KEY POINTS

- Monetary Metals is on a mission to change the belief that gold has nothing else to offer but itself

- The company offers investors with an opportunity to earn in gold ounces, not in dollars

- Gold can be used to finance productive enterprise, unlike Bitcoin, the company says

The financial market has seen the entry of various products and offerings, including the rising star of the digital realm, Bitcoin. But, amid the volatility of digital assets and fiat currencies, there is a timeless asset that has endured through ages. Widely circulated as currency in many countries before the advent of paper money, gold is an asset that still shines and remains a stable investment.

One company, Scottsdale, AZ-based Monetary Metals, found a way for gold investors to make gains in gold ounces, not dollars. Unlike other gold-related companies that buy or sell gold for dollar or other currency gains, Monetary Metals built its business around changing the old adage that gold doesn't move or doesn't have anything but itself to offer.

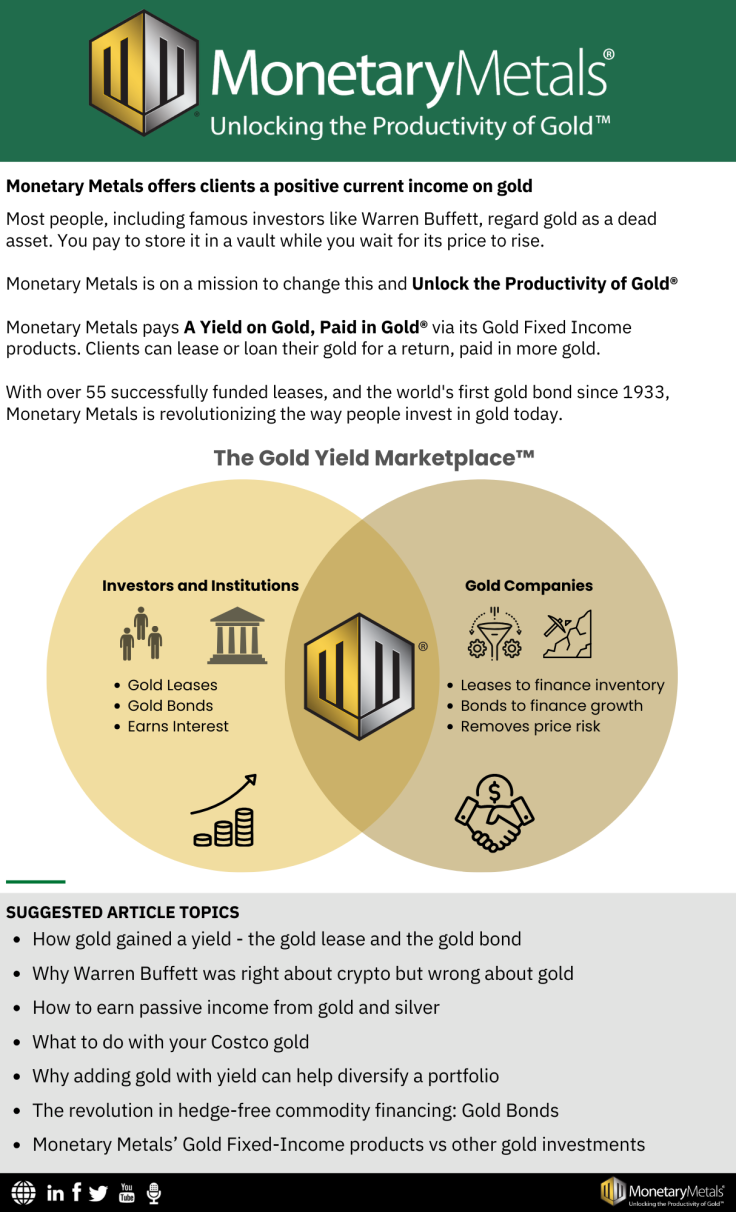

With Monetary Metals, investors are provided a path toward getting a chunk of this multi-trillion-dollar market through its Gold Yield Marketplace platform that connects individuals and institutions who want to earn a Yield on Gold, Paid in Gold, with qualified gold companies who want Gold Financing, Simplified.

The company, which was founded in 2012 by Keith Weiner, is "unlocking the productivity of gold" through Gold Leases and Gold Bonds offered to companies using precious metals in their production processes.

"Gold Leases finance precious metals inventory or work-in-progress while Gold Bonds finance production or business expansion. Both products deliver regular income in gold to investors, while providing capital denominated in ounces to qualified businesses, eliminating the need to hedge the gold price via futures," the company told International Business Times.

Gold Leases cater to jewelers, mints, manufacturers, refiners and bullion dealers, while Gold Bonds are focused on vaults, mining companies, and other gold-related firms.

In its recently released Gold Outlook 2024 report, the eighth annual release, the company noted that demand for physical gold and silver remains "robust," particularly in the Middle East, India, and Asia.

The report also noted that gold's "fundamental price is considerably above the market," which means that market tension is "pulling with an upward force." For silver, the fundamental price "is still above the market price," although a bit less than the upward force Monetary Metals sees in gold.

As of writing, gold remains the world's most valuable asset, with a market capitalization of over $15 trillion, as per CompaniesMarketCap data. Even the world's largest tech behemoths such as Microsoft, Apple and Google have yet to reach even half of gold's market value.

In comparison, Bitcoin, the trending asset that has had investors divided over its speculative nature, is on the ninth spot, with a $1.2 trillion market capitalization – still behind silver, with a $1.6 trillion market cap.

When asked whether the Monetary Metals agrees with MicroStrategy executive chairman Michael Saylor that "there will be a day where Bitcoin blasts past gold," the company pointed out that the world's first decentralized digital asset has "some major flaws" that often go unnoticed by investors and financial analysts.

Bitcoin's instability makes it an unsuitable asset for basic market transactions such as financing productive enterprise, the company said. On the other hand, gold is being used to finance businesses. Monetary Metals has, for seven years and counting, been using gold to finance businesses.

"While it's entirely plausible that Bitcoin priced in dollars could shoot the moon (or crash), the point is that it's precisely this volatility that prevents it from being used as a form of finance. And finance (not 'number go up') is the key to widespread monetary adoption."

In 2022, after Saylor said no person will establish a business on a client's gold assets, Weiner wrote an open letter that explained how Monetary Metals works – a business that pays interest on gold, in gold, through profits that the business generates, and not on price movement betting.

Weiner went on to note that unlike with Bitcoin, wherein BTC holders express dismay when prices plummet, "people are happy to own gold, even without the promise of a rising price."

In a world where people are educating themselves about investments of value, Monetary Metals offers gold investors an opportunity to earn a yield on their gold minus the speculator-related fears that haunt many financial investment offerings.