Investors are riding high on energy shares, capitalizing on surging oil prices and a resilient economy, while also bracing for potential inflationary pressures. In 2024, the S&P 500 energy sector has soared more than 9%, outpacing the broader index's year-to-date return of 7.3%.

Given this backdrop, it could be wise to add fundamentally strong energy stocks Petróleo Brasileiro S.A. - Petrobras (PBR), APA Corporation (APA), and Forum Energy Technologies, Inc. (FET) to one’s watchlist.

Recently, oil prices have been grappling with concerns about demand and the impact of elevated interest rates, leading to the potential for the steepest weekly loss in three months. Nevertheless, OPEC foresees strong fuel consumption during the upcoming summer season.

Looking forward to increased travel activity, OPEC anticipates a significant year-on-year rise in global jet/kerosene fuel demand by 600,000 bpd in the second quarter, accompanied by a 400,000-bpd increase in gasoline demand and a 200,000-bpd uptick in diesel demand.

In its latest monthly report, OPEC projects a notable surge in worldwide oil demand, estimating an increase of 2.25 million barrels per day (bpd) in 2024 and a further 1.85 million bpd in 2025. Despite acknowledging potential risks, OPEC remains hopeful about continued economic growth in 2024.

Maintaining its economic outlook, OPEC forecasts global economic growth of 2.8% for 2024, with the U.S. economy expected to contribute to increased fuel demand during the traditional summer period.

Moreover, the World Bank cautioned about the potential for an energy shock if a major conflict erupts in the Middle East, which could propel oil prices beyond $100 per barrel. Recent tensions in the region, particularly between Israel and OPEC member Iran, have heightened concerns, hinting at the precarious geopolitical landscape in the area.

Meanwhile, OPEC+ has decided to prolong its voluntary oil output cuts of 2.2 million barrels per day (bpd) into the second quarter. Such production cuts, coupled with geopolitical tensions, are fueling concerns about supply constraints.

However, non-OPEC+ countries, particularly the United States, are expected to drive world supply growth through 2025. Global output is forecasted to surge by 770 kb/d to 102.9 mb/d in 2024, with non-OPEC+ production expanding by 1.6 mb/d. Further growth is expected next year, with global output likely to rise by 1.6 mb/d.

In addition, with the significant dependence on oil, energy companies providing services in drilling, assessment, production, and upkeep are positioned for substantial growth. By 2027, the global oilfield services market is expected to reach a substantial valuation of $346.45 billion, exhibiting a CAGR of 6.6%.

Now, let’s delve deeper into the fundamentals of the featured stocks in detail:

Petróleo Brasileiro S.A. - Petrobras (PBR)

Based in Rio de Janeiro, Brazil, PBR is engaged in the exploration, production, and sale of oil and gas both domestically and internationally. It operates through three segments: Exploration and Production; Refining, Transportation and Marketing; and Gas and Power. PBR's activities encompass prospecting, drilling, refining, processing, trading, and transportation of crude oil from onshore and offshore fields, as well as shale or other rocks.

The oil and gas giant reported that its first-quarter production of oil, natural gas, and NGLs rose 3.7% from the prior-year level. Total hydrocarbon production reached 2,776 million barrels of oil equivalent (boe) per day, with crude oil production specifically rising by 4.4% to 2.24 million boe per day.

This increase in production can be attributed to the ramp-up of five FPSOs—Almirante Barroso, P-71, Anna Nery, Anita Garibaldi, and Sepetiba, as well as the commencement of production from 19 new wells in the Campos and Santos Basin.

Despite the production increase, total exports decreased by 4.4% year over year. While oil exports rose by 2.5% sequentially, they declined by 11.3% compared to the previous year. PBR attributed this drop to disruptions in the maritime freight transport route caused by conflicts in the Middle East, which altered the flow of oil exports.

During the fourth quarter (ended December 31, 2023), PBR’s sales revenue stood at $27.11 billion, while its gross profit increased marginally from the year-ago value to $14.65 billion. Its operating income and net income amounted to $8.02 billion and $6.28 billion, respectively, in the same period. In addition, it reported an adjusted EBITDA of $13.47 billion.

As of December 31, 2023, the company’s cash and cash equivalents came in at $12.73 billion, representing an impressive 59.2% year-over-year increase, compared to $7.99 billion as of December 31, 2022.

In terms of forward non-GAAP P/E, PBR is trading at 4.56x, 57.1% lower than the industry average of 10.65x. Likewise, the stock’s forward EV/EBITDA and Price/Sales multiples of 2.96 and 1.10 are 49% and 25.9% lower than the industry averages of 5.80x and 1.48x, respectively.

The consensus EPS estimate of $0.98 for the fiscal second quarter (ending June 2024) represents a 7.2% improvement year-over-year. The consensus revenue estimate of $26.26 billion for the current quarter indicates a 14.9% increase from the same period last year. The company has an impressive earnings surprise history, surpassing the consensus EPS estimates in three of the trailing four quarters.

Moreover, its revenue and EBITDA have grown at impressive CAGRs of 10.5% and 22.3%, respectively, over the past three years. Also, its levered FCF has increased at a 16% CAGR over the same period.

Over the past year, the stock has gained 71.6% to close the last trading session at $17.34.

PBR’s strong fundamentals are reflected in its POWR Ratings. It has an overall rating of B, which equates to Buy in our proprietary rating system. The POWR Ratings assess stocks by 118 different factors, each with its own weighting.

It has an A grade for Quality and a B for Momentum. Among the 42 stocks in the A-rated Foreign Oil & Gas industry, it is ranked #20. Click here to see the other ratings of PBR for Growth, Value, Stability, and Sentiment.

APA Corporation (APA)

APA is an energy company that explores, develops, and produces natural gas, crude oil, and natural gas liquids (NGLs). It operates in the United States, Egypt, and the offshore United Kingdom in the North Sea, Suriname, and other international locations.

On April 1, 2024, the company completed the acquisition of Callon Petroleum Company (CPE), a move aimed at driving improved capital productivity, performance, and significant cost synergies. With the addition of Callon, APA's daily reported production is set to reach approximately 500,000 barrels of oil equivalent (BOE), with around two-thirds originating from the Permian Basin.

In the latest earnings report, the company reported that it had increased the expected annual cost synergies by 50% to $225 million. As a result, APA's U.S. oil production is forecasted to surge by over 80% from the fourth quarter of 2023 to the expected fourth quarter of 2024.

APA also updated its full-year 2024 guidance, planning to invest $2.7 billion in upstream oil and gas capital for the year. The company anticipates operating an average of around ten rigs in the United States as APA actively manages and optimizes its combined rig fleet to enhance operational efficiency and maximize value for shareholders.

APA’s total revenues amounted to $1.95 billion in the first quarter that ended March 31, 2024, with a 2.5% year-over-year uptick in revenues from oil production. The company’s adjusted earnings came in at $237 million and $0.78 per share in the same period. Also, it generated net cash from operating activities of $368 million and an adjusted EBITDAX of $1.24 billion.

As of March 31, 2024, APA’s cash and cash equivalents stood at $102 million, compared to $87 million as of December 31, 2023.

In terms of forward non-GAAP P/E, APA is trading at 5.78x, 45.7% lower than the industry average of 10.65x. Its forward EV/EBITDA multiple of 2.83 is 51.1% lower than the industry average of 5.80. In addition, its forward EV/EBIT ratio of 4.45 is 54.3% lower than the industry average of 9.74.

Street expects APA’s EPS to increase 53.9% year-over-year in the second quarter (ending June 30, 2024) to $1.31. Its revenue for the current quarter is projected to amount to $1.92 billion. Further, APA is expected to witness EPS growth of 11.5% and 5.6% year-over-year, reaching $5.05 and $5.33 in the fiscal years 2024 and 2025, respectively.

Its revenue and EBITDA have grown at impressive CAGRs of 17.6% and 27.5%, respectively, over the past three years. Likewise, its EPS has improved significantly at a 651% CAGR over the same period.

However, the stock has plunged 3.5% over the past three months to close the last trading session at $29.18.

APA’s POWR Ratings reflect this promising outlook. The company has an overall B rating, which translates to Buy in our proprietary rating system.

It also has a B grade for Value and Quality. In the 82-stock Energy - Oil & Gas industry, it is ranked #16. To see additional POWR Ratings for APA for Growth, Momentum, Stability, and Sentiment, click here.

Forum Energy Technologies, Inc. (FET)

FET designs, manufactures, and distributes products catering to the global oil, natural gas, industrial, and renewable energy industries. It operates through three segments: Drilling & Downhole; Completions; and Production. The company offers a range of products and services for drilling, well construction, and artificial lift.

Earlier this year, FET acquired Variperm Energy Services, a leading manufacturer of customized downhole technology solutions providing sand and flow control products for heavy oil applications.

The strategic acquisition, which totals $150 million in cash and 2 million shares of FET's common stock, is well-aligned with its existing operations and is expected to yield mutual benefits for legacy FET and Variperm products. It also enhances the company’s downhole and artificial lift product portfolio.

Following this move, FET realigned its reportable segments, now operating in Drilling and Completions; and Artificial Lift and Downhole. Neal Lux, President and Chief Executive Officer, highlighted the impact of the acquisition on the company’s financial results in the first quarter of 2024, including a 9% sequential revenue growth, a 69% increase in EBITDA, and a 460-basis point expansion in EBITDA margins.

In terms of forward non-GAAP P/E, FET is trading at 8.58x, 19.4% lower than the industry average of 10.65x. Likewise, the stock’s forward EV/Sales and EV/EBITDA multiples of 0.45 and 3.59 are 77.9% and 38% lower than the industry averages of 2.04x and 5.80x, respectively.

For the fiscal first quarter that ended March 31, 2024, FET’s revenue increased 7.1% year-over-year to $202.40 million. Its gross profit grew 22.5% from the prior year to $63.80 million. The company’s adjusted operating income of $10.70 million indicates a growth of 33.7% year-over-year.

In addition, the company’s adjusted EBITDA increased 47.5% from the previous year to $26.10 million. Its cash and cash equivalents stood at $48.50 million as of March 31, 2024, compared to $46.20 million as of December 31, 2023.

Analysts expect FET’s revenue to increase 18.4% year-over-year to $875.10 million for the current year, while its EPS is expected to be $1.11 in the same period. For the fiscal year 2025, its revenue and EPS are projected to increase 5.4% and 92.3% year-over-year to $922.35 million and $2.14, respectively.

Moreover, the stock’s revenue and tangible book value have grown at CAGRs of 12.9% and 13.8% over the past three years, respectively.

FET’s shares have gained 2.1% over the past three months to close the last trading session at $19.39.

It’s no surprise that FET has an overall rating of B, which equates to Buy in our proprietary rating system. It has an A grade for Momentum and a B for Growth, Stability, and Sentiment. Out of 51 stocks in the Energy - Services industry, it is ranked #10.

In addition to the POWR Ratings we’ve stated above, we also have FET’s ratings for Value and Quality. Get all FET ratings here.

What To Do Next?

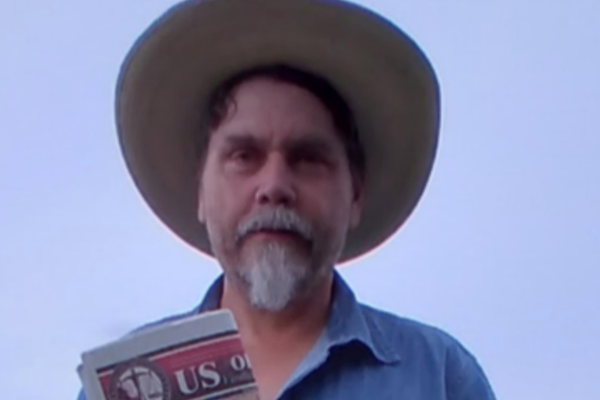

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

PBR shares were trading at $16.59 per share on Friday afternoon, down $0.07 (-0.42%). Year-to-date, PBR has gained 5.13%, versus a 7.93% rise in the benchmark S&P 500 index during the same period.

About the Author: Shweta Kumari

Shweta's profound interest in financial research and quantitative analysis led her to pursue a career as an investment analyst. She uses her knowledge to help retail investors make educated investment decisions.

May 2024 Energy Stocks Watchlist StockNews.com