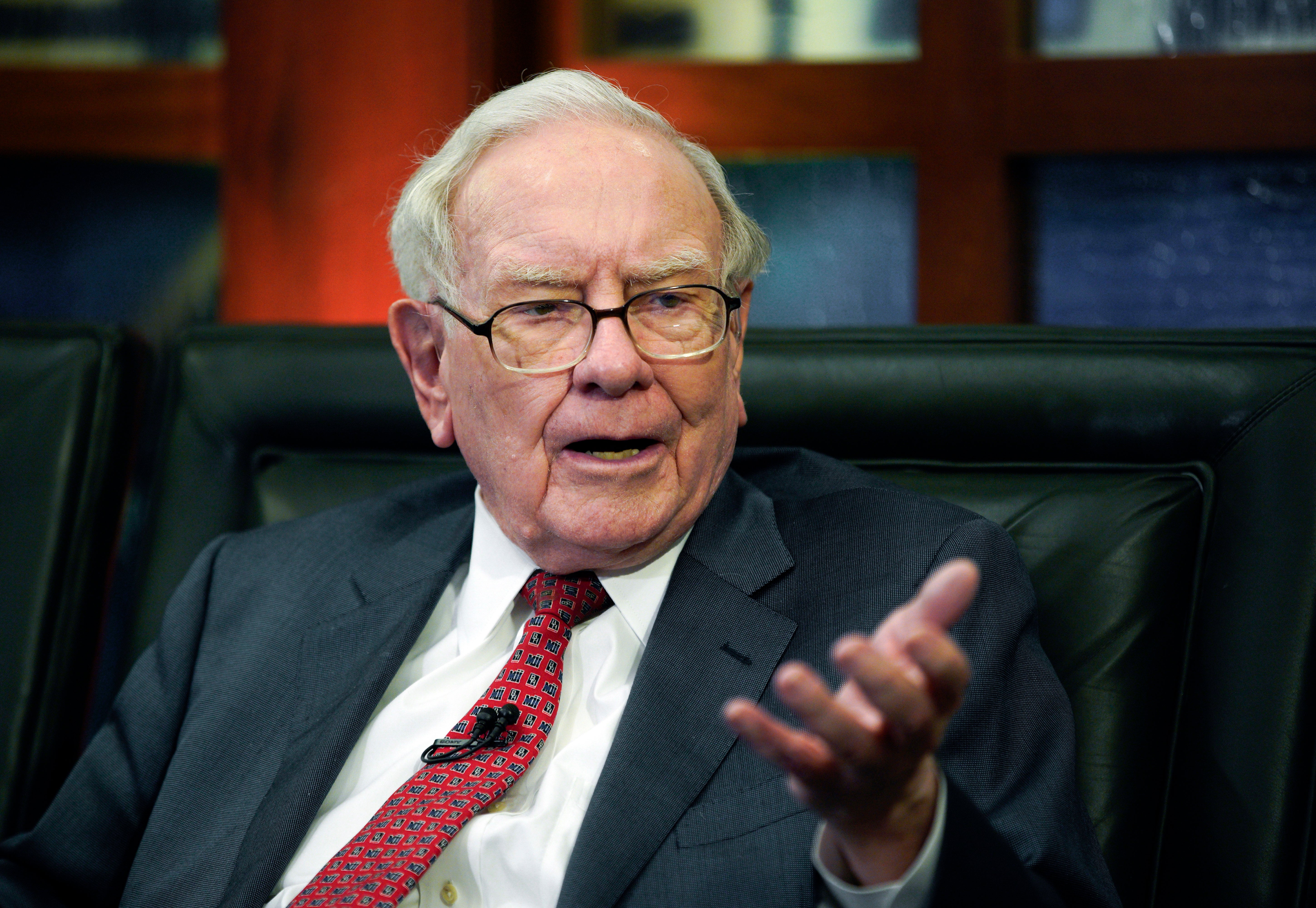

Warren Buffett's secret stock pick has finally been revealed: the insurer Chubb.

In a new regulatory filing, Mr Buffet's conglomerate Berkshire Hathaway reported it had purchased nearly 26 million shares of the Zurch-based insurer's stock, representing $6.7bn.

Shares in Chubb – which has worked with Donald Trump and the Titanic – soared by more than 8 per cent off the back of the news. As of just before 1pm ET on Thursday, Chubb’s share price stood at $264.

Berkshire had been granted confidentiality for two quarters to keep the details of one or more of its holdings confidential, and the purchases were not discussed during the conglomerate's annual meeting in Omaha earlier in May.

The conglomerate doesn't typically request confidentiality for its investments. The last time it made a similar request was in 2020 when it bought into Chevron and Verizon.

The Chubb shares mark Berkshire’s ninth biggest holding as of the end of March, according to CNBC.

Chubb has operated since 1882, with its companies insuring some of the cargo and passenger baggage on board the doomed Titanic. Today, it operates in 54 countries.

In March, the insurer hit headlines when it agreed to underwrite Mr Trump's nearly $92m appeal bond in his E Jean Carroll defamation lawsuit.

Berkshire is no stranger to the insurance industry. It has holdings in Geico, General Re reinsurance, and several home and life insurance companies. In 2022, it acquired Alleghany for $11.6bn.

The move to buy up shares in Chubb is in-line with Berkshire's recent investments in financial industries. Over the last few months, Berkshire has invested in Ally Financial, American Express, and the Bank of America.

It has also moved money out of consumer products, including selling off 10 million shares of Apple in February. Even with the sell-off, Apple remains Berkshire's largest holding. It also sold off 80 million shares of HP in the fourth quarter of 2023, reducing its holdings in the tech giant by 78 per cent.