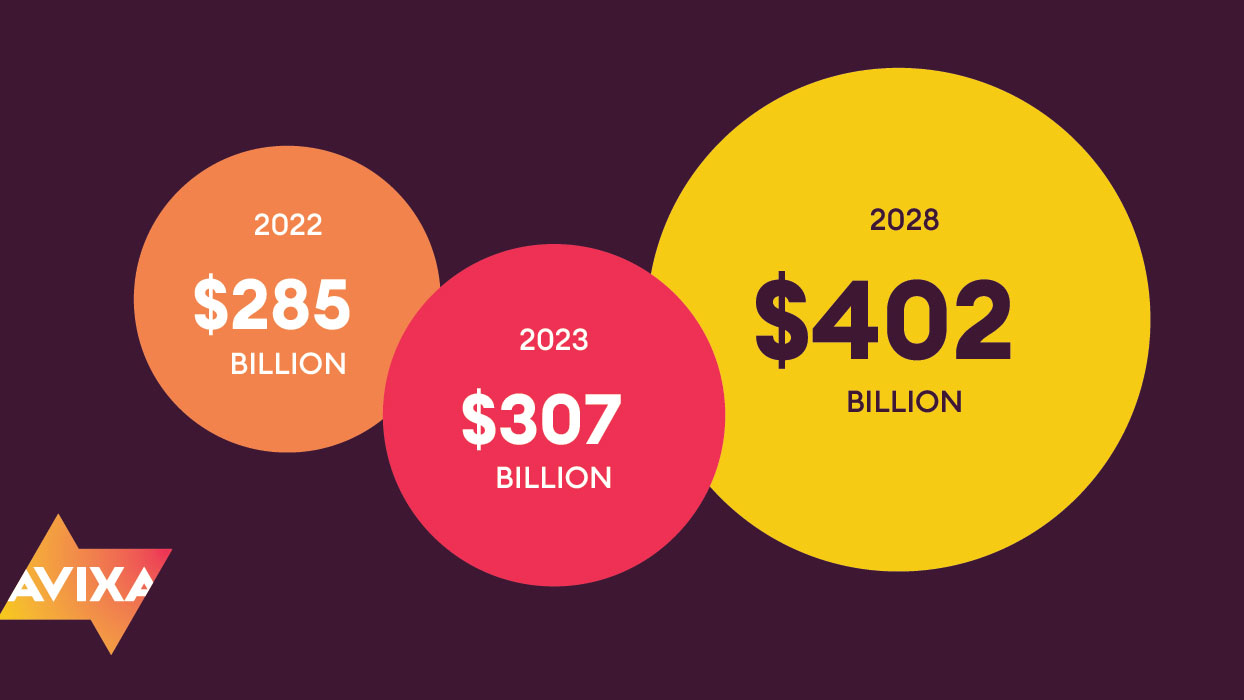

The Pro AV industry is forecast to add nearly $100 billion in revenue over the next five years, reaching $402 billion in 2028, according to AVIXA’s 2023 Industry Outlook and Trends Analysis (IOTA). With pandemic recovery largely in the past, the industry is poised for healthy growth through 2028, even if year-over-year percentages slowly decline.

AVIXA’s 2023 Industry Outlook and Trends Analysis (IOTA) presents data and analysis about the size of the Pro AV industry with a global perspective—plus regional and vertical breakouts. The research covers product trends, solution categories, and vertical markets.

[AVIXA Report: June Sales Growth Steady, Payroll Growth Stronger]

“This year’s update to the Pro AV industry forecasts shows a return to a rate of growth that would have been considered more normal before the pandemic,” says Sean Wargo, vice president of market intelligence, AVIXA. “However, looking below the surface, one can still see a varied landscape of opportunity. Immersive experiences across the venue and events market is a particular one to watch.”

Pro AV revenue will grow from $307 billion in 2023 to $402 billion in 2028—a 5.6% compound annual growth rate. The near term shows a mix of demand growth and deflation as supply issues improve. While 2022 did slightly better than initially expected, this came at the cost of 2023 growth because recovery was pulled forward from 2023 into 2022. On net, 2023 revenue totals reflect offsetting impacts of elevated demand and deflation in some core categories.

[Show Me the Monet: My Daughter and Her Friends Loved This Immersive Adventure]

APAC economies are experiencing higher growth each year, contributing to its position as the largest region for Pro AV spending. Most notable is the return of live events, reviving the rental and staging market. Digital signage is expanding faster in APAC, with a 7.2% growth rate as the consumer base grows.

The Americas were stronger in 2022 as in-person surged back but are expected to see lower 2023 growth. The return to in-person is a mixed story in the Americas. On the corporate side, U.S. companies have settled into a hybrid mode, driving less growth in conferencing solutions for offices. Though Pro AV is seeing the tail end of the growth from return to in-person, the venues and events industry is now spending in the region, leading growth. While the rise of software is a global phenomenon, it is the most pronounced in the Americas, where growth is nearly 12%.

EMEA experienced the lowest growth in 2022 due to the Russia/Ukraine War. Inflation is higher, and so is propping up growth slightly in 2023. EMEA is an events-based market, more than the rest of the world. The live events market is fully benefiting from audience return in EMEA, growing by 7.69%. Though overall growth is lower in the region, many core segments relating to events are seeing higher growth in EMEA. Sustainable energy is also a source for Pro AV spending growth.

Corporate remains the largest revenue source of Pro AV revenue, but more growth comes from media/entertainment and venues. These top markets remain dominated by spending on back-end technology. Content management hardware is crucial to the efforts of corporate, media and entertainment, and venues to reach and engage their employees and customers with content. While the cloud has become an important part of spending, on-premises hardware is still utilized for localized handling of content.

[Is Your Digital Signage as Good as DFW's Restroom?]

As travelers these days can attest, transportation hubs have been receiving a facelift. Digital signage is at the core of this, with many more displays being installed to direct and inform travelers. At the same time, security and surveillance systems are also advancing, driving additional AV spending.

Across many parts of the globe, investments are being made to transition to sustainable sources of energy and to improve grids. This also trickles down into the AV industry, most often in the form of control rooms for monitoring. While not a huge market for AV, it is one to watch for upside as the top-level investments increase.