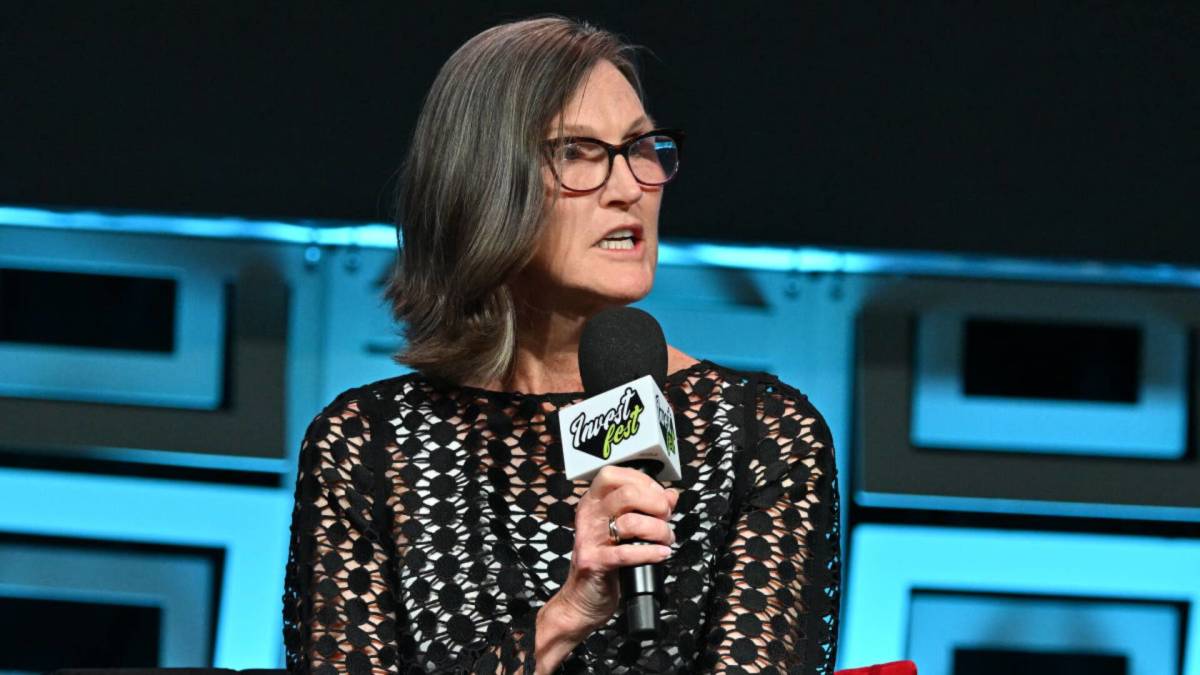

Cathie Wood, head of Ark Investment Management, has turned into the public face of money management over the past few years.

Known to her devotees as Mama Cathie, Wood rocketed to prominence thanks to a stupendous return of 153% in 2020 and clear presentations of her investment philosophy in ubiquitous media appearances.

But her longer-term returns are less stellar. Wood’s flagship Ark Innovation ETF ARKK, with $7.8 billion in assets, has generated a respectable return of 31% for the past 12 months. But the annualized return is negative 25% for the past three years and a mere positive 2% for five years.

That’s nothing to brag about, as the S&P 500 posted positive returns of 34% for one year, 12% for three years and 15% for five years. Wood’s goal is for at least 15% annual returns over five-year periods.

Cathie Wood’s Investment Philosophy

Her investment strategy isn’t hard to fathom. Ark’s ETFs generally buy young, small-company stocks in the high-tech categories of artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics. She views those areas as game changers for the global economy.

Related: Cathie Wood buys $35 million of beaten-down tech stock

These stocks are quite volatile, of course, so the Ark funds are subject to rollercoaster rides. And Wood frequently trades in and out of her top names.

Investment research titan Morningstar is quite critical of Wood and Ark Innovation ETF. “ARK Innovation has dubious ability to successfully navigate the challenging territory it explores,” Morningstar analyst Robby Greengold wrote last year.

The potential of Wood’s five high-tech platforms listed above is “compelling,” he said. “But Ark’s ability to spot the winners among them and navigate their myriad risks is less so. The strategy’s booms and busts have culminated in middling total returns and extreme volatility since its 2014 inception.”

It’s not an investment 101 portfolio. “The strategy narrowly invests in stocks with paltry current earnings, elevated valuations, and highly correlated stock prices,” Greengold said. “Their extreme volatility underscores their highly uncertain futures.”

Wood has defended herself from Morningstar’s criticism. “I do know there are companies like that one [Morningstar] that do not understand what we're doing,” she told Magnifi Media by Tifin in 2022.

“We do not fit into their style boxes. And I think style boxes will become a thing of the past, as technology blurs the lines between and among sectors.”

But some of Wood’s customers apparently agree with Morningstar. During Ark Innovation’s rally of the past 12 months, it saw a net investment outflow of $1.9 billion.

Cathie Wood’s trades this week

On Monday through Wednesday, Ark funds sold 779,972 shares of Twilio (TWLO) , a cloud-based communications platform. That cache was valued at $48.3 million as of Wednesday’s close.

Fund manager buys and sells:

- $7 billion fund manager touts 3 blue-chip stocks

- Cathie Wood buys $35 million of beaten-down tech stock

- Single Best Trade: Fund manager at $7 billion firm unveils favorite pick

The stock has slid 14% since Feb. 14, when its earnings report lagged expectations. Perhaps Wood wanted to pare her position to avoid further losses.

Also this week, Ark funds bought 249,420 shares of Moderna (MRNA) , the biotechnology company famous for its covid vaccine. The purchases were valued at a combined $25.7 million as of Wednesday’s close.

Moderna shares have dropped 32% over the past year, as its revenue from covid vaccines has dwindled. So Wood may view this as a buying opportunity.

Morningstar analyst Karen Andersen also is bullish, putting fair value for Moderna stock at $227, more than twice Thursday’s quote of $105.

Finally, Ark funds shed 162,704 shares of Block (SQ) (formerly Square), a financial payments company that includes Cash App. The kitty was valued at $13.3 million as of Wednesday’s close.

The stock has more than doubled since Oct. 30, boosted by strong earnings reports. So Wood may be taking profits.

Related: Veteran fund manager picks favorite stocks for 2024