming Joe Biden’s car policy

- The EV industry is facing an unusual new problem

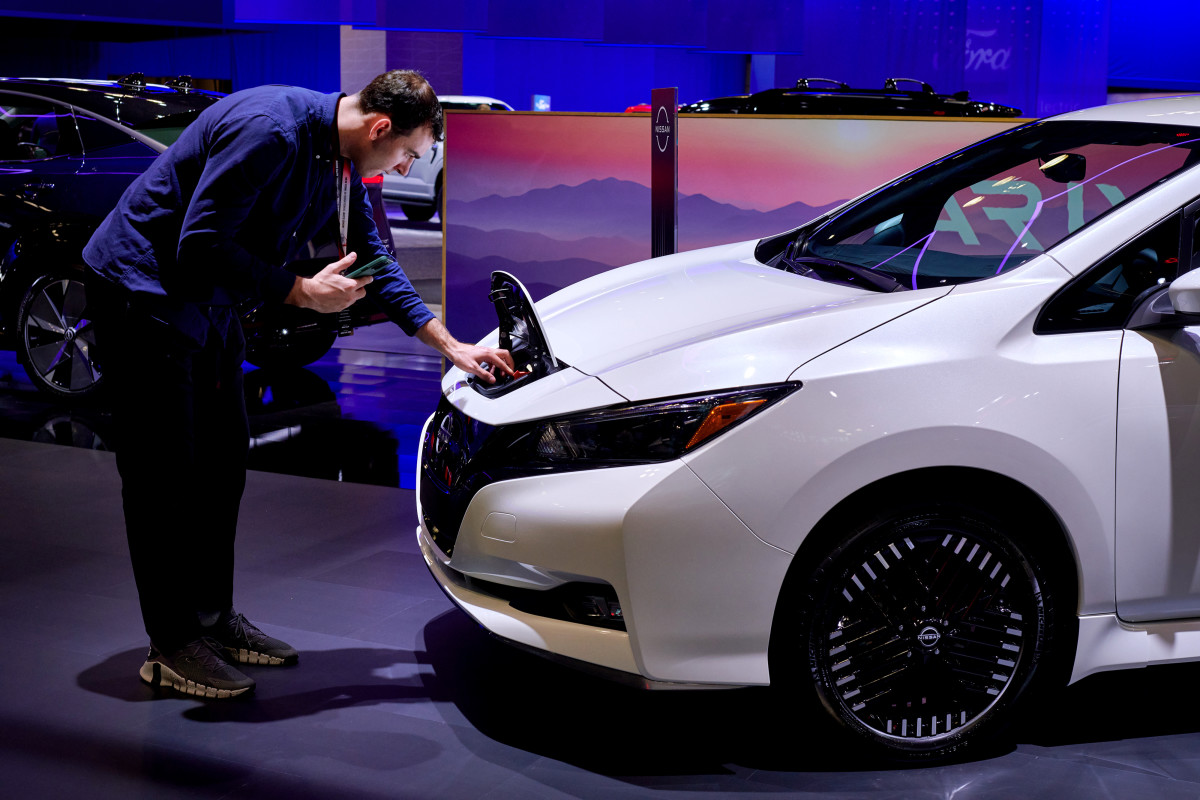

According to data from the U.S. government's portal at fueleconomy.gov, as of the time of this writing, 36 EVs and PHEVs are eligible for some federal tax credits ranging from $3,750 to $7,500, including the Cadillac LYRIQ, Honda Prologue, Nissan LEAF, Rivian's R1T and R1S, as well as Tesla's popular Model Y.

Though the list seems scarce and without some variety, other manufacturers are offering their own incentives to move their EVs. Until April 30, Hyundai is offering what they call "$7,500 retail bonus cash" on Ioniq 5, Ioniq 6 and Kona Electric models.

Additionally, Polestar is offering the Polestar 2 with a "$7,500 Polestar Clean Vehicle Incentive" for qualifying buyers.

Related: Veteran fund manager picks favorite stocks for 2024